THE MORE YOU KNOW

THE BETTER YOU NEGOTIATE

California stay-at-home order hurts Restaurant industry

To our hospitality friends:

WE ARE WITH YOU

Urging everyone in California to support all your local restaurants as they struggle through California’s new stay-at-home orders.

THINGS YOU CAN DO

1. Support your favorite restaurants that continue to operate outdoor service according to safe, CDC guidelines.

2. Buy GIFT CARDS from locally owned restaurants and give them out as holiday gifts.

3. When you order delivery, try and place your orders directly with the restaurant. Third-party apps take up to 30% of the value of the order. Let’s do what we can to give 100% of our support to the people creating our meals.

4. Share these tips with your friends and support the locally owned restaurants in your area.

This holiday season, let’s truly practice the act of giving.

#wereinthistogether #saverestaurants #ilovemycity

If you have any commercial leasing or purchasing questions call us ☎️ 858.356.2990 and Jamal will assist you.

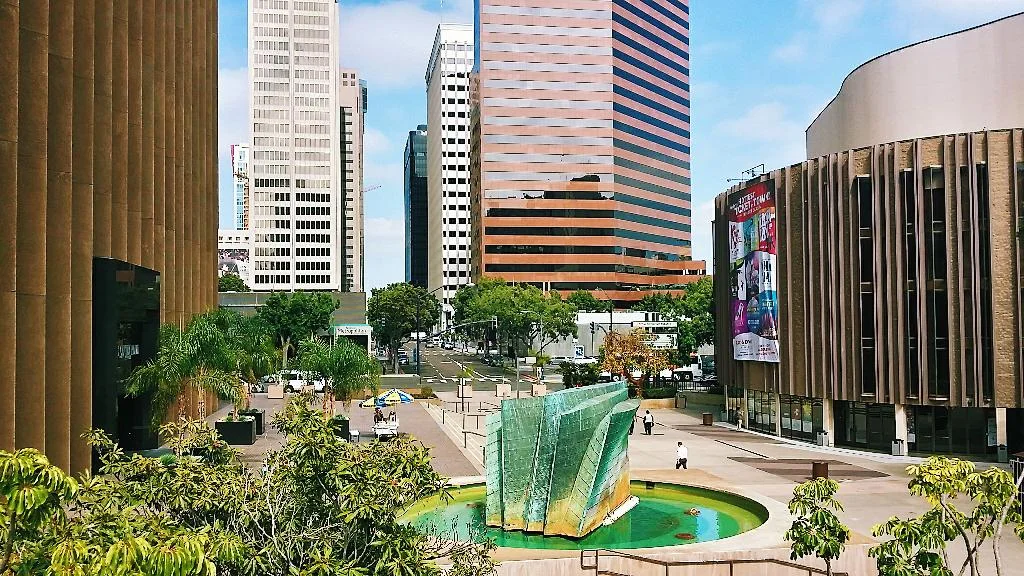

Urban Life Science Hub to Emerge in Downtown San Diego

Downtown San Diego welcomes sprawling life science campus on site of Manchester's Pacific Gate development. New commercial real estate development in marina district meant to diversify the tenant mix in the downtown submarket hopes to attract Top 50 biotech tenants.

IQHQ has closed on a majority of Manchester’s long-awaited development in San Diego’s Marina District, Pacific Gate. Once marketed as a grand mixed-use office/retail/hotel project with public space component, the project is perhaps the biggest development derailed by recessionary fears & Covid to-date. In steps Alan Gold and his new life science real estate investment group, IQHQ. Gold is no stranger to the Life Science facilities, he co-founded BioMed Realty trust, a life science facility development company he sold to Blackstone Group for a reported $8 billion in 2016. With this acquisition, IQHQ shifts the vision of the project to become San Diego’s first urban life science center. Dubbed RaDD, the San Diego Research and Development District will have unmatched views, open space, and retail amenities aimed at attracting top 50 life science companies. Manchester will retain two of the site’s eight blocks and continue developing one of the two planned hotels and 1.9-acre plaza, although the firm did not share a timeline for construction.

At the moment, construction isn’t scheduled to commence until 2021, with the district’s first phase complete in Q3 2023. Plans include a series of mid-rise structures and one 17-story tower, a museum, 3 acres of public green space and rooftop decks. The Navy’s 372,000 SF office on-site is complete and move-in ready.

The question on everyone’s lips is ‘why’.

Based on San Diego’s standing as the number 3 life science hub in the nation, with demand still driving development and an increasing number of existing pieces of industrial product being converted to satisfy their needs; new supply is needed. Existing life science hubs in Sorrento Valley, Torrey Pines and Carlsbad are achieving high rents and show no signs of stopping even through the recession and pandemic. So then, why downtown which is a minimum of 13 miles from any of these hubs? Downtown San Diego recently attracted UCSD’s expansion campus, paving the way for a more research-oriented business and resident mix. Downtown San Diego offers accessibility to a myriad of public transportation services including the new San Diego Trolley Blue Line which will connect Downtown to San Diego’s Life Science Hub in Torrey Pines near UCSD, the Green Line which connects it to SDSU, and also a half-hour train ride to the Solana Beach area. The Marina district also has a planned redevelopment of Seaport Village which would add even greater retail offerings as well as public space to the area. Add to all that the numerous multi-family developments in the area and the project suddenly makes more sense.

But isn’t downtown mainly an office hub?

Today the answer is ‘yes’. The roughly 1.5 million square feet of new office construction in the submarket may be tough to lease given the pandemic/recession In fact, multi-tenant office leasing is off over 50% year over year in the submarket, and new deliveries have yet to do any substantial pre-leasing. An urban waterfront science park could be a big draw for the Pfizer/Alexion/Roche/Merck of the world, and smaller companies would be sure to follow when large anchors are landed. Amongst the commercial real estate community there are rumors both Parallel Capital Partner’s current redevelopment of Horton Plaza is shifting to a life science use, and the recently sold Thomas Jefferson School of Law building as downtown's office market now appears over-built. All factors included, you can see why a more diverse tenant mix is needed.

Jamal Brown is the CEO of The Ocean Company, an exclusive tenant representation firm with offices in San Diego, Orange County and Los Angeles focusing on the leasing and acquisition of commercial real estate.

Main: 858.356.2990 | E-mail: jbrown@theoceanco.com | social: @theoceancompany

Experiential Retail and Mixed Use Communities Shape San Diego

From an employers standpoint Mission Valley was viewed as an accessible, yet unattractive submarket between downtown and UTC. These new developments will strengthen the area opportunity for a greater live/work atmosphere, as well as a recruiting hub.

If you haven't been paying attention to what is going on in Mission Valley let me help you.

SDSU was awarded the redevelopment of Qualcomm stadium (RIP Chargers) and will be expanding their campus presence, creating a new stadium, hotel, student housing, and 95k SF of retail as well as creating a public open space park.

Civita, the sustainable "city within a city" has completed phase one including housing, experiential retail and restaurants, and a 14.3 acre park. The development is pushing forward with phase 2 of its retail development.

Finally, Hines is redeveloping the Riverwalk golf course as a forward thinking, mixed-use community with over 90k square feet of retail, a 50 acre river park and 4000+ homes.

The fact that all of these developments are directly accessible from the trolley line, which itself is expanding into UTC, will truly connect San Diego neighborhoods in a way employers find beneficial. From an employers standpoint Mission Valley was viewed as an accessible, yet unattractive submarket between downtown and UTC. These new developments will strengthen the area opportunity for a greater live/work atmosphere, as well as a recruiting hub.

5 Metrics You Need To Know

So you think you’re ready for an additional location and are prepared to spend the time, capital and effort to expand. We have all heard the ‘location, location, location’ mantra, especially when it comes to retailers and restauranteurs; but there is much more to successfully expanding your offering than this. Truly understanding the business metrics in your current location Is beneficial to finding the right location to occupy. The five business evaluations below will help you and your business determine what space is right for your next location.

When planning any expansion of your brand, knowing the true occupancy cost of your business is essential for the success.

1.Revenue generating space: Unlike the majority of office or industrial users, retail and restaurant space occupiers generate income on a much smaller percentage of their rentable area. Space usable for displaying goods, seating customers, or other “front of house” activities is typically in the 50%-60% range. The effective cost of occupying space is derived from dividing your revenue over this percentage of your square footage. In the case of restaurants, the kitchen is absolutely an important component in generating income; however, when planned correctly this space is typically less than 20% of the entire establishment footprint. When planning any expansion of your brand, knowing the true occupancy cost of your business (revenue divided by that percentage of your space that generates income) is essential for the success. The cost for a potential new location should be examined utilizing these metrics.

2. Revenue as a percentage of your Facility Cost: Your facility cost is generally the second or third line item on your balance sheet, but identifying the cost of your facility in relation to the revenue you generate from it is a key metric needed for smart expansion. Your annual revenue/annual facility cost (Base Rent + Operating Expenses + Utilities) will provide a benchmark you can apply to potential future sites.

3. Effectiveness: Business owners can evaluate your actual annual occupancy cost metric by dividing your sales by the establishment’s selling space. While this can also be done by dividing the annual top line revenue by the gross square footage it is more useful to use the revenue/selling space formula if you wish to apply this to other locations. Remember, not all spaces are equal due to inherent space shape efficiencies.

4. Demographics: We all know local population income and age numbers matter; however, you may be operating in a ‘destination’ center wherein people from surrounding areas frequent often as a result of commute or travel. It is thereby important to understand the demographics of YOUR customers. While the neighborhood, average traffic counts, and proximity to other similar retailers does have an effect on your success, knowing: who, why, when and how your revenue is generated will provide guidance should you expand.

5. Discounting: Probably the least exciting topic but one of the most important. Taking the number of sales at discount or special pricing and dividing it by the total sales (Discount Sales/Total Sales) is necessary when developing a stores profile. Restauranteurs who have to offer heavy discounts/specials to get people in the door rarely have the necessary capital or financials to expand. It’s common knowledge that food margins are slim, and if you’re discounting your per plate costs there better be an avenue to make up for it., i.e. alcohol sales. Retailers offer discounts based on seasonal changes or specific items that aren’t moving, however, the percentage of a store’s discounts should remain consistent. If this percentage increases quarter over quarter (not just seasonally) it’s indicative of a problem.

For both restauranteurs and retailers knowing these metrics can help correctly identify geographic areas, and specific sites, suitable for expansion. Performing this front-end analysis will save you time, money, and prevent you from committing to the wrong space. If you have any questions related to expanding your brand into new locations call us for a free consultation.