THE MORE YOU KNOW

THE BETTER YOU NEGOTIATE

Getting Above Standard Tenant Improvements

Do you want great space that helps define your business and attract new clients? Is your company culture important to hiring and retaining top talent? If any of these statements resonate with you, then you cannot afford to accept standardized tenant improvements.

Above standard tenant improvements are typically any material used to improve your space that is above the common finishes the building owner utilizes . Usually the building owner has a list or book of all standard paint carpet, lighting and other flooring finishes that they are willing to provide to improve their space with. These may not showcase your businesses image, align with your company culture, or provide current/potential clients an idea of the caliber of your services. Many architectural firms, law firms and technology companies (just to name a few) need their space to make an impression on everyone who walks through their front doors. An architect uses their lobby to speak to their design capabilities, lawyers use this & other meeting areas to set the tone for their prowess and other businesses use their interior common areas to reinforce their brand & company values.

Achieving a certain look and feel beyond what a landlord is offering typically comes at an additional cost of construction. For example: building out 5,000 sf with building standard finishes may run $60/sf ($300,000); however, your company may want to add design elements to part or all of your space that will increase that number to $85/sf ($425,000). The $125,000 delta between these two numbers can be covered in the following ways.

Tenant pays for the difference: now most tenant rep brokers hate this as it isn’t ideal for companies without a large war chest. It consumes the tenant’s capital upfront and can typically be used better by the tenant to grow their business. In the event the tenant outgrows their space ahead of the natural lease expiration, they’ve sunk capital improving a space they didn’t use for the duration of their lease.

Landlord amortization of the difference: this is the most common solution to a tenant improvement overage. The landlord factors the additional cost of the tenant improvements into the tenant’s rent over time. This keeps the tenant from paying for the improvements upfront but does raise their monthly/annual rent obligation. This can be accomplished as a $/psf rent increase or an annual percentage increase. Think of it as a loan on the difference from the landlord. Does the landlord make a return on this loan...of course. Does the tenant lose if they outgrow the space ahead of the lease expiration? Yes, but not as much as if they pay out of pocket for the improvement difference up front.

Covering the difference through a loss in concessions: this is by far the most complicated and situation specific solution. If you have a savvy tenant representative, who knows your improvement costs will overrun a standard market landlord contribution; they will negotiate a robust rent abatement package, then reduce that once the improvement costs are known so that your rent cost/sf doesn’t increase dramatically. The drawback here is that most businesses use the rent abatement period to offset moving, furniture and other soft costs associated with new space. If those costs are minimal, this may be the best option for a business needing above standard tenant improvements.

*Value Engineering: while not always strategy for covering the cost difference in negotiations, having a great project manager or construction team working with your business & tenant representative to cut construction costs after you’ve secured a certain $/sf in landlord supplied improvement funds can be to your benefit. Make sure your tenant representative negotiated a clause which allows your business to utilize any unused funds in the form of full or partial rent payments.

If you need any help finding or negotiating on space, call us. We’re here to help. #findYOURspace

Finding Your First Office Space

Congratulations, business is good and you’re ready to open your first office! Now what? Startup companies that reach the point of needing an office location should examine all of their options before committing to office space. The toughest part of choosing that first office is knowing what criteria to base your decision on. Keep in mind that real estate costs are typically the second or third greatest expense on a company balance sheet, and many companies stay the red because they carry more facility related overhead than necessary.

Congratulations, business is good and you’re ready to open your first office! Now what?

Startup companies that reach the point of needing an office location should examine all of their options before committing to office space. The toughest part of choosing that first office is knowing what criteria to base your decision on. Keep in mind that real estate costs are typically the second or third largest expense on a company balance sheet, and many companies remain in the red because they carry more facility related overhead than necessary. Our suggestion for startup and small businesses looking for space is to keep three specific criteria in mind:

1. How much space do we really need for the foreseeable future?

2. Does the location or visibility of a space help our company generate more revenue?

3. How important is flexibility in the lease of any space we pursue?

Entrepreneurs who have reached this point need to be wary of how they approach leasing space. For example, many take on more space than the business requires, sign leases that have a longer term than necessary, or fail to negotiate adequate concessions, and protective clauses, during negotiations. Others sign up with executive office suite operators without realizing that the premium they are paying for space there could get them larger, or more desirable space somewhere else. Co-working spaces have a similar model to executive suite operators, but are typically more flexible when it comes to paying for space. If your business doesn’t yet require you to be in the space on a day-to-day basis, this option could be for you. Our advice to most young companies is to scout the market for space listed for sublease before engaging with the afore mentioned options. Subleased space often comes at a hefty discount from what the master tenant is paying the building owner. These spaces can come furnished, and typically have less than three years of term on them. Sometimes, a sublessor will even allow your business to sublease for a shorter term than what’s remaining on the master lease. Finally, subleases are an agreement to lease space with the master tenant, and although the landlord must approve them, can often be attained without using the business owner’s personal wealth and assets as collateral should the business become incapable of meeting its debts.

Startups and small businesses looking for space should hire an active tenant representative who understands their needs. The Ocean Company has assisted many young companies in securing their first spaces, and negotiates the best possible lease with your objectives in mind.

Urbanization's Effect on Commercial Real Estate

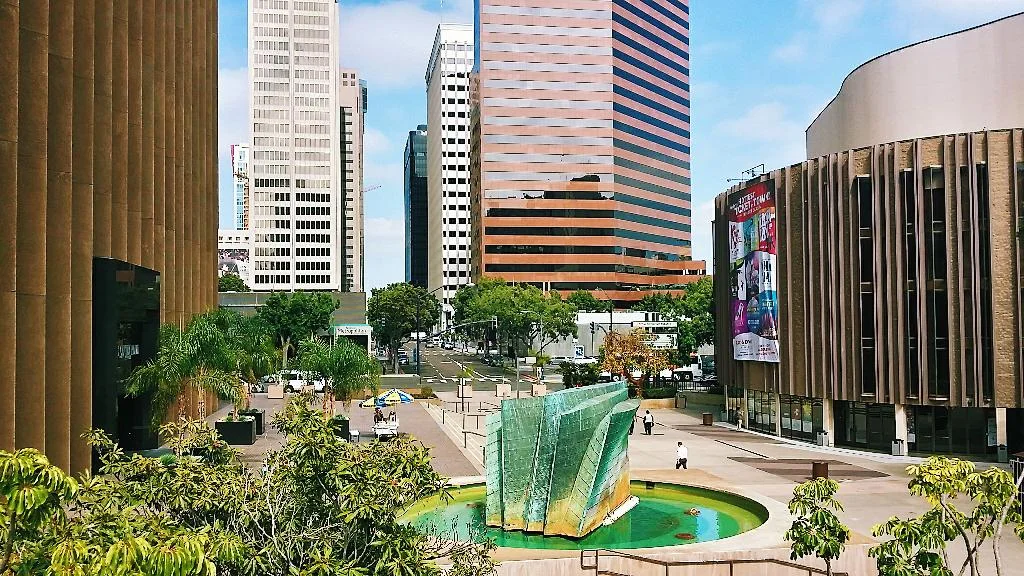

The great recession killed the suburbs. Since 2007, metropolitan cities across the country have experienced a migration of residents towards urban living environments. This trend could be the answer to urban decay, with many seeking more fiscally practical and cohesive living arrangements. Referred to as "re-urbanization", the trend is the opportunity San Diego needs to return neglected areas of downtown to their former prestige. Large adaptive reuse and infill projects have gained traction from Little Italy to East Village, including dynamic public spaces, but it will require buy-in from local employers before the transformation of 'America's Finest City' reaches its potential.

The great recession killed the suburbs. Since 2007, metropolitan cities across the country have experienced a migration of residents towards urban living environments. This trend could be the answer to urban decay, with many seeking more fiscally practical and cohesive living arrangements. Referred to as "re-urbanization", the trend is the opportunity San Diego needs to return neglected areas of downtown to their former prestige. Large adaptive reuse and infill projects have gained traction from Little Italy to East Village, including dynamic public spaces, but it will require buy-in from local employers before the transformation of 'America's Finest City' reaches its potential.

The new Central library, the renovation of Horton Plaza, and open space meeting areas like Quartyard, SMARTSfarm and Silo at Makers Quarter have created a buzz about downtown. The supply of living spaces downtown is increasing, and the increase in population is expected to drive an increase in demand for workspace. For office space users, this means considering locating you company near your employees or desired talent pool. If your employees demographic age is 23 – 35, odds are they reside in the area between Mission Valley, the beach communities, and Downtown. This demographic seeks employment in walk-able, livable urban areas which complement their lifestyle. Companies seeking top talent may need to consider their proximity to "live-work-play" environments in order to stay competitive. Planned developments like Makers Quarter and IDEA are courting large employers with build-to-suit options for mixed-use office/retail/residential spaces, which resemble small cities within a city. The challenge in bringing these developments to life is pre-leasing to an anchor tenant large enough to initiate construction. Recently San Diego companies The Active Network and Websense, who occupied approximately 100,000 SF each, relocated out of California, leaving a small pool of local tenants large enough these projects.

Downtown's diverse tenant mix now includes technology and professional service providers in numerous co-working spaces and incubators. The area is a logical place to create a hub for hi-tech entrepreneurs. Accelerators like Plug n Play, who expose early stage hi-tech companies to Silicon Valley capital, and Evonexus, the Qualcomm sponsored incubator located in the heart of the Civic-Core district, provide mentorship and strategic funding to start-ups making high-tech innovations. It’s likely that these businesses would stay in the area as they grow, creating a greater demand for office and living spaces. The economic benefit is measurable, according to Steven Cox, CEO of Take-Lessons "there will be 1,500 to 2,000 tech jobs created here in San Diego. The average tech job pays about $103,000. So, when you take a look at how technology and innovation fuels the economy, it’s really interesting to see how that’s growing, specifically in downtown." A study completed by The Downtown Partnership, concluded that every tech job brought downtown create(s) another 1.6 jobs meaning a welcome increase in new restaurants and retail businesses serving the area. All of this could lead to an increase the tax base in the area, resulting in more money for public works and infrastructure.

Employers do face obstacles in relocating downtown where parking spaces are scarce and costly. On-site parking downtown is generally granted at 1 parking space per one thousand feet of leased space, not attractive for high density space users with a large percentage of employees who commute from the suburbs. Parking rates in mid to high-rise office buildings range from $130 - $200/stall/month, and while surface lots in the area charge slightly less, this added expense prevents many employers from relocating to the area. The planned trolley expansion may ease these concerns, however service along the new line to UTC wouldn’t commence until 2019.

Downtown San Diego has come a long way, and is becoming more attractive to young companies, and businesses locating closer to talent or their employee base. It may take years for San Diego to have a thriving downtown sector, but with support from employers, and local government, will one day reach its potential.

What's Next for Tech?

During a recent IoT (Internet of Things, for those not familiar) Startup breakfast I realized a few things; the internet is going places most people can’t fathom, and I should have tried harder in Science class.

During a recent IoT (Internet of Things, for those not familiar) Startup breakfast I realized a few things; the internet is going places most people can’t fathom, and I should have tried harder in Science class.

While we are still a long way from flying cars and ‘Rosie’ the robot maid, scientists and entrepreneurs are creating devices which will be embedded into everything from farm equipment, to your refrigerator, to your jeans; more importantly, these devices will communicate with manufactures, service stations, medical personnel, and even each other. The processors for these embedded devices are getting smaller, cheaper, more powerful, and thanks to visionaries like SIGFOX, low power networks will exist globally to efficiently allow these devices to communicate, and retain a longer service life.

As I was dreaming of a future utopia that would make Doc Brown gasp, a presenter from Wind River (leaders in embedded software for connected systems) brought up the reality that interoperability, or the ability for devices to communicate with each other, has yet to be solved. The issue, today’s innovators are creating devices utilizing their own protocols with no standard way of translating that language. Add the implications a network security breach could have on a country full of connected, semi-automated devices or wearables, and we unveil the hurdles entrepreneurs face before I can safely own a self-driving vehicle that tells my self-maintaining refrigerator to order more beers after a long day.

How do we bridge the gap between today’s standard of living, and tomorrow’s standard of excellence? As technology entrepreneurs create applications for the future, the means by which to fund these innovations has become more robust. According to San Diego Venture Group’s David Titus "venture capital investment is up to its highest level since 2009, an estimated $30 billion in funding."

While these investment dollars are primarily chasing companies with market traction, angel investors have been seeding start-up and early stage companies that show promise in solving some of these issues.

Venture capital used to look for companies in a great market, or a product and team, now they also want companies to be killing it," says Titus.

The growth of start-up communities, hubs like CyberTech, and incubators likeEvoNexus that encourage collaboration will help bring well researched solutions to investors, and then to market.

The future is bright, and my sunglasses will know it.