THE MORE YOU KNOW

THE BETTER YOU NEGOTIATE

📢 Commercial Office Properties: Understanding the Loss of Value 📉

Recent transactions indicate a significant loss of value observed in commercial office properties. This trend, influenced by several factors, has sparked widespread discussion and analysis within the real estate industry. Today, we'll explore some of the key reasons behind this phenomenon.

1️⃣ Remote Work Revolution: The advent of remote work has undoubtedly played a crucial role in altering the dynamics of office spaces. The widespread acceptance and success of remote work during the pandemic have prompted many companies to adopt hybrid or fully remote work models. As a result, the demand for traditional office spaces has decreased, leading to a decline in their value.

2️⃣ Changing Workplace Preferences: The pandemic forced individuals and businesses alike to reassess their workplace preferences. Companies aiming for flexibility and cost optimization, have shifted towards smaller offices, shared workspaces, or even fully remote operations. Similarly, many employees have discovered the benefits of working from home, creating a preference for remote setups. This shift has impacted the demand and attractiveness of conventional office properties.

3️⃣ Technological Advancements: Advancements in technology and communication tools have eliminated the need for physical presence in the office. Video conferencing, collaboration software, and cloud computing have facilitated seamless remote work experiences, eroding the traditional reliance on office spaces.

4️⃣ Economic Uncertainty: The global economic downturn resulting from the pandemic has also affected the commercial real estate market. Many businesses faced financial challenges, downsizing or even closing their doors. This disruption has created a surplus of vacant office spaces, further contributing to the decline in their value.

5️⃣ Repurposing and Adaptive Reuse: In response to the changing landscape, property owners and investors have been exploring alternative uses for office buildings. Repurposing commercial office properties into residential units, hotels, or mixed-use spaces has gained traction to maximize value. While this trend promotes revitalization, it can also result in a surplus of available office properties, adding pressure to the market.

It's important to note that despite the current decline in value, the long-term future of commercial office properties remains uncertain. As businesses adapt and strategies evolve, there may be opportunities for these properties to regain their value. The ability to foster collaboration, networking, and creativity remains an essential aspect of physical workspaces.

Real estate investors and property owners are actively seeking innovative solutions to adapt to the changing needs of businesses and individuals. Whether through renovations, amenity enhancements, or redesigning existing spaces, the goal is to create appealing environments that align with the evolving demands of the workforce.

While the current loss of value in commercial office properties may present challenges, it also offers a chance for innovation and reinvention within the real estate industry. By embracing change and identifying new opportunities, stakeholders can navigate these uncertain times and shape the future of office space.

5 Metrics You Need To Know

So you think you’re ready for an additional location and are prepared to spend the time, capital and effort to expand. We have all heard the ‘location, location, location’ mantra, especially when it comes to retailers and restauranteurs; but there is much more to successfully expanding your offering than this. Truly understanding the business metrics in your current location Is beneficial to finding the right location to occupy. The five business evaluations below will help you and your business determine what space is right for your next location.

When planning any expansion of your brand, knowing the true occupancy cost of your business is essential for the success.

1.Revenue generating space: Unlike the majority of office or industrial users, retail and restaurant space occupiers generate income on a much smaller percentage of their rentable area. Space usable for displaying goods, seating customers, or other “front of house” activities is typically in the 50%-60% range. The effective cost of occupying space is derived from dividing your revenue over this percentage of your square footage. In the case of restaurants, the kitchen is absolutely an important component in generating income; however, when planned correctly this space is typically less than 20% of the entire establishment footprint. When planning any expansion of your brand, knowing the true occupancy cost of your business (revenue divided by that percentage of your space that generates income) is essential for the success. The cost for a potential new location should be examined utilizing these metrics.

2. Revenue as a percentage of your Facility Cost: Your facility cost is generally the second or third line item on your balance sheet, but identifying the cost of your facility in relation to the revenue you generate from it is a key metric needed for smart expansion. Your annual revenue/annual facility cost (Base Rent + Operating Expenses + Utilities) will provide a benchmark you can apply to potential future sites.

3. Effectiveness: Business owners can evaluate your actual annual occupancy cost metric by dividing your sales by the establishment’s selling space. While this can also be done by dividing the annual top line revenue by the gross square footage it is more useful to use the revenue/selling space formula if you wish to apply this to other locations. Remember, not all spaces are equal due to inherent space shape efficiencies.

4. Demographics: We all know local population income and age numbers matter; however, you may be operating in a ‘destination’ center wherein people from surrounding areas frequent often as a result of commute or travel. It is thereby important to understand the demographics of YOUR customers. While the neighborhood, average traffic counts, and proximity to other similar retailers does have an effect on your success, knowing: who, why, when and how your revenue is generated will provide guidance should you expand.

5. Discounting: Probably the least exciting topic but one of the most important. Taking the number of sales at discount or special pricing and dividing it by the total sales (Discount Sales/Total Sales) is necessary when developing a stores profile. Restauranteurs who have to offer heavy discounts/specials to get people in the door rarely have the necessary capital or financials to expand. It’s common knowledge that food margins are slim, and if you’re discounting your per plate costs there better be an avenue to make up for it., i.e. alcohol sales. Retailers offer discounts based on seasonal changes or specific items that aren’t moving, however, the percentage of a store’s discounts should remain consistent. If this percentage increases quarter over quarter (not just seasonally) it’s indicative of a problem.

For both restauranteurs and retailers knowing these metrics can help correctly identify geographic areas, and specific sites, suitable for expansion. Performing this front-end analysis will save you time, money, and prevent you from committing to the wrong space. If you have any questions related to expanding your brand into new locations call us for a free consultation.

Understanding 'Rentable' vs. 'Usable' Square Feet

All commercial buildings are not created equal. This is evident upon inspection of multiple factors; location, allocated parking, quality of construction, and amenities provided, just to name a few. But one of the most overlooked aspects of a building’s value to the tenant is the efficiency of that particular building when compared to another. This efficiency is in relation to the ratio of the space the tenant actually leases within their four walls (the usable square footage) and the amount of space attributed to all common areas of the building including the lobby, hallways, restrooms, common conference rooms, common kitchen areas, interior break areas, work out buildings, showers/lockers, phone and electrical rooms, and any other common use area that, when added to the usable square footage, makes up the rentable square footage. This ratio is called the building “core factor” (also referred to as “load factor”, “loss factor”, or “add-on factor”). Landlords are ensured of receiving income on this common space so it is distributed to each tenant as an “add on” to their usable square footage that then totals the tenant’s rentable square footage and this is what the rent is based on. The difference in a building’s efficiency and therefor the core factor can quickly offset a lower base rent per square foot that building may have over another. Core factors can vary by as much as 10% to 15% and many times they are “artificial” as in, implemented by the landlord with no confirmation. This becomes a marketing ploy, to offer a lower rent when, in reality, the end result is substantially more than other competing buildings with greater efficiency. We find that in many cases tenants, who have existed under leases for many years, still don’t understand this issue today.

Buildings calculate all space that is constructed as gross square footage. The standard of commercial property measurement (“BOMA”) then requires that all vertical penetrations (stairwells and elevator shafts) be deducted from the gross square footage and the remaining square footage is the rentable square footage. When a company negotiates a lease on commercial space, they are occupying the usable square footage which is the square footage within their four walls but paying for the rentable square footage, including their share of the common areas referenced above.

Understanding core factors translates directly to the bottom line. Since building costs are typically near the top of the expense list, the savings can be dramatic in comparison to other expenses. Pay attention to the core factor. The example below puts numbers to the story:

XYZ Company needs 30,000 square feet of usable space to operate their business and is evaluating two opportunities. Building A has a core factor of 19% (1.19) and Building B has a core factor of 11% (1.11). Both buildings are offering the same rental rate, say $2.00 per rentable square foot. In this scenario, XYZ Company has a choice of leasing 35,700 rentable square feet in Building A, at a monthly rent of $71,400, or leasing a more efficient 33,300 rentable square feet in Building B, at a monthly rent of $66,600 per month. Calculating the difference in XYZ Company’s rental costs, they will save $288,000 over a five year lease term if they locate in Building B for the same amount of usable square footage.

This is one of many pitfalls that can be costly if not known by companies leasing commercial space. Don’t get caught paying more than you should. Hire a broker to help you. It doesn’t cost you a dime but the savings can be extraordinary.

Finding Your First Office Space

Congratulations, business is good and you’re ready to open your first office! Now what? Startup companies that reach the point of needing an office location should examine all of their options before committing to office space. The toughest part of choosing that first office is knowing what criteria to base your decision on. Keep in mind that real estate costs are typically the second or third greatest expense on a company balance sheet, and many companies stay the red because they carry more facility related overhead than necessary.

Congratulations, business is good and you’re ready to open your first office! Now what?

Startup companies that reach the point of needing an office location should examine all of their options before committing to office space. The toughest part of choosing that first office is knowing what criteria to base your decision on. Keep in mind that real estate costs are typically the second or third largest expense on a company balance sheet, and many companies remain in the red because they carry more facility related overhead than necessary. Our suggestion for startup and small businesses looking for space is to keep three specific criteria in mind:

1. How much space do we really need for the foreseeable future?

2. Does the location or visibility of a space help our company generate more revenue?

3. How important is flexibility in the lease of any space we pursue?

Entrepreneurs who have reached this point need to be wary of how they approach leasing space. For example, many take on more space than the business requires, sign leases that have a longer term than necessary, or fail to negotiate adequate concessions, and protective clauses, during negotiations. Others sign up with executive office suite operators without realizing that the premium they are paying for space there could get them larger, or more desirable space somewhere else. Co-working spaces have a similar model to executive suite operators, but are typically more flexible when it comes to paying for space. If your business doesn’t yet require you to be in the space on a day-to-day basis, this option could be for you. Our advice to most young companies is to scout the market for space listed for sublease before engaging with the afore mentioned options. Subleased space often comes at a hefty discount from what the master tenant is paying the building owner. These spaces can come furnished, and typically have less than three years of term on them. Sometimes, a sublessor will even allow your business to sublease for a shorter term than what’s remaining on the master lease. Finally, subleases are an agreement to lease space with the master tenant, and although the landlord must approve them, can often be attained without using the business owner’s personal wealth and assets as collateral should the business become incapable of meeting its debts.

Startups and small businesses looking for space should hire an active tenant representative who understands their needs. The Ocean Company has assisted many young companies in securing their first spaces, and negotiates the best possible lease with your objectives in mind.

Urbanization's Effect on Commercial Real Estate

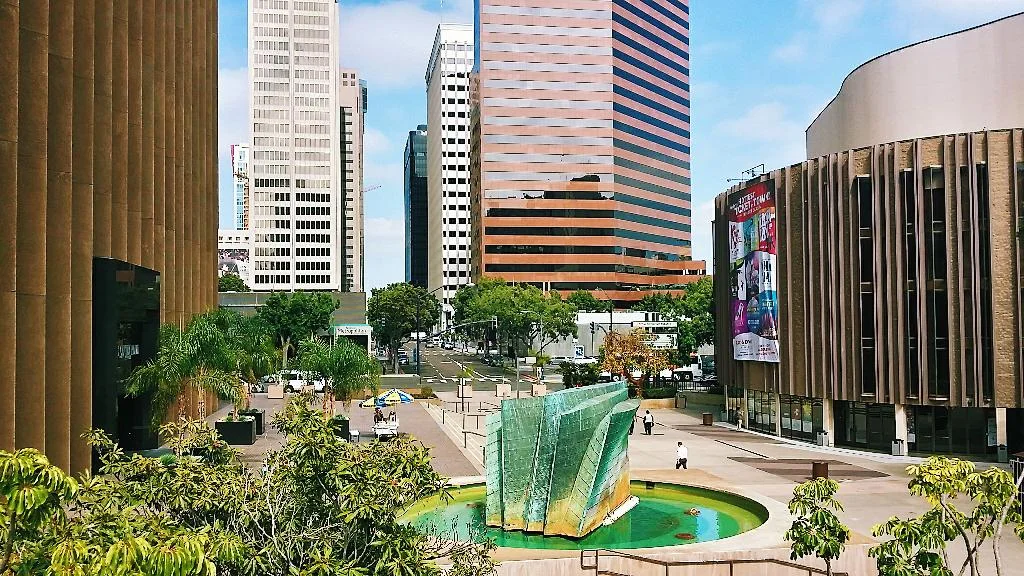

The great recession killed the suburbs. Since 2007, metropolitan cities across the country have experienced a migration of residents towards urban living environments. This trend could be the answer to urban decay, with many seeking more fiscally practical and cohesive living arrangements. Referred to as "re-urbanization", the trend is the opportunity San Diego needs to return neglected areas of downtown to their former prestige. Large adaptive reuse and infill projects have gained traction from Little Italy to East Village, including dynamic public spaces, but it will require buy-in from local employers before the transformation of 'America's Finest City' reaches its potential.

The great recession killed the suburbs. Since 2007, metropolitan cities across the country have experienced a migration of residents towards urban living environments. This trend could be the answer to urban decay, with many seeking more fiscally practical and cohesive living arrangements. Referred to as "re-urbanization", the trend is the opportunity San Diego needs to return neglected areas of downtown to their former prestige. Large adaptive reuse and infill projects have gained traction from Little Italy to East Village, including dynamic public spaces, but it will require buy-in from local employers before the transformation of 'America's Finest City' reaches its potential.

The new Central library, the renovation of Horton Plaza, and open space meeting areas like Quartyard, SMARTSfarm and Silo at Makers Quarter have created a buzz about downtown. The supply of living spaces downtown is increasing, and the increase in population is expected to drive an increase in demand for workspace. For office space users, this means considering locating you company near your employees or desired talent pool. If your employees demographic age is 23 – 35, odds are they reside in the area between Mission Valley, the beach communities, and Downtown. This demographic seeks employment in walk-able, livable urban areas which complement their lifestyle. Companies seeking top talent may need to consider their proximity to "live-work-play" environments in order to stay competitive. Planned developments like Makers Quarter and IDEA are courting large employers with build-to-suit options for mixed-use office/retail/residential spaces, which resemble small cities within a city. The challenge in bringing these developments to life is pre-leasing to an anchor tenant large enough to initiate construction. Recently San Diego companies The Active Network and Websense, who occupied approximately 100,000 SF each, relocated out of California, leaving a small pool of local tenants large enough these projects.

Downtown's diverse tenant mix now includes technology and professional service providers in numerous co-working spaces and incubators. The area is a logical place to create a hub for hi-tech entrepreneurs. Accelerators like Plug n Play, who expose early stage hi-tech companies to Silicon Valley capital, and Evonexus, the Qualcomm sponsored incubator located in the heart of the Civic-Core district, provide mentorship and strategic funding to start-ups making high-tech innovations. It’s likely that these businesses would stay in the area as they grow, creating a greater demand for office and living spaces. The economic benefit is measurable, according to Steven Cox, CEO of Take-Lessons "there will be 1,500 to 2,000 tech jobs created here in San Diego. The average tech job pays about $103,000. So, when you take a look at how technology and innovation fuels the economy, it’s really interesting to see how that’s growing, specifically in downtown." A study completed by The Downtown Partnership, concluded that every tech job brought downtown create(s) another 1.6 jobs meaning a welcome increase in new restaurants and retail businesses serving the area. All of this could lead to an increase the tax base in the area, resulting in more money for public works and infrastructure.

Employers do face obstacles in relocating downtown where parking spaces are scarce and costly. On-site parking downtown is generally granted at 1 parking space per one thousand feet of leased space, not attractive for high density space users with a large percentage of employees who commute from the suburbs. Parking rates in mid to high-rise office buildings range from $130 - $200/stall/month, and while surface lots in the area charge slightly less, this added expense prevents many employers from relocating to the area. The planned trolley expansion may ease these concerns, however service along the new line to UTC wouldn’t commence until 2019.

Downtown San Diego has come a long way, and is becoming more attractive to young companies, and businesses locating closer to talent or their employee base. It may take years for San Diego to have a thriving downtown sector, but with support from employers, and local government, will one day reach its potential.