THE MORE YOU KNOW

THE BETTER YOU NEGOTIATE

Getting Above Standard Tenant Improvements

Do you want great space that helps define your business and attract new clients? Is your company culture important to hiring and retaining top talent? If any of these statements resonate with you, then you cannot afford to accept standardized tenant improvements.

Above standard tenant improvements are typically any material used to improve your space that is above the common finishes the building owner utilizes . Usually the building owner has a list or book of all standard paint carpet, lighting and other flooring finishes that they are willing to provide to improve their space with. These may not showcase your businesses image, align with your company culture, or provide current/potential clients an idea of the caliber of your services. Many architectural firms, law firms and technology companies (just to name a few) need their space to make an impression on everyone who walks through their front doors. An architect uses their lobby to speak to their design capabilities, lawyers use this & other meeting areas to set the tone for their prowess and other businesses use their interior common areas to reinforce their brand & company values.

Achieving a certain look and feel beyond what a landlord is offering typically comes at an additional cost of construction. For example: building out 5,000 sf with building standard finishes may run $60/sf ($300,000); however, your company may want to add design elements to part or all of your space that will increase that number to $85/sf ($425,000). The $125,000 delta between these two numbers can be covered in the following ways.

Tenant pays for the difference: now most tenant rep brokers hate this as it isn’t ideal for companies without a large war chest. It consumes the tenant’s capital upfront and can typically be used better by the tenant to grow their business. In the event the tenant outgrows their space ahead of the natural lease expiration, they’ve sunk capital improving a space they didn’t use for the duration of their lease.

Landlord amortization of the difference: this is the most common solution to a tenant improvement overage. The landlord factors the additional cost of the tenant improvements into the tenant’s rent over time. This keeps the tenant from paying for the improvements upfront but does raise their monthly/annual rent obligation. This can be accomplished as a $/psf rent increase or an annual percentage increase. Think of it as a loan on the difference from the landlord. Does the landlord make a return on this loan...of course. Does the tenant lose if they outgrow the space ahead of the lease expiration? Yes, but not as much as if they pay out of pocket for the improvement difference up front.

Covering the difference through a loss in concessions: this is by far the most complicated and situation specific solution. If you have a savvy tenant representative, who knows your improvement costs will overrun a standard market landlord contribution; they will negotiate a robust rent abatement package, then reduce that once the improvement costs are known so that your rent cost/sf doesn’t increase dramatically. The drawback here is that most businesses use the rent abatement period to offset moving, furniture and other soft costs associated with new space. If those costs are minimal, this may be the best option for a business needing above standard tenant improvements.

*Value Engineering: while not always strategy for covering the cost difference in negotiations, having a great project manager or construction team working with your business & tenant representative to cut construction costs after you’ve secured a certain $/sf in landlord supplied improvement funds can be to your benefit. Make sure your tenant representative negotiated a clause which allows your business to utilize any unused funds in the form of full or partial rent payments.

If you need any help finding or negotiating on space, call us. We’re here to help. #findYOURspace

Avoiding Percentage Rent

If you’re an office tenant skip this one, it thankfully doesn’t apply to you - restaurant and retail space users should take notes. Your landlord is like that disgusting troll under the bridge in the story your mom used to read you. They want more than what’s fair because they think they’re in control. You’re about to pay them a monthly amount of rent, and your share of property taxes, property insurance and common area maintenance, in order to operate your business in their property. In addition, or sometimes in lieu of, they want their grubby little hands in your pocket by charging you a percentage of your (typically) gross sales...sometimes above a breakpoint but sometimes from the first dollar you earn. This is called percentage rent, and it’s absurdly legal.

As a rule of thumb your restaurant or retail store should never lease space that costs more than 6 - 10% of your projected gross sales. Seriously. Landlords who believe you have the ability to make millions of dollars in annual revenue in their space will try to parasitically attach themselves to your success using an overage percentage (DM me for details) or an absolute gross sales breakpoint on top of your rent. Whatever you sell above this breakpoint gets multiplied by your percentage and goes to the landlord. Seriously. Avoiding this is tough, but not impossible. First, know the conversation needs to be had upfront in lease negotiations and either make the percentage based on sales of something specific: i.e.: food sales, alcohol sales, super high end product you sell few of; or make your breakpoint so high you are UNLIKELY to hit it. Second, make the percentage a low number. Landlords are going to try something between 5 - 7% but it’s okay to laugh at them and offer 2 - 3%. Do not be afraid to walk away from the negotiating table in order to do this. Far too many restaurant owners fall in love with space and just agree to this nonsense. Unless you’re Tiffany’s you should stay far away from leases like these without protecting yourself, and if you need help, call us!

Jamal Brown has represented commercial tenants in lease negotiations for over 16 years.

5 Leasing Tips We Can Learn From Dogs

The two most persistent beings in the universe have to be dogs and children. Why are these little cutthroats so good at getting what they want? Here’s a few take aways we can we apply to the commercial leasing process which should help your company get what it needs.

Explore all your options: Dogs will stick their nose in everything just to figure out if it’s edible. At the onset of facility negotiations, you need to enroll as many desirable locations as possible. You also need to ask for everything that would make a facility contract compliment your business plan. Be strategic in the structure of the financial terms and the amount of exposure so your business can thrive.

Be Persistent: Ever had a dog beg for snacks/your dinner/belly rubs/a walk and then give up after one rebuke? Me neither. So when you don’t get a positive initial response to your requested lease terms, ask again. You may need to modify the language a little but go for what your business needs until you get it.

Play Dead: With a little training, dogs will do this for a reward. Sometimes it’s necessary in lease negotiations to take a step back, act offended, and let a landlord think their negotiation strategy killed a deal. More often than not you’ll reap the reward.

Leave Nothing Left: Whether it’s treats or steak bones, dogs rarely leave anything unfinished. Real estate costs are usually the 2nd or 3rd most costly expense your business will incur. You owe it to yourself and your employees to mitigate the fixed costs and your exposure to additional charges in negotiations. Grind multiple locations down simultaneously and don’t leave money on the table. Use each site as leverage against one another. Push hard until there’s nothing left.

Trust Your Pack: Dogs are a pretty good judge of character, and in their pack (human or canine) everyone plays their role. You need professional service providers throughout the leasing process. An experienced tenant representation broker to guide you through site selection and negotiation, a project manager to assist with construction pricing, scheduling and vendor coordination, and an attorney to negotiate and review lease language. Not only can you leverage these professionals to create the best outcome, you can spend more time focusing on your core business while they work for you. Lone wolves don’t accomplish much, you need a pack.

Jamal Brown is the CEO of The Ocean Company, an exclusive tenant representation firm with offices in San Diego, Orange County and Los Angeles focusing on the leasing and acquisition of commercial real estate.

Main: 858.356.2990 | E-mail: jbrown@theoceanco.com | social: @theoceancompany

Not All Buildings Are Created Equal

All commercial buildings are not created equal. One of the most overlooked aspects of a building’s value to the tenant is the efficiency of that particular building when compared to another. This efficiency is in relation to the ratio of the space the tenant actually leases within their four walls (the usable square footage) and the amount of space attributed to all common areas of the building including the lobby, hallways, restrooms, common conference rooms, common kitchen areas, interior break areas, work out buildings, showers/lockers, phone and electrical rooms, and any other common use area that, when added to the usable square footage, makes up the rentable square footage. This ratio is called the building “core factor” (also referred to as “load factor”, “loss factor”, or “add-on factor”). Understanding core factors translates directly to the bottom line. Since building costs are typically near the top of the expense list, the savings can be dramatic in comparison to other expenses. Pay attention to the core factor.

Why Your Tech Company Should Choose San Diego

San Diego has long been regarded as a sleepy seaside city, home to defense contractors, military bases, and the legendary zoo. Our 262 sunshine days and heavy attention on our thriving tourist industry has done little to combat this. While Silicon Valley has historically overlooked the startup community in America’s Finest City there are signs of a change in dynamics as the cost of living, and doing business in San Francisco and Oakland become unpalatable. In fact, San Diego has more entrepreneurs per capita than San Francisco and San Jose according to Inc. Magazine which ranked San Diego as one of the top 5 cities for entrepreneurs. So why should companies and capitalists consider San Diego the next tech hub? Here are our top five reasons to ditch the Valley for the beach.

The Talent

San Diego has a number of higher learning institutions which produce thousands of savvy, innovative graduates. UCSD is an extremely competitive school who’s average applicant has a 4.0 GPA. Currently ranked 41st overall in the 2019 edition of Best Colleges in the nation, UCSD is ranked 19th for computer science. Roughly 50% of their graduates are trained in biology & engineering. More VC-backed entrepreneurs are emerging from UCSD than from Boston University: UCSD produced 349 entrepreneurs who founded 330 companies and raised $5.73 billion from the start of 2006 through to the end of June 2018, according to research by PitchBook

Major collaborators with the university include companies like Glaxo Smith Klein and CIRM. San Diego State University is ranked 5th for information technology and 19th in California for computer science. The entrepreneurial community at SDSU is very active and its Lavin Entrepreneurship Center was recently awarded the Nasdaq Center of Entrepreneurial Excellence award by the Global Consortium of Entrepreneurial Centers (GCEC). University of San Diego is currently ranked 90th (US News & world Report) in the nation and its Shirley-Marcos School of Engineering is currently ranked 12th in the country. Clearly San Diego is home to many talented young minds equipped with skills in the industries of tomorrow and the entrepreneurial spirit.

Why is this important? The recruiting war for talent, engineering, sales, customer success, business development, marketing, etc., is far less competitive in San Diego than in San Francisco. In a recent article, 44% of San Diego millennial workforce was considering leaving the region due to a lack of career advancement and wage growth. The median household income in San Diego is $80,000, far less than San Jose or San Francisco.

The Cost of Doing Business

California is well-known for its tech regions in the San Francisco Bay Area (San Francisco, the outer Bay Area regions, and Silicon Valley) and Los Angeles (Silicon Beach and growing presence in Culver City); however, the cost of running businesses there (facility costs and labor) far outpaces San Diego. Renting commercial office space in both San Francisco and Los Angeles comes at a premium when compared to San Diego (May 2019, Costar) when comparing similar product across all classes. According to a December 2018 report by Brex, San Diego startups spend about $207,000 per month, which is far less than the $369,000 per month spent by startups in San Francisco.

From Brex: 2018 State of Spend, written by Chris Read

While a higher burn rate for a startup may be tied to areas with greater access to top-tier venture capital, it certainly doesn’t correlate to a stronger business model. Hiring talent in San Diego will cost employers less than the next two tech regions in California, and the workforce in San Diego expects fewer additional financial perks than their counterparts. Venture capital is choosing San Diego tech startups over life science/biotech investments as they require less money and have a lower valuation. San Diego startups raised the largest amount of venture capital in the third quarter of 2018 since 1995: $907 million. (Venture Beat )

When considering their capital allocation and future reinvestment, many angels/funds will choose early stage tech companies. Once the next round (enter Private Equity or Softbank) is secured this provides greater liquidity.

Why is this important? San Diego’s superior cost of doing business means your company will experience greater growth over the same period by securing A players at a lower price tag. Even with the desire for higher wages from the San Diego millennial workforce, the cost of obtaining the best-of-the-best is an improvement over San Francisco.

The Growing Tech Community

San Diego has long been known the backyard for companies like Qualcomm and Illumnia. While large companies like these do employ a significant part of the tech/biotech community, they also inspire new businesses in the region. A number of startup companies founded by ex-Qualcomm employees have successfully grown over the years and spread the tech community footprint. San Diego’s tech community is split geographically into three regions; Carlsbad, Sorrento Valley/UTC, and Downtown. While these regions currently don’t interact as cohesively as The San Francisco Bay Area, semi-annual events like Startup Week and events held by San Diego Venture Group, Foundrs, ThinkTank, and Tech Coast Angels have incredible turnouts. Larger companies like Apple, Amazon and Dropbox have recently increased their presence in the region. Amazon expanded into an 85,000 SF facility and is developing a facility near the US/Mexico border on a 2 Million SF facility. Apple leased 97,000 SF (UTC) announcing it plans to hire 1,200 employees in the region over the next three years. In addition to this, incubators with backing from giants like GSK have increasingly played a role in the growing startup community. The increase of large co-working operators in all three tech regions continues to drive community as small businesses within leverage each other through their early stages. Co-working operators similar to Wolf, who watch their tenant’s grow may invest in them becoming a capital source in the angel round.

The Future

The relocation of companies like Bizness Apps, Wrike, and others have real estate developers launching speculative projects to court tech businesses. Stockdale Capital Partners recently won approval to convert downtown San Diego’s Horton Plaza into a 772,000 SF high tech campus. The project is estimated to create 4,000 jobs and build on the existing tech community in the area which already boasts 140 startups. Projects like Superblock, Makers Quarter and UCSD (which has a new campus underway downtown) are increasing the infrastructure needed to attract more tech companies and investment dollars. San Diego has all the necessary components to become the next west coast tech hub. The question is no longer ‘if’ but when.

Jamal Brown is the CEO of The Ocean Company, an exclusive tenant representation firm with offices in San Diego, Orange County and Los Angeles focusing on the leasing and acquisition of commercial real estate.

Main: 858.356.2990 | E-mail: jbrown@theoceanco.com | social: @theoceancompany

5 Reasons You're Not Attracting Talent

Employers are experiencing difficulty matching open positions with extraordinary talent.

If your organization is having trouble attracting the best talent for the job you may be facing the following five common problems. Never fear, we've got a few solutions that will help your company stand out amongst the competition.

1. Obscurity

During the Great Recession when jobs were scarce, employers could be selective about hiring the best of the best. We are currently at the height of the economic cycle and there are plenty open, well paying positions. Talent has to be wooed by more than money, you need a great company culture and job-related perks. In addition to all this you need to spread the word about these aspects of working with your business. If top talent doesn’t know about these aspects of your business through social media or your presence in the community you’ll have a tough time attracting them.

2. Workforce Fulfilment

The millennial workforce wants to feel like their efforts are having an impact. The solution to attracting the cream of the crop is in making sure your open positions have compelling descriptions tied into the overall company mission. It doesn't hurt to have a socially responsible company ethic either.

3. Location, Location, Location

You may have heard this mantra in real estate, but it also applies to workplace desirability. Today's young professionals tend to flock to desirable, often urban areas in walkable distance to social centers. These typically exist within densely populated hubs, and if you aren’t in them or nearby, you’ll have a hard time gaining their interest.

4. It’s all about your space

While you may not need a Facebook or Google style campus, your space says a lot about the company culture and what it’s like to work there. Does your space encourage collaboration, innovation, is your leadership accessible, and is the company brand reflected in its design? You never get a second chance to make a first impression so pay attention to what your space says about you.

5. Do everything you can to keep existing talent

Sounds like a no-brained but your competitors are trying to recruit your talent daily. Not only that, but word of mouth about what it’s like to work with your organization may be dissuading other talented professionals from joining your team. Make sure your team is happy and well compensated. Develop with a strategic plan to improve employee engagement, heck, buy them lunch. Creating this type of work environment will land you referrals to other talent from your existing team, and your clients. Be prepared and aggressive and you’ll stand out amongst your industry peers, and talent pool.

Jamal Brown is the CEO of The Ocean Company, an exclusive tenant representation firm with offices in San Diego, Orange County and Los Angeles focusing on the leasing and acquisition of commercial real estate.

Main: 858.356.2990 | E-mail: jbrown@theoceanco.com | social: @theoceancompany

5 Metrics You Need To Know

So you think you’re ready for an additional location and are prepared to spend the time, capital and effort to expand. We have all heard the ‘location, location, location’ mantra, especially when it comes to retailers and restauranteurs; but there is much more to successfully expanding your offering than this. Truly understanding the business metrics in your current location Is beneficial to finding the right location to occupy. The five business evaluations below will help you and your business determine what space is right for your next location.

When planning any expansion of your brand, knowing the true occupancy cost of your business is essential for the success.

1.Revenue generating space: Unlike the majority of office or industrial users, retail and restaurant space occupiers generate income on a much smaller percentage of their rentable area. Space usable for displaying goods, seating customers, or other “front of house” activities is typically in the 50%-60% range. The effective cost of occupying space is derived from dividing your revenue over this percentage of your square footage. In the case of restaurants, the kitchen is absolutely an important component in generating income; however, when planned correctly this space is typically less than 20% of the entire establishment footprint. When planning any expansion of your brand, knowing the true occupancy cost of your business (revenue divided by that percentage of your space that generates income) is essential for the success. The cost for a potential new location should be examined utilizing these metrics.

2. Revenue as a percentage of your Facility Cost: Your facility cost is generally the second or third line item on your balance sheet, but identifying the cost of your facility in relation to the revenue you generate from it is a key metric needed for smart expansion. Your annual revenue/annual facility cost (Base Rent + Operating Expenses + Utilities) will provide a benchmark you can apply to potential future sites.

3. Effectiveness: Business owners can evaluate your actual annual occupancy cost metric by dividing your sales by the establishment’s selling space. While this can also be done by dividing the annual top line revenue by the gross square footage it is more useful to use the revenue/selling space formula if you wish to apply this to other locations. Remember, not all spaces are equal due to inherent space shape efficiencies.

4. Demographics: We all know local population income and age numbers matter; however, you may be operating in a ‘destination’ center wherein people from surrounding areas frequent often as a result of commute or travel. It is thereby important to understand the demographics of YOUR customers. While the neighborhood, average traffic counts, and proximity to other similar retailers does have an effect on your success, knowing: who, why, when and how your revenue is generated will provide guidance should you expand.

5. Discounting: Probably the least exciting topic but one of the most important. Taking the number of sales at discount or special pricing and dividing it by the total sales (Discount Sales/Total Sales) is necessary when developing a stores profile. Restauranteurs who have to offer heavy discounts/specials to get people in the door rarely have the necessary capital or financials to expand. It’s common knowledge that food margins are slim, and if you’re discounting your per plate costs there better be an avenue to make up for it., i.e. alcohol sales. Retailers offer discounts based on seasonal changes or specific items that aren’t moving, however, the percentage of a store’s discounts should remain consistent. If this percentage increases quarter over quarter (not just seasonally) it’s indicative of a problem.

For both restauranteurs and retailers knowing these metrics can help correctly identify geographic areas, and specific sites, suitable for expansion. Performing this front-end analysis will save you time, money, and prevent you from committing to the wrong space. If you have any questions related to expanding your brand into new locations call us for a free consultation.

Does a Modern Office Space Need a Kitchen/Break Room

Office space occupiers often wonder if creating a kitchen or break room within their workspace is necessary. Commercial Real Estate expert Jamal Brown breaks down the reasons why designing a kitchen or a break room as an additional meeting area within your office space may be the best solution. Finding a tenant representation broker that knows how to maximize your usable square footage and use your space to support the company culture is key. If you have any questions on our office space design recommendations, feel free to call us. The Ocean Company is a team of commercial lease and property acquisition specialists with offices in Los Angeles, Orange County and San Diego California.

Protecting Your Business From Supplemental Tax Bills

As a tenant occupying a commercial building you are paying your proportionate share of that building's common area maintenance, property taxes, and property insurance. The way these property expenses are billed to your business varies depending on the type of lease structure you have negotiated. NNN lease structures pass all cost through to their tenants directly, Gross leases have a base year (cumulative actual expenses needed for the building in that particular calendar year) for calculating a tenant's exposure to building maintenance costs and then any expenses over the base year expense value are billed back to each tenant based on their pro-rata share. In Q4 2018, commercial real estate values are at an all time high. Property owners are selling their real estate for a profit but as a tenant, this means you are going to receive a higher assessed property tax value after the sale. In short you're occupancy costs are going to increase due to the sale of the property. There are way to protect yourself and your business against these costs. If you're interested in finding out how, contact us. We can help. 858.356.2990

How To Convert Warehouse Into Office Space

Many small businesses and startups are being choked by rising commercial real estate pricing. Rents are currently at or above pre-recession prices, making companies choose between their facility, or expanding their business. There are options out there for users of office space who want "cool" or creative work-spaces, and we wanted to share one with you. Converting industrial warehouse space into a usable office work-space is achievable with a few minor changes. The two items which need the most attention are climate control, and light. Adding some sort of cooling air circulation will greatly change the atmosphere of a warehouse work environment. Replacing solid doors with glass, and reducing the number of walls within the entire space will allow more ambient light to flow through the work space.

Neighborhood Spotlight: Liberty Station/ Point Loma

Point Loma and Liberty Station

Neighborhood Business Spotlight: Brick San diego

Image by @andy_king_photography

Business Spotlight: BRICK SAN DIEGO: Liberty Station’s premier event venue

Brick San Diego is an event venue comprised of 6,000 sf of open space located in Point Loma’s Liberty Station. This inviting event space is available for weddings, holiday parties, corporate events and more. Brick’s operators, 828 Venues, created a beautiful interior that can be transformed into anything a client dreams. Brick’s event planning team has been servicing the community for over five years, and can help you throw the best gala in Liberty Station. Here are five reasons to book this space and work with Brick’s team while planning your next celebration.

1. 24-hour Rentals: Take as much time as you need.

Understanding that event set up and execution can take more time than just a few hours, this unique event space allows for 24 hour rentals so you can set up without the time constraints that most other venues would impose.

2. Open Vendor Policy: Creative freedom, whether you want to DIY or not.

While many venues will maintain an exclusive list of vendors that you must chose from when planning an event, BRICK offers the option to bring in your desired vendors! Not only does this allow you to create the celebration of your dreams, it ensures that your gala will be unique and memorable. They also have a list of vendors on call that are familiar with the space so no matter what you choose, this flexibility sets BRICK apart from the rest.

3. BRICK Coordination: Available to handle your every need.

Having an event can become stressful, especially if you plan to also be enjoying the party. Brick offers an exclusive coordinator for your day of needs and even can help with the planning process. While an outside coordinator can be helpful, having someone on site that knows the regulations and policies can alleviate so much stress!

4. Indoor + Outdoor Space: Extend the party outside.

One of the many benefits of having a space in Liberty Station is the ample use of outside space. There are several grassy areas, patios and the views of the downtown skyline are unbeatable. When you have an event, allowing people to move between indoor and outdoor space can extend the ambiance.

5. #BRICKBeverage: Bar service curated to your tastes.

BRICK offers a catered bartender service so that you don’t need to worry about your guests having cocktails. Not only is service included with the many package offers, it takes an extra step out of the planning process so that you can enjoy your event without breaking the bank!

Point Loma Market Statistics

The Point Loma submarket is a mix of office and retail space that retains a small community feel. With older product outside of Liberty Station, there are many unique options for commercial space build outs. Liberty Station and it’s recently redeveloped military housing complex is undeniably one of the most unique offerings in the city of San Diego. The tenant mix ranges from schools (High Tech High), the famous Public Market, multiple restaurants, shopping establishments, religious facilities, and professional services.

Recently, McMillan sold it’s remaining 66 year master lease on the retail component in Liberty Station to Pendulum Property Partners. This includes all the

restaurant and retail spaces in the project.

Below are some Point Loma submarket statistics.

Retail Space Data:

Construction: 9,000 square feet of space expected to be delivered by Q4 2019

Sales: Average price of $388 per square foot

Vacancy rate: 3.2%

12 month rent growth: 2.2%

Office Space Data:

Median Sale price: $2.1 million

Sales: Average price of $225 per square foot

Vacancy Rate: 4.8%

12 month rent growth: 4.3%

Considering Point Loma or Liberty Station as a location for your business? Hire an expert you can trust. For more information on commercial real estate in Point Loma or Liberty Station, contact us and we can help you find the best space for your business!

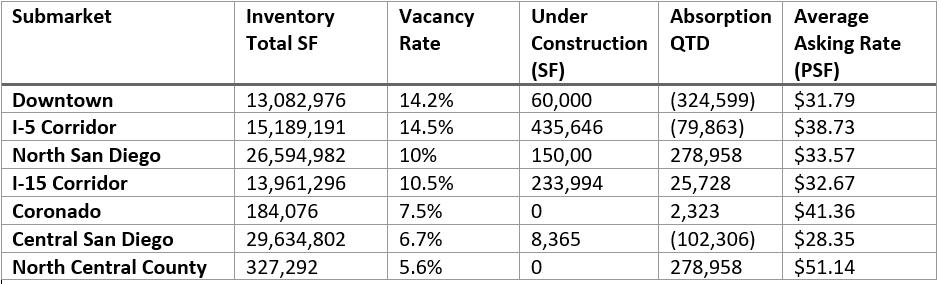

San Diego Office Market Report Q3 2018

When considering purchasing or leasing office space in San Diego one of the most important steps you can take to start, is to understand the state of the local market. As a commercial real estate professional and one of the top San Diego tenant representatives I make it my priority to research this information for you.

Below is an overview of the commercial real estate transactions in America’s Finest City, San Diego.

Prominent Purchase Transactions of Q3 2018

*Information compiled through data provided at CoStar

Prominent Lease Transactions Q3 2018

*Information compiled through data provided at CoStar

Commercial Office Space Report Q3 2018

Looking for a space for your business? Fill out the form below so we can help you get started on your search

Neighborhood Business Spotlight: 5th Ave Kitchen and Bar

HILLCREST & BANKERS HILL

Inside bar of 5th Ave Kitchen & Tap, Featured drink Blackberry Margarita

To get a better idea of how any neighborhood operates, it’s always a good idea to go right to the source of local business and community. Business owners have their finger on the pulse of the community and can tell you first hand the advantages of certain neighborhood features. To better understand the neighborhood of Bankers Hill and Hillcrest for commercial business, we set out to find someone seeing success in this growing neighborhood.

This led us to interview and tour one of the newest and brightest establishments in the Bankers Hill/ Hillcrest neighborhood. 5th Ave Kitchen and Bar opened in early 2018 and has seen tremendous success in the neighborhood with both residents and other business owners.

5th ave Kitchen and Tap has placed themselves directly on the border of Hillcrest and Bankers hill in a neighborhood that is a mix of close knit community, visiting tourists and thriving business districts. Not only does the establishment offer a New Orleans influenced menu but the owner and managers and have made it a priority to be a part of the community. Block by block, reaching out to neighbors and business owners alike.

The business is situated on 5th avenue closest to Upas Street and has large retractable garage door windows that allow the beautiful San Diego breeze to enter the restaurant. The interior consists of ample bar and table seating in addition to 16 TV’s showing the latest sports games locally and nationally. We continued walking through the restaurant and arrived on the back patio which is easily the crowning jewel of this location. With open air, sparkling lights, bocce ball, and room for events of up to 100 people, this back patio invites community gatherings of all shapes and sizes.

Following our tour of the location we had an opportunity to sit with the Owner Andrew and the manager Renata to ask them more about their goals for 5th ave Kitchen & Tap.

Back Patio Event area at 5th Ave Kitchen & Tap

What do you like most about this location for your business?

One of the Biggest benefits to this area is that we border three really unique neighborhoods. We have Hillcrest to the North, Bankers Hill to the South and Balboa park to the East. Our establishment is right in the middle of all of that which diversifies our crowd.

What sets you apart from other eateries in the neighborhood?

When we opened this location we restyled our menu to have a fresh ingredient list with influences of New Orleans style food. I take a lot of time to create food that everyone can enjoy. We cater to such a diverse crowd its important to have something for everyone. Our patio is also an added bonus to this location. We have room for 100 person events out here and we can even make the space private for the events. This community ranges in demographic so widely but everyone has a place here. This restaurant is really a hidden gem of the neighborhood.

What sort of specials do you offer?

We have a daily happy hour that offers drink specials and discounted appetizers. We also have weekly football specials with unique New Orleans inspired food. This has become sort of a hub for Saints fans in the region so we cater to the crowd on those days. The San Diego WHO DATS have made this a frequent gameday watch spot so we make sure there are plenty of good eats to go with it.

What do you want people to know about 5th Ave Kitchen and Tap?

We designed this location to be open to the neighborhood so the retractable garage door windows really invite people inside. We were able to give this location a face lift and really make it stand out when we decided to open the business here, which is also important because it adds to the thriving neighborhood. We really love being in this community. Everyday we see neighbors we know, greet other business owners at lunch time or happy hour, and get to expand on our already growing customer base. It really works because we have been active in our local neighborhood and we are not just another store front. We had options in other neighborhoods to open but ultimately chose this location because of the thriving community around every corner.

I’m also really proud of our cuisine. Handpicking ingredients and making sure that everything is fresh and made to order was a big priority for me when designing this menu. The Cajun style burgers and po’boy sandwiches are some of my favorite items we make.

Your back patio is a great area for events, what sort of events to you host here?

We’ve spent a lot of time making this patio space inviting and ready for events. We have hosted birthday parties, dog rescue events, football team fundraisers and even drag queen bingo. We don’t charge an event space rental and for every event we create a unique menu and have full bar options. I think that really opens up the range of who likes to hold events here. We are so close to so many business districts so it also makes this space a great location for corporate mixers and happy hours. We want everyone to feel invited to hold an event here so we go out of our way to make every event a success.

What would you say to another business owner looking to open a store front or business here?

This community is growing. There are so many residential housing developments within walking distance and the foot traffic seems to increase by the day. The local average range of income has increased over 25k in the last three years alone and will likely continue to rise. Outside of the residential community, the business community is welcoming and very focused on working together to help each other out. We sponsor each other in fundraisers, host events and all support each other at local business owner events. There can sometimes be misconceptions about the demographic here and what I want people to know is that there isn’t just one type of person in this area. There’s the lifelong residents, business owners and operators, the LGBT community and a lot of families too. The opportunity is endless. If someone wants to open a business, this is definitely the San Diego neighborhood to do it.

What are your favorite things on the menu? What should people definitely not miss when visiting your location?

There are so many items to chose from but I definitely have to say our Shrimp Po Boy sandwich and our Southern Gentleman burger. Both are made in traditional Cajun styles and really bring a taste of home into our menu. I’d also suggest whatever seasonal and shareable specials we have available because they are made fresh to order and are unique every week.

We get a lot of rave reviews about our wings too. They are flash fried and come with a variation of sauces. The BBQ sauce we offer with our wings is made locally in Oceanside, That Boy Good BBQ sauce. As a joke the owner gave me the recipe without the measurements to let me try to get the recipe right. After several attempts I gave up and now we have his sauce offered in house. We also make several other sauces right here in the restaurant so they add that special flavor to every batch.

If there’s any room left for dessert I’d suggest ending the meal with the White Chocolate Bread pudding. Every time we serve it there’s nothing left when we return for the plate. Our desserts are also seasonal so we can stay with the freshest ingredients but right now that’s my favorite.

If you are interested in learning more about the neighborhood send us an email or stop on in to visit 5th Ave Kitchen & Tap. They’ll roll out the red carpet and make you feel right at home!

Hillcrest and Bankers Hill commercial real estate valuable information

If you are looking to expand your current business location or even open a new store front, check out all the details on this quickly rising community in the heart of San Diego.

Total Vacancy Rate for Class A commercial space: 25.3%, up a total of 5% in the last quarter

Hillcrest is the 16th most walkable neighborhood in San Diego with a Walk Score of 81

In the heart of San Diego this neighborhood is easily accessible to the I5 and I163 freeways

City planners have recently increased the building height limit in this section of San Diego to 100 feet, allowing for commercial growth while keeping a neighborhood feel.

Much of the available space is street level, allowing foot traffic to be a driving factor in business growth

Rental rates are comparable to many other business districts such as UTC, Downtown and Del Mar Heights. This sub section of the city can often be viewed as under priced for the area allowing more creative business entities to rent commercial space

What I Wish Business Owners Knew About Leasing Commercial Real Estate

When running a business one of the key things to think about for long term survival is your bottom line. If you’ve spent any time evaluating a profit and loss report one of the biggest expenses is generally space rental.

I’ve spent years in the commercial real estate industry and today I’m sharing with you the biggest pieces of information that I wish business owners knew before entering into a lease for a commercial space.

Leasing commercial real estate is a process

Entering into the commercial real estate realm is a process. Keep these 5 key steps in mind before beginning the process.

Planning phase

Understand where you are in the business cycle and how far in advance you can reasonably predict your space needs. This is usually done internally or with the assistance of your tenant representation agent’s team including a space planner.

Site Selection

requires around two to three weeks of research as your tenant representative compiles all the available and upcoming spaces that could work for your needs. Once you’ve had a chance to review the options and selected a short list of potential matches, your tenant rep schedules property visits where your team can get a feel for the property, and surrounding area.

Negotiation

Your top two to three choices must be negotiated with simultaneously to achieve the best economic package. This can take anywhere from 1 to 3 months as the six financial components of the lease are negotiated across various rounds of offers. During this time an architectural drawing (space plan) is completed and agreed upon.

Documentation

Once your business selects a location and signs a letter of intent, the landlord’s attorney must create a preliminary draft of the lease (1 – 2 weeks) which must then be reviewed and often altered. Alterations to the language in the lease are negotiated between the tenant’s attorney and the landlord’s attorney, which can take two to four weeks. During this time the tenant’s financials are reviewed by the landlord, and any concerns with the tenant’s financial health are discussed.

Tenant Build out

Construction drawings are made from the agreed upon space plan, then sent through the city planning department who issues permits. If the tenant is selecting contractors and controlling the build-out (strongly recommended) their team will create a construction time-line for completion. Depending upon size of the space and the degree of work to be completed the construction time-line could be as long as three months.

Landlord’s are in the business of making money through renting space

Whether you’re a new tenant deciding to lease space or an existing tenant who enjoys a good relationship with your landlord or property manager, do not negotiate your facility lease directly without representation.

This isn’t buying a car, landlords are in the business of real estate and have resources and information you don’t. Your company’s 2nd or 3rd largest expense is facility spend, and negotiating a multi-year facility contract without examining your options or knowledge of the marketplace puts your business at a disadvantage.

I spent five years as a property manager for large, national property ownership groups as well as small local investors and one thing they share in common is hoping they can capture your tenancy at the highest possible rent without having to make concessions in the process. Your relationship with any landlord is always a business relationship, level the playing field by hiring a professional that will educate you with the information your landlord is withholding.

Hire a tenant representative

You wouldn’t hire an attorney to represent you if they represented your adversary in a legal dispute. Why allow a brokerage firm to represent your company in negotiations if the majority of their business is representing landlords and their interests?

Just because a full service brokerage has a ‘tenant rep’ team, doesn’t mean they are free of conflict. They sit in the same company meetings as the landlord representatives who share details of your lease. They are also under pressure from their co-workers and management to ‘bring them a deal’ which means your best interests aren’t upheld.

A tenant-only brokerage has no allegiance to the landlord community and only negotiates terms and conditions that achieve your goals, regardless of which properties are under consideration. The best part is that your tenant representation comes at no cost to you.

Let’s be serious, your companies rent revenue is paying for your landlord’s mortgage, property taxes, property maintenance and insurance. It also pays for the landlord’s agent fees. Having someone on your side is not only smart, it will save you money. A pure tenant representation agent takes part of the fee the landlord pays their agent, which would be paid to them regardless if you had someone on your side or not.

Not all buildings are created equal

While there may be striking similarities between the look and type of amenities of many buildings, there are very important differences to consider when selecting a location.

See our blog post about the difference between a property’s rentable and usable square footage before you select one site over another.

Your space is a reflection of culture. It can be used to recruit talent

Want to attract top talent and keep them? Create the type of space which showcases your company’s unique offerings and capabilities during the leasing process.

Design your ideal space and negotiate a tenant improvement package that will bring your vision to life. When done correctly, your space will encourage collaboration, and benefit from an increase in output while becoming one of the top places to work

Want to learn more about leasing a commercial space? Work with our team of professionals to help you locate your ideal space in Southern California. We are a tenant only representation company and can help you navigate each of these key things in your process.

Leave us a question in the comments or click the link below to start the process of looking for a space that exceeds your expectations

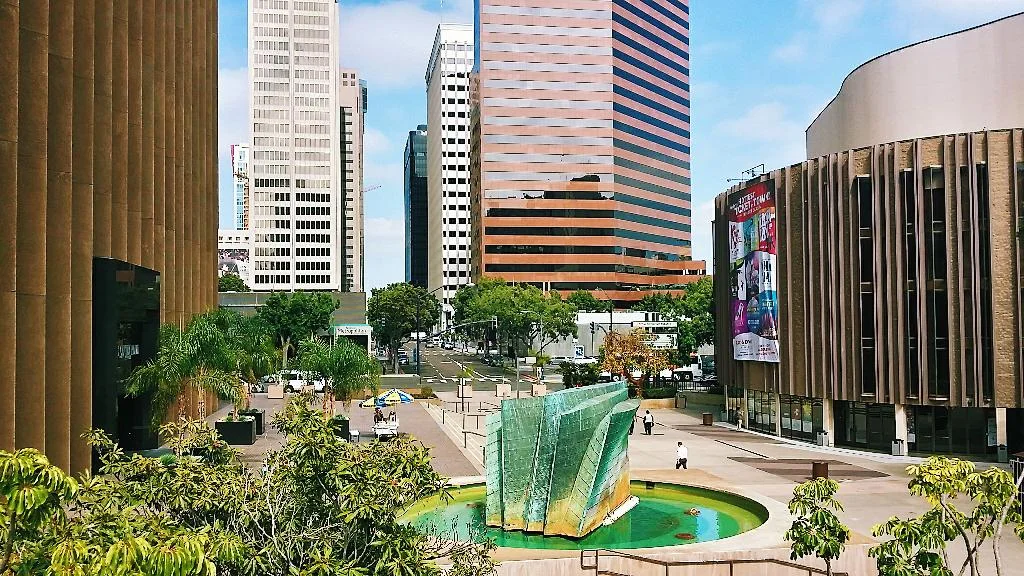

Here's what is going on Downtown San Diego

Downtown is the most dynamic neighborhood in San Diego, and multiple changes to the skyline are on the horizon. Here are some of the planned developments around town residents and businesses are keeping an eye on.

Little Italy

Rendering of 2100 Kettner

Amid all the bustling restaurants, bars and tasting rooms, Little Italy has a planned 163,000 square foot mixed-use building which is sure to bring more attention to San Diego’s hottest district. Later this year construction is slated to begin on this office/retail project which features high ceiling, indoor-outdoor retail spaces which can be delivered by December 2020. The Kilroy Realty project also takes advantage of the Little Italy’s scenery and also offers outdoor work-spaces and lounge areas. The eclectic brick and steel construction will fit right into the neighborhood and should attract many companies whose workforce will value the many amenities in the neighborhood. 2100 Kettner’s office space is scheduled to be delivered March of 2020, and will include underground parking at 1.5 spaces/1,000 square feet; a higher ratio than many Downtown competitors.

Columbia District

Rendering of Pacific Gateway

Manchester’s Pacific Gateway, a $1.5 Billion redevelopment of 12 acres of land along San Diego’s waterfront has broken ground and is scheduled to be complete by 2021. This seven building complex will also feature a 4.5 acre open space park and 1.1 million square feet of office space, almost 400,000 square feet of retail/restaurant space and 2400 subterranean parking spaces.

Rendering of Portside Pier courtesy of Tucker Sadler

Portside Pier is underway following the demolition of Anthony’s Fish Grotto, a longtime San Diego institution. In its place will be a two story, 42,000 square foot structure and promenade with a viewing deck and a 12 boat dock-and-dine facility allowing boaters to access the project’s future restaurants: Brigantine on the Bay, Miguel’s Cocina, Ketch Grill & Taps and Portside Coffee & Gelato. The project is expected to open in late 2019.

Marina District

Rendering of Seaport Village

Redevelopment of Seaport Village, slated to begin by 2022, is still meandering through planning stages with the Port District. The 70 acre site has plans to become a mixed use project including a 5 star 237 room hotel (367,964 square feet), office spaces (144,987 square feet) , a 237 room hostel, a learning center (65,150 square feet), a 480 foot observation tower and even an 192,050 square foot aquarium. This project has the potential to drastically change the future of San Diego’s skyline and the way tourists interact with the Marina district.

Gaslamp District

Rendering of 777 Front courtesey of Bosa Development

The big news here is the sale and future redevelopment of Horton Plaza and 777 Front Street. Stockdale Capital Partners are in escrow (their money has gone non-refundable) to buy the aging retail project with the plan to remove part of the structure and build a modern 900,000 square foot office building. The remaining retail space will be reconfigured and refinished for a more enjoyable shopping experience. Bosa Properties plans to convert the adjacent outdated retail building at 777 Front Street into an 162,000 square foot creative office project with an attractive glass and steel aesthetic. Hoping to capitalize on the wave of reorganization led by many of their multi-family projects downtown, Bosa’s latest project will cater to technology companies and will have a fitness center, courtyard with seating, gaming and other amenities. Interior demolition has already begun and delivery is slated for late 2019.

East Village

The most active development area in Downtown San Diego, East Village has office, retail, and multi-family projects in every stage of construction. Out of the 2,900 multi-family projects in the works, many of them are in East Village and include affordable housing options like Affirmed’s project on 17th St, Chelsea’s project on 13th St., and Nook East Village’s micro-apartments. New retail projects like PunchBowl Social and public spaces planned by Makers Quarter will increase demand for the area and support greater shopping and restaurant operations.

Hotel development is also underway with the Ritz Carlton, San Diego’s first five-star hotel. Along with the 160 room hospitality offering, the Ritz will sell market rate residences and low-income rental units on opposite sides of the hotel. Bordered by 7th and 8th avenues & Market and Island the project should be complete by early 2022 and include 156,000 square feet of office space.

UCSD’s downtown facility, currently underway, is located between Park and 11th, and Market and G Street. The 34 story apartment will contain 426 apartments, an amphitheater, a four story (66,000 square feet) USCD building and leave The Historic Remen House at the corner. This facility will bring together business, art and community groups as well as faculty and students. Delivery of the project scheduled completion in early 2021 with the hope that concerts, art exhibits and seminars will be open to the public by summer 2021.

Jamal Brown is the CEO of The Ocean Company, an exclusive tenant representation firm with offices in San Diego, Orange County and Los Angeles focusing on the leasing and acquisition of commercial real estate.

Downtown San Diego is Booming: Here's Why

Downtown San Diego’s many new developments are attracting millennial residents, technology businesses, and changing the way the downtown sub-market is viewed.

By Ellen Paris contributor for Forbes

Downtown San Diego is booming with residential and commercial development. No longer is it the once sleepy navy town boasting the best climate in the country. The weather remains beautiful year-round while the city has reinvented itself as a dynamic place to live, work and play.

The Downtown San Diego Partnership’s numbers confirm this. There are more than 37,000 residents, 81,000 employees and 4,000 businesses downtown currently. In addition, more than 120 tech and innovation startups call downtown home.

When Petco Park, home to the San Diego Padres, opened in 2004, development near the ballpark hit the fast track. Fast forward to late 2008 and 2009 when projects in development and the planning stages came to a halt. That has all changed.

Today, streets from the Gaslamp to the East Village to Little Italy are alive with happy people, trendy restaurants, craft breweries, coffee houses, yoga studios and eclectic shops. The vibe is young and lively as people and their dogs enjoy the downtown lifestyle. Locals joke there are more dogs living downtown than children.

Listen to David Graham, deputy chief operating officer, City of San Diego: “We have actually been planning for a vibrant downtown for years. It began with Horton Plaza in the '80s. The live/work lifestyle is built into our development plans. We are planning for 90,000 residents in downtown by 2035.”

Around 41% of downtown’s population are Millennials and 21% Gen X. Olga Moreno, account director at Crowe PR in the East Village, lives and works downtown. “I love walking to my office in ten minutes while enjoying the beautiful weather,” said Moreno, who rents an apartment in the Marina neighborhood. “At this point, many of my friends also live downtown, which is really fun and allows me to spend a lot of quality time with them on weekends,” she adds.

At the end of 2017, a downtown development status report by Civic San Diego said there were 25 projects under construction. This included more than 4,500 apartments, four hotels with a total of 863 rooms and 257,000 square feet of retail space. Looking at “Projects Pending Construction," it is clear downtown’s residential growth remains strong. An additional 4,138 apartments have permit approval.

Nat Bosa, a major downtown developer and founder of Bosa Development, owns a significant number of downtown development sites. “This development cycle has been driven by rental product to meet the demand of the growing demographics of Millennials who choose to live and work downtown.”

"Downtown is a vibrant young community attracting both people and companies. It’s a city that is sustainable, mobile and smart. This is what a city should be to attract both residents and companies to propel growth,” Graham explains.

Hayley Kerr, originally from New York, moved to downtown two years ago from Los Angeles. She rents just north of the much-in-demand East Village neighborhood. “I love that I barely use a car. I walk to work, the gym, restaurants, bars, Balboa Park, the waterfront, Little Italy and Padres' games.”

San Diego is not a city of concrete canyons. Planned into downtown’s growth are multiple parks, open spaces and pocket parks welcoming residents, workers and visitors. Community calendars offer a variety of free outdoor events including yoga, concerts and movies. “Our plans have always focused on creating a living, breathing vibrant place for all to be a part of,” Graham adds.

Another plus for downtown: It’s one of a few large urban cities with an accessible international airport located downtown. Move to downtown and ditch your car since getting around there is easy and often free. The Free Ride “FRED,” which launched almost two years ago, is a downtown shuttle service of all-electric vehicles people can access via a mobile app.

Daniel Reeves, president at Juniper Strategic Advisory, has spent six years working on the city’s economic development and public policy issues. “It’s pretty exciting times with the current redevelopment projects for Horton Plaza and Seaport Village. These are massive opportunities for large-scale revitalization in line with what Petco Park and the Convention Center did for downtown’s economic development,” said Reeves.

Beau Hodson, founder of Transparent Mortgage, specializes in residential lending in the downtown market. “People are starting careers here and this is where they want to live. I also see affordability in the San Diego downtown market compared to San Francisco or Los Angeles, which is fueling the growth.”

San Diego is a city with a lot going for it. The planned growth of downtown will only boost its popularity among desirable American cities to live, work and play in.

Manchester Transforms The Marina

Demolition on the Navy Broadway complex is almost complete which means construction is soon to start on Doug Manchester’s seaside masterpiece aptly named Pacific Gateway. When complete, this 17 acre mixed-use development will include the U.S. Navy’s headquarters, four office buildings totaling approx. 320,000 SF, exterior deck spaces, an athletic center, a 1.9 acre park and over 320,000 SF of retail and cultural amenities.

Sure to change the experience of locals and tourists alike, Pacific Gateway will re-imagine the Marina district and invigorate an otherwise sleepy side of downtown San Diego. Should the city of San Diego be sagacious enough to expand its dated convention center and keep tourist income pouring into the city, it will benefit from Pacific Gateway’s two planned hotels: one glass walled, 11-story luxury boutique with 260 rooms; and a larger, 28-story convention hotel with 1,090 rooms.

Retailers are already salivating at the chance to occupy space in the new development, as the Marina district is adjacent to the harbor and its weekly cruise ship tourists, and the airport. The eight block development is scheduled to open all at once, in grand style, at its scheduled completion in 2020.

How To Convert a Warehouse into Office Space

Many small businesses and startups are being choked by rising commercial real estate pricing. Rents are currently at or above pre-recession prices, making companies choose between their facilities, or expanding their business. There are options out there for users of office space who want "cool" or creative work-spaces, and we wanted to share one with you. Converting industrial warehouse space into a usable office work-space is achievable with a few minor changes. The two items which need the most attention are climate control, and light. Adding some sort of cooling air circulation will greatly change the atmosphere of a warehouse work environment. Replacing solid doors with glass and reducing the number of walls within the entire space will allow more ambient light to flow through the work space.

Understanding 'Rentable' vs. 'Usable' Square Feet

All commercial buildings are not created equal. This is evident upon inspection of multiple factors; location, allocated parking, quality of construction, and amenities provided, just to name a few. But one of the most overlooked aspects of a building’s value to the tenant is the efficiency of that particular building when compared to another. This efficiency is in relation to the ratio of the space the tenant actually leases within their four walls (the usable square footage) and the amount of space attributed to all common areas of the building including the lobby, hallways, restrooms, common conference rooms, common kitchen areas, interior break areas, work out buildings, showers/lockers, phone and electrical rooms, and any other common use area that, when added to the usable square footage, makes up the rentable square footage. This ratio is called the building “core factor” (also referred to as “load factor”, “loss factor”, or “add-on factor”). Landlords are ensured of receiving income on this common space so it is distributed to each tenant as an “add on” to their usable square footage that then totals the tenant’s rentable square footage and this is what the rent is based on. The difference in a building’s efficiency and therefor the core factor can quickly offset a lower base rent per square foot that building may have over another. Core factors can vary by as much as 10% to 15% and many times they are “artificial” as in, implemented by the landlord with no confirmation. This becomes a marketing ploy, to offer a lower rent when, in reality, the end result is substantially more than other competing buildings with greater efficiency. We find that in many cases tenants, who have existed under leases for many years, still don’t understand this issue today.

Buildings calculate all space that is constructed as gross square footage. The standard of commercial property measurement (“BOMA”) then requires that all vertical penetrations (stairwells and elevator shafts) be deducted from the gross square footage and the remaining square footage is the rentable square footage. When a company negotiates a lease on commercial space, they are occupying the usable square footage which is the square footage within their four walls but paying for the rentable square footage, including their share of the common areas referenced above.

Understanding core factors translates directly to the bottom line. Since building costs are typically near the top of the expense list, the savings can be dramatic in comparison to other expenses. Pay attention to the core factor. The example below puts numbers to the story:

XYZ Company needs 30,000 square feet of usable space to operate their business and is evaluating two opportunities. Building A has a core factor of 19% (1.19) and Building B has a core factor of 11% (1.11). Both buildings are offering the same rental rate, say $2.00 per rentable square foot. In this scenario, XYZ Company has a choice of leasing 35,700 rentable square feet in Building A, at a monthly rent of $71,400, or leasing a more efficient 33,300 rentable square feet in Building B, at a monthly rent of $66,600 per month. Calculating the difference in XYZ Company’s rental costs, they will save $288,000 over a five year lease term if they locate in Building B for the same amount of usable square footage.

This is one of many pitfalls that can be costly if not known by companies leasing commercial space. Don’t get caught paying more than you should. Hire a broker to help you. It doesn’t cost you a dime but the savings can be extraordinary.

Utilities Rates To Increase Occupancy Costs

The City of San Diego's water department recently proposed large rate increases for commercial property through 2019. The increased rates are currently being reviewed, but San Diego businesses will feel the impact should they be implemented.

Public Utilities Department Rate Increase Proposal Factsheet

The Public Utilities Department is proposing a series of water rate increases. These increases will have to be approved by City Council and, until they are, nothing is official. The proposed increases are:

• 9.8 % beginning January 1, 2016

• 6.9 % beginning July 1, 2016

• 6.9 % beginning July 1, 2017

• 5.0 % beginning July 1, 2018

• 7.0 % beginning July 1, 2019

The percentages represent the overall amount of increase to the Public Utilities Department. Each customer’s exact increase will vary depending on customer class and amount of water used. A single-family customer using 12 HCF a month will see their bill go from $70.81 a month to $77.27 a month.

The Public Utilities Department conducted an extensive Cost of Service Study to determine the amount of the proposed rate increases. The Study:

• Determined the Public Utilities’ revenue requirements to purchase and deliver water to our customers;

• Reviewed financial requirements for the upcoming five years;

• Recommended water rate increases through 2019.

The reasons for the proposed rate increases are:

• Increased cost of water sold to us by the County Water Authority;

• To help pay for the new desalination plant in Carlsbad;

• To help pay for the Pure Water Program;

• To make up the difference in the budget due to decreased water sales because of the water use restrictions mandated by the State because of the drought.

The Public Utilities Department will appear before the City Council’s Environment Committee on August 5 to present the proposed rates. The Committee will be asked to forward the rates to the full City Council. If they do so, the City Council will be asked to approve a Notice that will be mailed to every customer explaining the proposed rate increases and allowing customers to protest the proposed rates.

The Notice, which is required under Proposition 218, must be mailed at least 45 days prior to the City Council approving the proposed rates. The Council will be asked at its November 17 meeting to approve the new rates. If they do so the first increase will go into effect January 1.

In addition to the rate increases for potable water, the Department is asking that the recycled water rate go from 80 cents and HCF (748 gallons) to $1.73 per HCF. This increase will pay for the ongoing costs of operating the system as the recycled water rate has not gone up since 2001. There are no planned increases in Wastewater rates.

Office properties will pass the increased costs though to their tenants annually, resulting in higher common area maintenance fees in 2016 and beyond. The magnitude of these increases depends on your lease's Base Year for operating expense calculations. Unfortunately, landlords do not classify government mandated utilities rates as "controllable" expenses, and even if your lease has a cap on operating expense increases, the proposed water rate increases will effect your future occupancy cost.

Industrial, retail, medical office and R&D (that means you Life Science/Biotech tenants) properties which have tenants on triple-net (NNN) leases pass increased operating expense costs through to their tenants directly. Tenants with this type of lease have greater exposure to volatile fluctuation in building maintenance costs, property insurance and property taxes than their traditional office counterparts. The industries which consume greater amounts of water, craft breweries for instance, will see a hike in their occupancy costs as soon as the rate increases are implemented.

At the time this was written, no rate increase has been approved. San Diego's business community still has the opportunity to make its voice heard.

The Ocean company is a commercial tenant advisory serving the business community of San Diego. We specialize in facility negotiations, forensic lease audit and project management for our neighbors.