THE MORE YOU KNOW

THE BETTER YOU NEGOTIATE

Navigating the Current Biotech Real Estate Landscape: Opportunities for Life Science Businesses

The biotech real estate market is currently experiencing a significant shift. Demand for life science properties is softening, with rising vacancies and increased competition for tenants, particularly in the major life science hubs of Boston, San Francisco, and San Diego. According to Cushman & Wakefield, vacancies have surged to 24%, 27%, and 17% in these cities, respectively. For life science businesses, this presents both challenges and unique opportunities to leverage the changing landscape to their advantage.

Why the Shift in the Biotech Real Estate Market?

Several factors have contributed to this change. Reduced venture capital funding, particularly for smaller companies, has forced many firms to reconsider their space needs. Furthermore, the end of the pandemic’s surge in research and development (R&D) funding—largely driven by COVID-19 treatments and vaccines—has led to a slowdown in demand. Add to this the increasing cost of lab construction (up by 20%) and specialized equipment (rising 30-50%), and it’s easy to see why the biotech real estate sector is facing a reckoning.

However, one area that continues to thrive is Class A real estate. Major players like Alexandria Real Estate Equities are doubling down on high-end, self-contained, multitenant campuses that offer on-site services designed to attract top talent. These amenities, coupled with the prestige of Class A properties, make these spaces highly sought after, with rental prices expected to continue rising despite overall market softness.

The Shift Toward Mega Campuses

One of the most important trends in biotech real estate is the move toward “mega campuses.” Alexandria, for instance, is investing heavily in these campuses, which now account for nearly 70% of the company’s annual rental revenue. These campuses offer more than just lab space—they provide an ecosystem, with on-site amenities such as fitness centers, dining options, and collaborative spaces, creating a built-in advantage for companies looking to attract top-tier scientific talent. According to Alexandria executives, these campuses also offer the best prospects for financing and long-term rent growth.

How Life Science Companies Can Leverage the Market

For life science companies, the current market conditions offer several opportunities to maximize leverage and secure favorable terms:

1. Take Advantage of Tenant Allowances:

As landlords compete to fill vacancies, tenant improvement allowances have increased by 38% in top markets, according to CBRE. These allowances give tenants the flexibility to customize lab and office spaces to meet their specific needs. Life science companies should negotiate aggressively for these concessions, especially for highly specialized spaces like vivariums and clean rooms, which come with higher build-out costs.

2. Capitalize on Softer Demand:

With vacancy rates at historical highs and a growing amount of sublease space available, life science companies can negotiate lower rents or lock in favorable terms. Companies with a clear long-term vision should consider expanding or relocating to top-tier markets where rents may have softened, while locking in advantageous deals for the future.

3. Consider Strategic Location Choices:

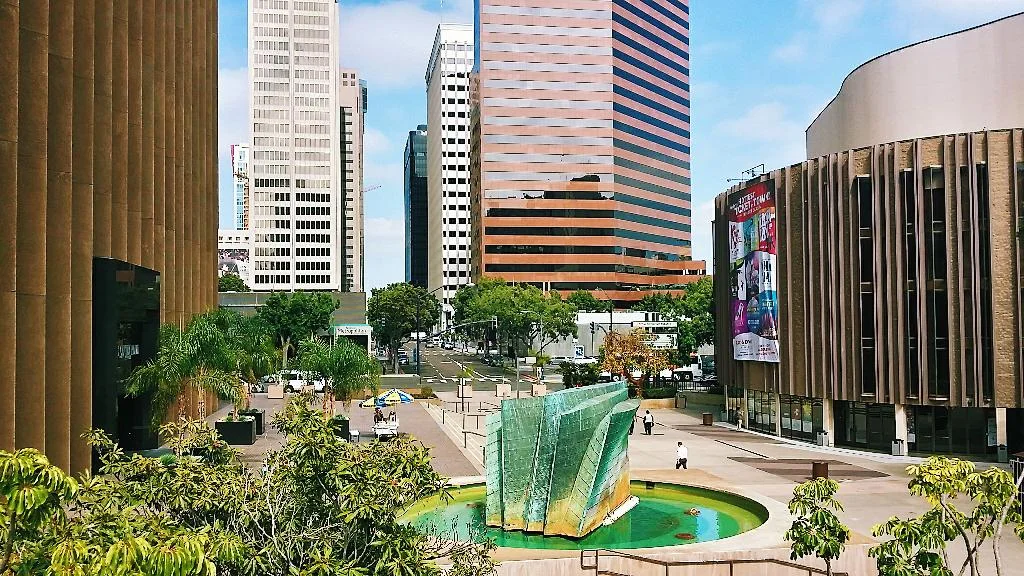

While mega campuses are in high demand, not all life science firms need to be in the most prestigious locations. Some emerging biotech hubs, such as New Jersey, are experiencing a surge in new construction but without the oversupply issues plaguing major markets. These areas offer competitive pricing while still providing access to talent and infrastructure. For businesses looking to optimize their real estate spend, exploring these secondary markets could yield significant savings.

4. Partner with Landlords Offering Flexibility:

In this volatile market, having flexibility in your lease terms is crucial. Companies should seek out landlords who are willing to provide options for expansion or downsizing, as business needs can change quickly. With some developers facing difficulties filling space—especially in properties converted from general office use—this is the perfect time to negotiate for more flexible terms.

The Long-Term Outlook: Why Now is the Time to Act

While the current market offers leverage, experts predict that the high demand for Class A space and specialized lab facilities will push rents higher as new spaces come online through 2025. For life science companies, this means the window for securing favorable terms may be limited. Acting now to lock in competitive rents or securing prime space in a top-tier campus could pay dividends in the coming years.

Moreover, for companies focused on growth, leasing space in a well-amenitized campus could provide a strategic advantage when recruiting talent. With the biotech industry’s reliance on highly specialized professionals, offering an attractive work environment can be a key differentiator in a competitive job market.

Conclusion

The biotech real estate market is in flux, but this presents opportunities for savvy life science businesses to maximize their leverage. Whether it’s negotiating for better tenant allowances, securing flexible lease terms, or capitalizing on market softening in prime locations, the key is to act strategically. As the market continues to shift, businesses that make informed decisions now will be better positioned for future growth in an increasingly competitive landscape.

SEO Keywords: biotech real estate, life science property, life science business, Alexandria Real Estate, mega campuses, tenant improvement allowances, Class A space, lab construction costs, biotech leasing, life science market

Getting Above Standard Tenant Improvements

Do you want great space that helps define your business and attract new clients? Is your company culture important to hiring and retaining top talent? If any of these statements resonate with you, then you cannot afford to accept standardized tenant improvements.

Above standard tenant improvements are typically any material used to improve your space that is above the common finishes the building owner utilizes . Usually the building owner has a list or book of all standard paint carpet, lighting and other flooring finishes that they are willing to provide to improve their space with. These may not showcase your businesses image, align with your company culture, or provide current/potential clients an idea of the caliber of your services. Many architectural firms, law firms and technology companies (just to name a few) need their space to make an impression on everyone who walks through their front doors. An architect uses their lobby to speak to their design capabilities, lawyers use this & other meeting areas to set the tone for their prowess and other businesses use their interior common areas to reinforce their brand & company values.

Achieving a certain look and feel beyond what a landlord is offering typically comes at an additional cost of construction. For example: building out 5,000 sf with building standard finishes may run $60/sf ($300,000); however, your company may want to add design elements to part or all of your space that will increase that number to $85/sf ($425,000). The $125,000 delta between these two numbers can be covered in the following ways.

Tenant pays for the difference: now most tenant rep brokers hate this as it isn’t ideal for companies without a large war chest. It consumes the tenant’s capital upfront and can typically be used better by the tenant to grow their business. In the event the tenant outgrows their space ahead of the natural lease expiration, they’ve sunk capital improving a space they didn’t use for the duration of their lease.

Landlord amortization of the difference: this is the most common solution to a tenant improvement overage. The landlord factors the additional cost of the tenant improvements into the tenant’s rent over time. This keeps the tenant from paying for the improvements upfront but does raise their monthly/annual rent obligation. This can be accomplished as a $/psf rent increase or an annual percentage increase. Think of it as a loan on the difference from the landlord. Does the landlord make a return on this loan...of course. Does the tenant lose if they outgrow the space ahead of the lease expiration? Yes, but not as much as if they pay out of pocket for the improvement difference up front.

Covering the difference through a loss in concessions: this is by far the most complicated and situation specific solution. If you have a savvy tenant representative, who knows your improvement costs will overrun a standard market landlord contribution; they will negotiate a robust rent abatement package, then reduce that once the improvement costs are known so that your rent cost/sf doesn’t increase dramatically. The drawback here is that most businesses use the rent abatement period to offset moving, furniture and other soft costs associated with new space. If those costs are minimal, this may be the best option for a business needing above standard tenant improvements.

*Value Engineering: while not always strategy for covering the cost difference in negotiations, having a great project manager or construction team working with your business & tenant representative to cut construction costs after you’ve secured a certain $/sf in landlord supplied improvement funds can be to your benefit. Make sure your tenant representative negotiated a clause which allows your business to utilize any unused funds in the form of full or partial rent payments.

If you need any help finding or negotiating on space, call us. We’re here to help. #findYOURspace

What's Next for Tech?

During a recent IoT (Internet of Things, for those not familiar) Startup breakfast I realized a few things; the internet is going places most people can’t fathom, and I should have tried harder in Science class.

During a recent IoT (Internet of Things, for those not familiar) Startup breakfast I realized a few things; the internet is going places most people can’t fathom, and I should have tried harder in Science class.

While we are still a long way from flying cars and ‘Rosie’ the robot maid, scientists and entrepreneurs are creating devices which will be embedded into everything from farm equipment, to your refrigerator, to your jeans; more importantly, these devices will communicate with manufactures, service stations, medical personnel, and even each other. The processors for these embedded devices are getting smaller, cheaper, more powerful, and thanks to visionaries like SIGFOX, low power networks will exist globally to efficiently allow these devices to communicate, and retain a longer service life.

As I was dreaming of a future utopia that would make Doc Brown gasp, a presenter from Wind River (leaders in embedded software for connected systems) brought up the reality that interoperability, or the ability for devices to communicate with each other, has yet to be solved. The issue, today’s innovators are creating devices utilizing their own protocols with no standard way of translating that language. Add the implications a network security breach could have on a country full of connected, semi-automated devices or wearables, and we unveil the hurdles entrepreneurs face before I can safely own a self-driving vehicle that tells my self-maintaining refrigerator to order more beers after a long day.

How do we bridge the gap between today’s standard of living, and tomorrow’s standard of excellence? As technology entrepreneurs create applications for the future, the means by which to fund these innovations has become more robust. According to San Diego Venture Group’s David Titus "venture capital investment is up to its highest level since 2009, an estimated $30 billion in funding."

While these investment dollars are primarily chasing companies with market traction, angel investors have been seeding start-up and early stage companies that show promise in solving some of these issues.

Venture capital used to look for companies in a great market, or a product and team, now they also want companies to be killing it," says Titus.

The growth of start-up communities, hubs like CyberTech, and incubators likeEvoNexus that encourage collaboration will help bring well researched solutions to investors, and then to market.

The future is bright, and my sunglasses will know it.