THE MORE YOU KNOW

THE BETTER YOU NEGOTIATE

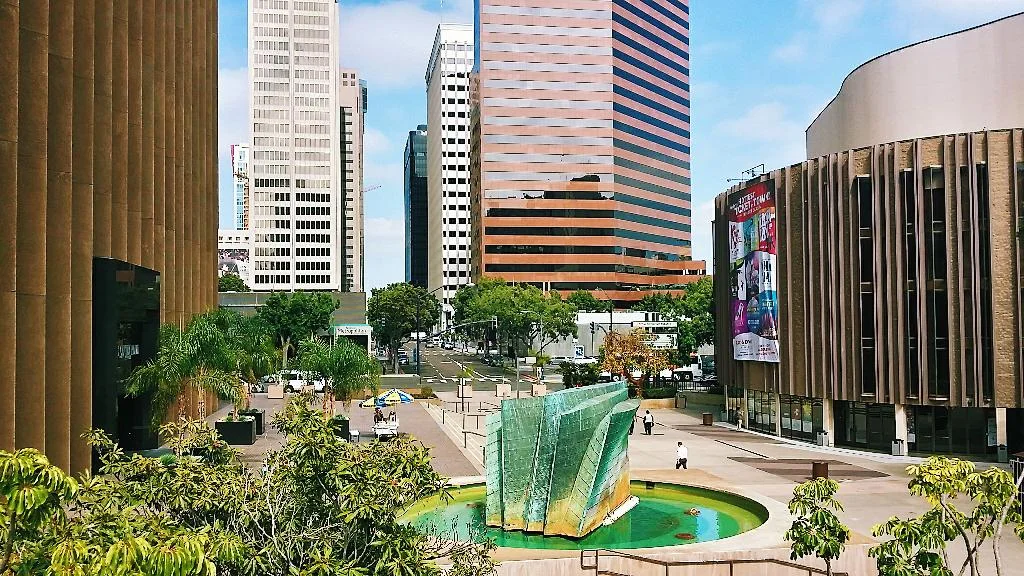

Social Calendar: Things to do in Sandiego - October 2025

October is the official end of summer in San Diego, but that doesn’t mean life slows down. This month is packed with outdoor events for adults and families.

Saturday, Oct 11

• La Jolla Art & Wine Festival – two-day art show with 170+ artists, wine & beer garden, and live music.

Sunday, Oct 12

• San Diego International Film Festival – screenings and premieres across La Jolla and Gaslamp Quarter.

Thursday, Oct 16

• Experience Encanto Art Stroll begins — community art walk and artisan vendors in Southeast San Diego.

Friday, Oct 17

• Mission Bayfest Reggae Music Festival (Oct 17–19) – three-day festival featuring top reggae artists on the bay.

• San Diego Symphony: Mendelssohn & Korngold: From Prodigy to Master – performance at Jacobs Music Center.

• La Mezcla | Ghostly Labor (UCSD Epstein Amphitheater) – dance and multimedia performance exploring labor and identity.

Saturday, Oct 18

• Renee Rapp – live concert at Cal Coast Credit Union Open Air Theatre.

• Alice Cooper, Judas Priest & Corrosion of Conformity – hard rock legends performing together.

Sunday, Oct 19

• Tianguis de la Raza Artisan Market – cultural celebration and artisan fair in Logan Heights.

Wednesday, Oct 22

• Boz Scaggs: Rhythm Review – live at Humphreys Concerts by the Bay.

Thursday, Oct 23

• North Park nightlife crawl – rotating craft beer specials and pop-up art installations.

Friday, Oct 24

• Art San Diego 2025 opens (Oct 24–26) – major contemporary art fair with galleries, live art demos, and installations.

Saturday, Oct 25

• Haunted Hotel Disturbance – Gaslamp’s long-running immersive horror attraction.

Sunday, Oct 26

• The Starting Line – pop punk band performing live at The Observatory North Park.

Tuesday, Oct 28

• Stereolab – avant-garde indie band at The Observatory North Park.

Wednesday, Oct 29

• Shintaro Sakamoto – psychedelic Japanese rock artist performing at The Observatory.

Friday, Oct 31 (Halloween Night)

• Haunted Gaslamp Quarter Block Party – DJs, live performances, and themed pop-ups.

• Belmont Park BOO Bash – family-friendly Halloween event with trick-or-treating and live entertainment.

What the Government Shutdown Means for SBA Loans and Commercial Real Estate Buyers in Southern California

If you are in the process of buying commercial real estate in Southern California, you have likely heard that the federal government entered a temporary shutdown on October 1, 2025. While these shutdowns are usually short-lived, they can cause meaningful slowdowns in deal flow—especially for those relying on SBA 7(a) or SBA 504 loans.

For now, the SBA has paused loan processing until funding resumes. Approved loans should remain intact, but any application still under review is temporarily frozen. While this delay can be inconvenient, it does not mean deals must stall entirely. With the right strategy and communication, many buyers can keep transactions moving forward.

How Different Property Types Are Affected

Office and medical office buyers may feel the most impact since SBA financing plays a major role in owner-user purchases. Industrial property buyers tend to have more options through conventional or private financing, meaning fewer delays. Retail and mixed-use properties sit in the middle—impact varies depending on lender and loan structure.

Workarounds for SBA Delays

There are practical ways to keep deals alive:

Bridge Financing: Some Southern California lenders offer short-term bridge loans that can close now and convert to SBA once the shutdown ends.

Private and Regional Lenders: Local banks and credit unions sometimes provide similar programs to SBA, allowing buyers to stay on schedule.

Document Readiness: Keep all financials and disclosures current so your file can move immediately once funding resumes.

Open Communication: Coordinate closely with your broker and escrow team to request extensions early and maintain seller confidence.

Our Opinion:

Historically, government shutdowns are temporary and funding typically resumes quickly. The key is to stay adaptable. Buyers should view this pause as a timing issue rather than a financial roadblock. Lenders are prepared to pivot once operations resume, and in the meantime, relationships with experienced brokers and local lending partners will be the biggest advantage.

How The Ocean Company Can Help

At The Ocean Company, we guide clients through every phase of the commercial real estate process—especially when market or government conditions shift unexpectedly. Our team works with a network of trusted SBA, regional, and private lenders across San Diego and Southern California to help clients identify flexible solutions. Whether you’re acquiring a medical office in La Jolla, an industrial property in Carlsbad, or an owner-user office in Mission Valley, we can help you strategize the best path forward.

The government may be on pause, but your business growth does not have to be. Contact The Ocean Company to explore financing options, secure bridge lending, and prepare for SBA loan funding to resume.

What Frequently Asked Questions (FAQ) Should You Know Before Leasing Commercial Real Estate

You should always hire an experienced tenant representative who can answer/assist with the following FAQs:

❓What are the key factors to consider before signing a commercial lease?

- Lease Term: Understand the length of the lease and whether it aligns with your business goals.

- Rent and Increases: Clarify the rent amount, any escalations over time, and how they’re calculated.

- Space Requirements: Ensure the space meets your current and future business needs.

- Location: Evaluate the location’s accessibility, visibility, and proximity to customers, suppliers, and employees.

- Lease Clauses: Review clauses related to maintenance, repairs, alterations, and subleasing to understand your responsibilities and rights.

⁉️What are common negotiation points in a commercial lease agreement?

- Rent Negotiation: Seek competitive rates & negotiate for rent abatement.

- Rent Escalation: Always seek the lowest annual increase possible.

- Lease Commencement: Always try to push a commencement date out until all of your tenant improvements are complete and you’re ready to fully occupy the space.

- Tenant Improvements: Negotiate for landlord-funded improvements or a large landlord contribution to construction costs needed to customize the space to your needs.

- Lease Term and Renewal Options: Negotiate for favorable lease length terms & renewal options to provide flexibility for your business.

- Operating Expenses: Clarify which operating expenses you’re responsible for & negotiate caps or exclusions to limit your financial exposure.

- Assignment and Subletting: Negotiate for flexibility to assign or sublease the space if your business needs change.

❓What are the important clauses to pay attention to in a commercial lease document?

- Maintenance and Repairs: Understand your responsibilities and liabilities for maintaining & repairing the premises.

- Default and Remedies: Clarify the conditions under which the lease can be terminated and the remedies available to both parties.

- Insurance Requirements: Review insurance obligations, including liability coverage and any required policies.

- Indemnification: Understand the extent to which you’re responsible for liabilities arising from the use of the premises.

- Termination and Exit: Pay attention to lease termination clauses, early termination options, and any associated penalties or obligations.

If you’re unclear on whether or not a space is right for you, or you’re just starting the process of finding a home for your business, we’re here to help.

The Shifting Tides of Commercial Real Estate Debt in 2025

The commercial real estate (CRE) world is changing fast in 2025, and two big areas—office vacancy rates and Commercial Mortgage-Backed Securities (CMBS) debt—are at the center of it all. Whether you’re a tenant looking for office space, a buyer eyeing an investment, or just someone keeping tabs on the market, understanding these trends is key to making smart moves in a tricky environment.

Let’s break it down.

---

Office Vacancy Rates: What’s Going On?

The Big Picture

At the end of 2024, the national office vacancy rate hit 19.8%, up 1.5% from the year before. That’s a big jump, and it’s a clear sign that the office market is still struggling to adapt to the new normal. Remote and hybrid work aren’t going anywhere, and companies are rethinking how much office space they actually need. Many are downsizing or opting for more flexible setups, leaving landlords with empty spaces and shrinking rental incomes.

For tenants, this is a golden opportunity. With so much vacant space, landlords are more willing to cut deals—think lower rents, free renovations, or shorter lease terms. But while tenants are winning in the short term, the bigger picture is a little murkier. High vacancy rates can lead to falling property values and financial headaches for landlords, which could ripple through the market in unexpected ways.

San Francisco: A Cautionary Tale

If you want to see how extreme things can get, look no further than San Francisco. By the third quarter of 2024, the city’s office vacancy rate hit a jaw-dropping 37.3%—a new record. That’s more than one in three offices sitting empty. Why? San Francisco’s tech-heavy economy has been hit hard by the shift to remote work, and many companies are leaving the city altogether.

For tenants in San Francisco, this means incredible bargaining power. But for landlords, it’s a nightmare. Rising costs (like property taxes and maintenance) combined with falling rents are squeezing profits, and some are struggling to stay afloat. It’s a stark reminder that even in prime markets, the office sector is facing serious challenges.

---

CMBS Debt: The Other Shoe Drops

Defaults Are on the Rise

While office vacancies are making headlines, the CMBS market is quietly facing its own crisis. CMBS—Commercial Mortgage-Backed Securities—are bundles of loans tied to commercial properties, and they’re a major source of financing for the industry. But in 2024, CMBS default rates nearly tripled, hitting 8.7%. That’s the highest level since the 2008 financial crisis.

What’s driving this? Rising interest rates. As borrowing costs go up, landlords are finding it harder to refinance their debt. This is especially true for single-asset, single-borrower (SASB) loans, which are tied to individual properties. When landlords can’t refinance or sell their properties, defaults become almost inevitable. And with so many office properties struggling, the CMBS market is feeling the heat.

The 1740 Broadway Wake-Up Call

If you needed proof that even the safest bets can go sideways, look no further than the 1740 Broadway office tower in New York City. In 2024, the AAA-rated bond tied to this property was downgraded after a failed sale and delays in appraisals. This was the first loss on a AAA-rated CMBS since 2008, and it sent shockwaves through the industry.

Why does this matter? AAA-rated bonds are supposed to be rock-solid, so a loss like this is a big deal. It’s a reminder that even the most secure investments can be risky in today’s market. For lenders and investors, it’s a wake-up call to be more cautious. For everyone else, it’s a sign that the CRE debt market is on shaky ground.

---

What This Means for Tenants and Buyers

Tenants: It’s Your Moment

If you’re looking for office space, now’s the time to strike. With vacancy rates at record highs, landlords are desperate to fill their buildings. That means you can negotiate deals that would’ve been unthinkable a few years ago—lower rents, free upgrades, or even the ability to walk away if your business needs change.

But before you sign on the dotted line, do your homework. Make sure your landlord is financially stable and that the property is well-maintained. The last thing you want is to move into a building that’s headed for foreclosure.

Buyers: Proceed with Caution

For buyers, the market is a mixed bag. On one hand, falling property values and distressed sales can create great opportunities for those with cash to spend. On the other hand, rising interest rates and tighter credit conditions make financing more expensive and harder to come by.

If you’re thinking about buying, focus on properties with strong fundamentals—think location, tenant mix, and long-term growth potential. And don’t be afraid to walk away if the numbers don’t add up. In a market this volatile, patience is a virtue.

---

What’s Next? Strategies for 2025 and Beyond

The commercial real estate market is in flux, but that doesn’t mean you can’t come out ahead. Here are a few tips for navigating the challenges and opportunities of 2025:

1. For Tenants:

- Use your leverage. Negotiate lower rents, better terms, and more flexibility.

- Do your due diligence. Make sure your landlord and the property are financially sound.

- Think long-term. Consider how your space needs might change in the next few years.

2. For Buyers:

- Look for value. Distressed sales and falling prices can create great opportunities.

- Be smart about financing. Lock in rates early and explore alternative funding sources.

- Stay disciplined. Don’t let FOMO (fear of missing out) push you into a bad deal.

3. For Lenders and Investors:

- Be cautious. Scrutinize borrowers and properties more closely than ever.

- Diversify. Spread your risk across different property types and markets.

- Stay informed. Keep an eye on market trends and regulatory changes.

---

The Bottom Line

The commercial real estate market is facing some serious headwinds in 2025, from sky-high office vacancy rates to a shaky CMBS market. But with challenges come opportunities—for tenants, buyers, and investors who are willing to adapt and think strategically.

Whether you’re signing a lease, buying a property, or just keeping an eye on the market, staying informed is your best defense. The CRE world might be unpredictable right now, but with the right approach, you can still come out on top.

Q3 Figures for Medical Office Leasing Indicate Tighter Market for Southern California

Medical office space (MOB) in Southern California is in high demand, driven by demographic changes, evolving healthcare needs, and limited new construction. For healthcare providers and medical practices in San Diego, Orange County, and Los Angeles, these market presents unparalleled opportunities to secure strategic locations.

Here’s an in-depth look at the trends shaping the region’s medical office market and how The Ocean Company can help your practice thrive in this competitive landscape.

Why Medical Office Space Is in High Demand

The medical office market has remained resilient in the face of shifting economic conditions, bolstered by several key factors:

Aging Population:

By 2050, households with adults aged 65+ in San Diego are projected to grow by 8 percentage points, with similar trends across Orange County and Los Angeles.

This aging demographic drives increased demand for healthcare services, creating a need for more specialized facilities.

Outpatient Care Growth:

Advances in technology and patient preferences are shifting services from hospitals to outpatient facilities, fueling demand for well-designed MOBs.

Limited New Development:

New MOB construction across Southern California has lagged, with fewer than 300,000 square feet built in San Diego since 2021 and only 60,000 square feet currently under construction.

Convenience for Patients:

Healthcare providers are prioritizing locations close to residential areas to make care more accessible, especially in suburban neighborhoods.

Regional Trends in Medical Office Space

San Diego

San Diego’s medical office market is one of the most competitive in the region:

Vacancy Rates: MOB vacancy rates in San Diego dropped to 6.1% in late 2023, the lowest in over 20 years.

Development Pipeline: With limited new construction, areas like Chula Vista, Kearny Mesa, and East County are seeing increased activity as healthcare providers seek to meet growing demand.

Biotech and Healthcare Synergy: San Diego’s robust life sciences and biotech industries create unique opportunities for medical practices to collaborate with research institutions.

Orange County

Orange County continues to attract healthcare providers due to its growing population and affluent demographics:

Vacancy Rates: MOB vacancy rates stood at 11.7% in Q3 2023, reflecting steady demand.

Rental Rates: Average lease rates remain consistent at $2.82 per square foot per month (triple net basis), making it a cost-effective option compared to other regions.

Suburban Demand: Communities like Mission Viejo and Irvine are hotspots for new medical offices, as providers prioritize proximity to residential areas.

Los Angeles

Los Angeles boasts one of the largest medical office markets in the country, with diverse opportunities for healthcare providers:

Vacancy Rates: MOB vacancy rates in Greater Los Angeles declined to 10.6% in Q2 2024, with total availability at 12.4%.

Rental Trends: Average asking lease rates increased to $4.07 per square foot per month, reflecting strong demand for high-quality spaces.

Urban and Suburban Opportunities: From Pasadena to Santa Monica, Los Angeles offers a mix of urban hubs and suburban communities ideal for a variety of healthcare specialties.

The Benefits of Medical Office Space for Healthcare Providers

Investing in medical office space offers several advantages for healthcare businesses:

Purpose-Built Spaces:

Designed to accommodate specialized equipment, exam rooms, and waiting areas, MOBs enhance operational efficiency.

Stable Demand:

Healthcare services are essential and recession-proof, ensuring long-term occupancy and stable revenue for property owners.

Strategic Locations:

MOBs are often located near hospitals, residential neighborhoods, and transportation hubs, making them convenient for patients and staff.

How The Ocean Company Can Help

Securing medical office space in Southern California requires expertise and local market knowledge. The Ocean Company specializes in tenant representation and investment sales, ensuring healthcare providers find the right location for their needs.

Our Services:

Market Insights:

We provide detailed analyses of the medical office market in San Diego, Orange County, and Los Angeles to identify prime opportunities.

Strategic Negotiation:

We negotiate lease and purchase terms that align with your practice’s goals, helping you maximize your investment.

Tailored Solutions:

Whether you’re a small practice or a multi-specialty group, we customize our approach to meet your unique requirements.

Tips for Finding the Perfect Medical Office Space

Start Early: Begin your search well before your current lease expires to secure the best options.

Define Your Needs: Consider factors like patient demographics, proximity to hospitals, and space requirements for equipment.

Leverage Local Expertise: Partner with a brokerage that understands the intricacies of medical real estate in Southern California.

The Future of Medical Office Space in Southern California

As the population ages and healthcare evolves, the demand for medical office space in San Diego, Orange County, and Los Angeles will only continue to grow. Limited new construction and increasing competition make now the perfect time to secure your ideal location.

Secure Your Medical Office Space Today

If you’re ready to expand, relocate, or establish a new practice, The Ocean Company is here to help. With expertise in the Southern California market and a focus on tenant representation, we’ll guide you to the perfect space for your practice.

Contact us today to schedule a consultation and explore available medical office spaces in San Diego, Orange County, and Los Angeles. Let’s find the space that supports your growth and success!

Budding Opportunities in Downtown San Diego’s Office Market

With a high vacancy rate and declining lease costs, downtown San Diego has become a tenant’s market. Businesses looking for office space now have greater flexibility and bargaining power, making this an ideal time to secure prime office locations at discounted rates.

1. Downtown San Diego’s Market Overview

Currently, the average vacancy rate in downtown San Diego is 31.5%, with a total availability of 36.6%. These high rates mean that landlords are increasingly willing to negotiate to secure tenants, resulting in a rare advantage for businesses seeking office space.

Key Recent Transactions

The sale of Five Thirty B and Symphony Towers at significant discounts highlights a broader trend affecting downtown office properties. The low demand has driven prices down, creating opportunities for tenants to secure office space at reduced costs.

2. Benefits for Tenants in Today’s Market

Businesses are discovering unique benefits as they negotiate leases in this evolving market:

• Reduced Rental Costs: Average asking rents have declined slightly, offering savings for businesses signing new leases.

• Flexible Leasing Options: Landlords may offer more flexible terms, such as shorter leases or generous incentives, to attract tenants.

• Prime Location Availability: High vacancy rates mean that premium locations, such as downtown San Diego, are accessible to a wider range of businesses.

3. Why Businesses Should Consider Downtown San Diego

Downtown San Diego’s appeal as a cultural and business hub makes it a strategic choice for companies. Access to restaurants, entertainment, and waterfront attractions creates a lively atmosphere for employees and clients alike.

Long-Term Prospects

While current vacancies are high, experts suggest that downtown San Diego will remain a desirable location due to its lifestyle offerings. Companies establishing a presence now may benefit from the area’s eventual recovery and increasing popularity.

For businesses seeking affordable office space in San Diego, the current market conditions downtown provide a compelling case to act now. With a glut of available spaces, tenants have a rare chance to lock in favorable leases in premium locations.

The Ocean Company is here to help your business find the perfect space in San Diego’s competitive market. Our team specializes in tenant representation and can secure the best lease terms for you. Contact us today to learn how we can help you take advantage of the current market conditions!

Sublease Space in Orange County Drops: What Tenants Need to Know

In Q3 2024, available sublease space in Orange County fell to 3.0 million square feet, representing a 7.2% decrease from last quarter and a significant 21.7% drop year-over-year. This decline suggests that sublease opportunities are becoming scarcer, especially as many companies let their sublease terms expire.

Understanding the Sublease Market

Subleasing has been a key strategy for businesses looking to reduce costs by leasing out unused office space. However, with the drop in available sublease space, it’s clear that fewer companies are offloading their excess office real estate. This could be due to companies reaching the end of their sublease agreements, or because fewer businesses are willing to sublease their space in the current economic climate.

Office Availability: A Look at the Numbers

Overall office availability in Orange County dropped by 10 basis points to 22.9% in Q3 2024, down from 24% a year ago. This may not seem like a significant shift, but combined with the fall in sublease space, it reflects a tightening market for tenants who may be looking for flexible options.

The Impact on Tenants:

• Fewer sublease options mean less flexibility for tenants looking to secure short-term or more affordable office space.

• Class A properties remain in demand, especially with trophy spaces added to the market, but availability is tight.

• Average asking rental rates are rising slightly, with the market seeing increases of $0.10 per square foot from the previous quarter.

How to Navigate the Market:

For tenants, this shift in the sublease market means fewer options and potentially higher costs. If you’re considering expanding or relocating, it’s important to act quickly before availability tightens further. Even if sublease space is not your preferred option, understanding its role in the overall market can help you make better leasing decisions.

If you’re searching for the best office space solutions in the Orange County or Los Angeles areas, let The Ocean Company guide you. Our expertise in tenant representation will ensure you get the space you need at a price that makes sense for your business.

Orange County Office Leasing Market Sees Surge in Q3 2024: What It Means for Tenants

The office leasing market in Orange County experienced a significant shift in the third quarter of 2024, recording 1.9 million square feet (msf) in leasing activity. This reflects a 29.9% increase from the previous quarter and a modest 2.3% increase year-over-year. These numbers indicate a positive shift in market dynamics, driven primarily by lease renewals.

Leasing Trends in Q3 2024: The Airport Area Takes the Lead

A substantial portion of the lease activity during this period came from the Airport Area submarket, a hub for financial services and insurance companies. These sectors were responsible for driving the demand, with many businesses opting to renew their leases rather than expand their office space. Notably, eight out of the top 10 lease transactions were renewals, showing that while leasing activity is up, new office space demand remains limited.

Why the Wait-and-See Approach?

Despite the uptick in leasing, occupiers are still cautious. Many businesses are adopting a wait-and-see approach, hesitating to expand or move into new spaces. This is largely due to the uncertainty surrounding the economy and the continuing trend of hybrid work models. As a result, many companies are choosing to downsize their office space footprints to reflect the reduced in-office headcount. This caution is something tenants need to be aware of as it shapes the market’s future availability and pricing.

Key Takeaways for Tenants:

• Leasing renewals are dominating the market, especially in key submarkets like the Airport Area.

• Financial and insurance sectors are driving demand, a factor to consider if you’re in a related industry.

• Tenants looking for new space may find limited availability as companies continue to downsize.

• With occupiers hesitant to expand, now could be a strategic time to renegotiate lease terms.

How The Ocean Company Can Help

Whether you’re looking to renew your lease or explore new opportunities, The Ocean Company specializes in tenant representation in the Orange County and Los Angeles markets. We have the expertise to help you navigate this shifting landscape and secure the best possible deal for your business.

Call us today to discuss your office space needs and discover how we can help you find the perfect solution.

Top Real Estate Strategies for Healthcare Practices

For healthcare practices looking to buy or lease real estate in Orange County, now is a great time to explore opportunities. Unlike the broader office market, which has been struggling, the healthcare real estate sector is thriving, which offers plenty of leverage for practices seeking new space. With vacancy rates still relatively low, particularly in medical office buildings (MOBs), demand remains strong, but there are areas where healthcare providers can benefit.

One key advantage for healthcare practices is the growing trend of office-to-medical conversions. As traditional office spaces continue to see high vacancy rates, landlords are increasingly willing to convert these properties into healthcare facilities. This trend gives practices a chance to negotiate favorable terms, especially if you’re targeting areas with older or underused office spaces that can be adapted for healthcare use. Areas like the Tri-Cities (Irvine, Newport Beach, and Costa Mesa) offer attractive options for practices looking to expand, as they are seeing positive absorption and interest from major health systems.

Another point of leverage is the shift towards outpatient care. With more healthcare providers moving away from large hospital-based models, there is an opportunity to secure space in growing suburban markets where patient demand is high but competition remains manageable. Practices specializing in high-demand areas like dermatology, ophthalmology, or physical therapy may find excellent leasing deals as landlords look to fill vacancies with stable, long-term tenants.

Lastly, the private equity slowdown in healthcare could work in your favor. With fewer acquisitions happening, independent practices might have more negotiating power when securing real estate, as institutional buyers are less aggressive. This could lead to more flexible terms or lower upfront costs when purchasing or leasing space. Now is the time to leverage these trends and position your practice for long-term growth in Orange County’s healthcare real estate market.

The Ocean Company is an advisory service for commercial tenants. If you have questions about facility leases or want to acquire or dispose of a commercial property contact us.

Email: info@theoceanco.com

Medical Practices Face Staffing and Facility Issues

Medical practices are currently facing significant challenges related to both staffing and real estate. These issues are compounded by a dynamic healthcare landscape shaped by increasing patient demand, economic pressures, and evolving care delivery models. Here are the biggest problems in these two areas:

Staffing Challenges

1. Labor Shortages: One of the most pressing issues is the nationwide shortage of healthcare workers, especially nurses, physicians, and medical support staff. As demand for healthcare services rises, fueled by an aging population and increased insurance coverage, medical practices struggle to find qualified personnel. According to recent surveys, burnout from the COVID-19 pandemic and long working hours are causing many healthcare professionals to leave the industry or reduce their hours.

2. High Turnover Rates: High turnover in medical staff is another problem. Replacing employees is expensive and time-consuming, leading to higher labor costs and reduced operational efficiency. This turnover impacts patient care and continuity, as well as staff morale.

3. Wage Inflation: To attract and retain talent, practices are facing significant wage inflation. Offering competitive salaries, bonuses, and benefits adds to operational costs, especially for smaller practices. For example, nurse and physician assistant wages have been rising consistently, pushing some practices to their financial limits.

4. Burnout and Workload: Many healthcare professionals are experiencing burnout due to high patient volumes, administrative burdens (such as documentation and insurance requirements), and increased complexity in healthcare regulations. This can affect job satisfaction, staff retention, and the quality of care provided to patients.

5. Administrative Burden: Medical practices also struggle with an increasing administrative burden, including regulatory compliance, billing, and insurance coding. These tasks often fall on medical staff or require dedicated administrative roles, adding to staffing pressures and increasing operational costs.

Real Estate Challenges

1. Rising Rental Costs: The cost of leasing medical office space has been rising steadily. With average rents for medical office space reaching record highs in 2023, practices in high-demand areas are struggling to balance the need for suitable space with their operational budgets. Practices may be forced to relocate or downsize to cope with rising costs, which can disrupt operations and patient accessibility.

2. Limited Availability of Space: Medical practices require specialized spaces that meet specific regulatory and clinical needs, such as exam rooms, diagnostic equipment spaces, and waiting areas. However, finding available properties that can be customized or retrofitted for healthcare use is challenging, particularly in urban areas with high real estate demand. This scarcity drives up prices and can lead to longer search times for suitable spaces.

3. Construction and Renovation Costs: The cost of constructing or renovating medical office buildings has soared due to increased prices for materials and labor. Practices looking to build new facilities or modify existing spaces face higher upfront expenses, which can impact long-term financial planning. Additionally, construction timelines have lengthened due to labor shortages and supply chain disruptions, further complicating expansion plans.

4. Long-Term Leases and Inflexibility: Medical office leases tend to be long-term, with tenants staying in the same location for years due to the high cost of moving and specialized fit-out needs. However, these long-term leases can pose a challenge if a practice needs to expand or downsize in response to fluctuating patient demand. Practices often find themselves locked into spaces that no longer meet their needs, or they must negotiate expensive lease modifications.

5. Competition from Larger Healthcare Systems: Large healthcare systems are expanding aggressively, and many are buying up medical office spaces or building their own facilities. Independent practices often find themselves priced out of prime locations or unable to compete for the best real estate, which can impact their ability to attract patients and retain staff.

6. Telehealth’s Impact: While telehealth has increased since the pandemic, it hasn’t completely alleviated the demand for physical office space. Many medical services, such as imaging, surgery, and lab work, require in-person visits. Balancing telehealth services with the need for physical office space presents challenges for practices trying to optimize their real estate investments.

Intersections Between Staffing and Real Estate Issues

• Space Requirements for Staff: As practices expand their teams or offer new services, the need for more space increases. However, the rising cost and limited availability of real estate can make expanding difficult. Conversely, staffing shortages may lead practices to operate with smaller teams, resulting in underutilized office space.

• Operational Costs Impacted by Both Staffing and Real Estate: Rising labor costs combined with increasing rent and construction expenses are placing a significant strain on healthcare practices. Many practices, especially smaller or independent ones, are facing tough decisions on how to manage their budgets without sacrificing patient care.

Addressing these challenges requires strategic planning and adaptability, including a focus on employee retention strategies, creative leasing arrangements, and possibly leveraging tele-health or hybrid care models to reduce space demands where possible.

The Ocean Company is a leading advisory to healthcare practices seeking facility negotiation and occupancy cost examination.

The Growing Demand for Medical Office Space: Key Insights for the Healthcare Industry

The healthcare real estate market is experiencing significant momentum as the delivery of healthcare continues to shift toward outpatient care. With an aging population and the rise of outpatient services, medical office spaces have become one of the most sought-after property types by both healthcare providers and investors. Let’s explore how these trends impact healthcare real estate, tips for leasing medical office space, and how occupancy costs might affect your practice.

Why Medical Office Space is in High Demand

The U.S. healthcare system is transforming, with more services moving out of hospitals and into outpatient settings. This shift is largely driven by an aging population—especially with the number of people over 80 expected to increase by 50% in the next decade—who require regular medical attention. According to the Laramar Group, this trend, along with higher insurance coverage and technological advances, continues to push demand for medical office buildings (MOBs).

In 2023, medical office construction reached new heights, with nearly 10.8 million square feet delivered nationwide, up from 10.3 million square feet in 2022. Major Midwest markets like Chicago, St. Louis, and Indianapolis are leading the charge in medical office space development and investment. As occupancy rates for medical properties remain stable—consistently above 90% since 2010—the sector has shown remarkable resilience, even as other office spaces face challenges from the remote work trend.

Tips for Leasing Medical Office Space

Leasing medical office space is a critical decision for healthcare practices. Here are some key considerations:

1. Location Matters: Proximity to patients is essential. Practices should consider locations near population centers, hospitals, and easily accessible transportation routes. Choosing the right location can help drive patient volume and ensure long-term success.

2. Space Design and Equipment Needs: Medical office spaces often require specific build-outs to accommodate exam rooms, diagnostic equipment, and patient flow. Make sure to account for these customizations when negotiating lease terms and timelines. Retrofitting standard office space into a medical office can be costly, so it’s best to work with a real estate agent experienced in healthcare properties.

3. Long-Term Lease Considerations: Unlike traditional office leases, healthcare providers tend to remain in the same location for extended periods due to the cost of moving specialized equipment and the importance of patient familiarity. A long-term lease can offer stability but should include provisions for expansions or modifications as your practice grows.

4. Understand the Market: Rental rates for medical office space continue to rise, with average net asking rents hitting a record $24.37 per square foot in 2023. In competitive markets like Chicago, where average rents are about $23 per square foot, it’s important to strike a balance between your budget and securing a prime location.

The Impact of Occupancy Costs on Healthcare Practices

Occupancy costs, including rent, utilities, and maintenance, represent a significant portion of a healthcare practice’s overhead. Rising construction costs and high demand for medical office space are putting upward pressure on rents. However, this expense can be mitigated by choosing the right lease structure and negotiating favorable terms. For example, landlords might offer rent abatement during the build-out phase or tenant improvement allowances to offset upfront costs.

Key Considerations for Managing Occupancy Costs:

• Lease Type: Gross leases, where the landlord covers all operating expenses, can provide more predictability for budgeting. On the other hand, triple-net (NNN) leases, where the tenant is responsible for taxes, insurance, and maintenance, offer more transparency on costs but could be riskier if property expenses spike.

• Space Efficiency: Ensure your medical office is the right size for your practice’s needs. Too much space can lead to unnecessary costs, while too little space may restrict growth. It’s critical to evaluate the layout and functionality of the office to avoid future disruptions.

• Energy Efficiency: Look for buildings with energy-efficient features or work with landlords to implement cost-saving upgrades like LED lighting or efficient HVAC systems. These can help reduce long-term utility expenses.

The Long-Term Outlook for Medical Office Real Estate

The outlook for medical office space remains strong, with healthcare services essential regardless of economic cycles. Healthcare expenditures as a percentage of GDP are projected to rise to 20% by 2030, and demographic trends—such as the growing number of insured individuals and the aging population—will continue to drive demand for medical services.

Despite the rising demand, new medical office construction starts dropped nearly 45% in 2023 due to rising borrowing and construction costs. This decline in new supply will likely keep vacancy rates low and maintain upward pressure on rents, creating a landlord-friendly market in many regions. For healthcare providers, this means locking in favorable lease terms sooner rather than later could be a smart move.

Conclusion: Investing in Healthcare Real Estate

Medical office buildings offer stability and growth potential for both healthcare providers and investors. Whether you are looking to lease, buy, or sell healthcare real estate, understanding market dynamics, construction trends, and occupancy costs will help position your practice or investment portfolio for long-term success. Healthcare real estate is a resilient asset class, driven by essential services and long-term demographic trends, making it a strategic choice for both providers and investors alike.

Key Takeaways:

• Medical office space is in high demand due to demographic changes and the shift toward outpatient care.

• Leasing considerations should focus on location, space design, and long-term growth potential.

• Rising occupancy costs can impact healthcare practices, so negotiating favorable lease terms and optimizing space usage is essential.

• The healthcare real estate market remains strong, offering stability in an ever-evolving economy.

As the healthcare industry continues to expand and evolve, staying informed about market trends and real estate opportunities will ensure you make sound, strategic decisions for your practice or investment.

Office Leasing in 2024: Is Now the Right Time to Secure Your Next Lease?

As we enter the final stretch of 2024, the office leasing market in Orange County is seeing increased activity, with 1.9 million square feet (msf) of office space leased in Q3 2024. This represents a 29.9% jump from the previous quarter, but is this spike a sign that now is the time for your business to secure its next lease?

Renewal Deals are Driving Growth

A key insight from Q3 2024 is that renewal deals are driving the leasing market. Many businesses are opting to stay in their current offices, with eight of the top 10 lease transactions coming from renewals. This trend points to a cautious market where expansion is on hold and companies are focusing on stability over growth.

Why Office Demand is Still Limited

Despite the increase in leasing activity, the demand for new office spaces remains relatively low. Many businesses are choosing to downsize their office footprints in response to the ongoing trend of remote and hybrid work. Companies are hesitant to take on new leases as they reassess their long-term space needs, leading to a “wait-and-see” approach that is keeping the market somewhat subdued.

What Tenants Need to Consider:

• Downsizing trends mean that availability for larger office spaces may increase in the future, but the current market is tight for new space.

• Leasing renewals are often negotiable, and with occupiers focused on maintaining their existing space, there’s room to secure favorable terms.

• Rental rates are creeping up slightly, but this offers an opportunity for businesses to lock in lower rates before further increases occur.

Is It the Right Time to Lease?

The key takeaway for tenants is that timing is everything. While the market is shifting and many occupiers are holding off on expansions, this could be an opportunity to secure a new lease at a competitive rate. If your business is growing or in need of a change, acting sooner rather than later might allow you to capitalize on current conditions before rental rates increase further.

The Ocean Company is Here to Help

If you’re considering a lease renewal or looking for new office space in Orange County or Los Angeles, The Ocean Company can guide you through the process. We specialize in tenant representation and can help you navigate this evolving market.

Contact us today to discuss your leasing options and find the best space for your business.

Navigating the Current Biotech Real Estate Landscape: Opportunities for Life Science Businesses

The biotech real estate market is currently experiencing a significant shift. Demand for life science properties is softening, with rising vacancies and increased competition for tenants, particularly in the major life science hubs of Boston, San Francisco, and San Diego. According to Cushman & Wakefield, vacancies have surged to 24%, 27%, and 17% in these cities, respectively. For life science businesses, this presents both challenges and unique opportunities to leverage the changing landscape to their advantage.

Why the Shift in the Biotech Real Estate Market?

Several factors have contributed to this change. Reduced venture capital funding, particularly for smaller companies, has forced many firms to reconsider their space needs. Furthermore, the end of the pandemic’s surge in research and development (R&D) funding—largely driven by COVID-19 treatments and vaccines—has led to a slowdown in demand. Add to this the increasing cost of lab construction (up by 20%) and specialized equipment (rising 30-50%), and it’s easy to see why the biotech real estate sector is facing a reckoning.

However, one area that continues to thrive is Class A real estate. Major players like Alexandria Real Estate Equities are doubling down on high-end, self-contained, multitenant campuses that offer on-site services designed to attract top talent. These amenities, coupled with the prestige of Class A properties, make these spaces highly sought after, with rental prices expected to continue rising despite overall market softness.

The Shift Toward Mega Campuses

One of the most important trends in biotech real estate is the move toward “mega campuses.” Alexandria, for instance, is investing heavily in these campuses, which now account for nearly 70% of the company’s annual rental revenue. These campuses offer more than just lab space—they provide an ecosystem, with on-site amenities such as fitness centers, dining options, and collaborative spaces, creating a built-in advantage for companies looking to attract top-tier scientific talent. According to Alexandria executives, these campuses also offer the best prospects for financing and long-term rent growth.

How Life Science Companies Can Leverage the Market

For life science companies, the current market conditions offer several opportunities to maximize leverage and secure favorable terms:

1. Take Advantage of Tenant Allowances:

As landlords compete to fill vacancies, tenant improvement allowances have increased by 38% in top markets, according to CBRE. These allowances give tenants the flexibility to customize lab and office spaces to meet their specific needs. Life science companies should negotiate aggressively for these concessions, especially for highly specialized spaces like vivariums and clean rooms, which come with higher build-out costs.

2. Capitalize on Softer Demand:

With vacancy rates at historical highs and a growing amount of sublease space available, life science companies can negotiate lower rents or lock in favorable terms. Companies with a clear long-term vision should consider expanding or relocating to top-tier markets where rents may have softened, while locking in advantageous deals for the future.

3. Consider Strategic Location Choices:

While mega campuses are in high demand, not all life science firms need to be in the most prestigious locations. Some emerging biotech hubs, such as New Jersey, are experiencing a surge in new construction but without the oversupply issues plaguing major markets. These areas offer competitive pricing while still providing access to talent and infrastructure. For businesses looking to optimize their real estate spend, exploring these secondary markets could yield significant savings.

4. Partner with Landlords Offering Flexibility:

In this volatile market, having flexibility in your lease terms is crucial. Companies should seek out landlords who are willing to provide options for expansion or downsizing, as business needs can change quickly. With some developers facing difficulties filling space—especially in properties converted from general office use—this is the perfect time to negotiate for more flexible terms.

The Long-Term Outlook: Why Now is the Time to Act

While the current market offers leverage, experts predict that the high demand for Class A space and specialized lab facilities will push rents higher as new spaces come online through 2025. For life science companies, this means the window for securing favorable terms may be limited. Acting now to lock in competitive rents or securing prime space in a top-tier campus could pay dividends in the coming years.

Moreover, for companies focused on growth, leasing space in a well-amenitized campus could provide a strategic advantage when recruiting talent. With the biotech industry’s reliance on highly specialized professionals, offering an attractive work environment can be a key differentiator in a competitive job market.

Conclusion

The biotech real estate market is in flux, but this presents opportunities for savvy life science businesses to maximize their leverage. Whether it’s negotiating for better tenant allowances, securing flexible lease terms, or capitalizing on market softening in prime locations, the key is to act strategically. As the market continues to shift, businesses that make informed decisions now will be better positioned for future growth in an increasingly competitive landscape.

SEO Keywords: biotech real estate, life science property, life science business, Alexandria Real Estate, mega campuses, tenant improvement allowances, Class A space, lab construction costs, biotech leasing, life science market

The Importance of Tenant Representation in Los Angeles

Introduction

Tenant representation is a crucial service in the commercial real estate sector, especially in a competitive market like Los Angeles. At The Ocean Company, we specialize in providing top-notch tenant representation services to help businesses find the perfect spaces for their needs.

What is Tenant Representation?

Tenant representation involves a commercial real estate broker acting on behalf of a tenant to find, negotiate, and secure rental spaces. This service is essential for businesses looking to lease commercial properties without the hassle and risk of going it alone.

Benefits of Tenant Representation

Expert Negotiation: Ensure you get the best lease terms.

Market Insight: Gain access to insider knowledge of the local market.

Time Efficiency: Save valuable time by letting experts handle the search and negotiation process.

The Los Angeles Commercial Real Estate Market

Los Angeles is a sprawling metropolis with a complex real estate market. Understanding the nuances of this market is critical for any business looking to lease commercial space.

Key Areas to Consider

Downtown LA: Known for its high-rise office buildings and bustling business environment.

Santa Monica: A hub for tech companies and creative industries.

Beverly Hills: Ideal for luxury retail and professional services.

Why Choose The Ocean Company for Tenant Representation?

At The Ocean Company, we pride ourselves on our local expertise and commitment to client satisfaction. Here’s why you should choose us:

1. Extensive Market Knowledge

Our brokers have an in-depth understanding of the Los Angeles commercial real estate market, ensuring you get the best advice and opportunities.

2. Personalized Service

We tailor our services to meet the unique needs of each client, ensuring a personalized and efficient experience.

3. Strong Negotiation Skills

Our team is skilled in negotiating favorable lease terms, saving you money and securing the best possible deal.

Steps in the Tenant Representation Process

1. Initial Consultation

We begin with a detailed consultation to understand your business needs and goals.

2. Market Research

We conduct comprehensive market research to identify suitable properties.

3. Property Tours

We arrange and accompany you on tours of selected properties, providing expert insights and advice.

4. Lease Negotiation

We handle all aspects of lease negotiation, ensuring terms that are favorable to you.

5. Finalization

We assist with the finalization of the lease agreement, ensuring all legal and logistical aspects are covered.

Conclusion

Tenant representation is a vital service for any business looking to lease commercial space in Los Angeles. At The Ocean Company, we are dedicated to providing exceptional tenant representation services that help you find the perfect space for your business.

Looking for the perfect commercial space in Los Angeles? Contact The Ocean Company today and let our experts guide you to the best lease terms and locations!

How Interest Rates and Leasing Trends Affect San Diego's Industrial Real Estate

The surge in industrial developments over the past two years has slowed considerably. Developers completed over 1.5 billion square feet of industrial projects in the U.S. during 2022 and 2023, but many of these were finished without tenants, pushing the vacancy rate from 3.8% to 6.4%. Now, early 2024 data shows a 30% drop in completed projects, signaling a significant slowdown in new developments.

Interest Rates and Their Impact

Higher interest rates have played a crucial role in curbing new industrial construction starts. By the fall of 2023, industrial construction starts had plummeted to 10-year lows, with projections indicating a continued decline through mid-2025. This decrease in new projects is a direct response to the financial environment, which affects developers' ability to finance new constructions.

Important Numbers:

Construction start decline: Down 40% in early 2023, further 60% drop in the following 12 months.

Interest rate impact: Higher costs limit new development financing.

Implications for San Diego's Market

San Diego’s industrial real estate market, while influenced by national trends, has its unique dynamics. The slowdown in new industrial projects could lead to a tighter market locally, especially if tenant demand remains steady or improves.

Local Market Insights:

Tightening Supply: Fewer new completions could reduce available industrial spaces.

Investment Potential: Limited new supply may increase the value of existing properties.

Tenant Opportunities: Businesses may need to act quickly to secure desirable spaces.

The Ocean Company: Your Partner in San Diego Real Estate

Navigating these changes requires expert knowledge and strategic planning. At The Ocean Company, we offer specialized services in tenant representation and investment sales to help you succeed in San Diego’s competitive market. Our team is dedicated to providing personalized solutions tailored to your specific needs.

What We Offer:

Customized Search: Finding industrial spaces that match your business requirements.

Strategic Investment Advice: Helping you capitalize on market opportunities.

Local Market Expertise: Providing up-to-date insights and trends.

Interested in making the most of the current market conditions? Reach out to The Ocean Company today and discover how we can assist you in achieving your real estate goals in San Diego.

Investing in Los Angeles Commercial Real Estate: A Guide for New Investors

Los Angeles is a prime market for commercial real estate investment, offering numerous opportunities for new investors. At The Ocean Company, we specialize in helping clients navigate the complexities of commercial real estate in LA. This guide will provide you with essential tips and insights to get started.

Why Invest in Los Angeles Commercial Real Estate?

Los Angeles is one of the most dynamic and diverse real estate markets in the world. Here are some compelling reasons to invest:

Strong Economic Fundamentals

Diverse Economy: LA's economy is supported by a wide range of industries, from entertainment to technology.

Population Growth: Continuous population growth drives demand for commercial spaces.

Global City: As a global city, LA attracts businesses and investors from around the world.

High Demand for Commercial Spaces

The high demand for commercial spaces in key areas like Downtown LA and Santa Monica ensures steady rental income and potential for property appreciation.

Types of Commercial Real Estate Investments

1. Office Buildings

Office spaces in business hubs like Downtown LA are always in high demand.

2. Retail Spaces

Retail properties in areas like Beverly Hills and Santa Monica offer high visibility and foot traffic.

3. Industrial Properties

Industrial properties in locations like the South Bay are crucial for logistics and manufacturing businesses.

Key Considerations for New Investors

Investing in commercial real estate requires careful planning and due diligence. Here are some key considerations:

Location

Choose locations with high demand and potential for growth. Research local market trends and future developments.

Property Condition

Inspect the property thoroughly to identify any potential issues or required renovations.

Financing

Secure financing options that offer favorable terms. Consider working with local banks or financial institutions familiar with the LA market.

Legal Aspects

Ensure all legal aspects are covered, including zoning laws, property taxes, and lease agreements.

Working with a Commercial Real Estate Broker

A commercial real estate broker can provide invaluable assistance in navigating the investment process. Here’s how The Ocean Company can help:

Market Analysis

We provide detailed market analysis to help you make informed investment decisions.

Property Search

We assist in finding properties that meet your investment criteria and goals.

Negotiation

Our experts negotiate the best purchase terms on your behalf, ensuring a profitable investment.

Closing the Deal

We guide you through the closing process, ensuring all legal and financial aspects are handled smoothly.

Conclusion

Investing in Los Angeles commercial real estate offers tremendous opportunities for new investors. By understanding the market and working with experienced professionals like The Ocean Company, you can maximize your investment potential.

Ready to invest in Los Angeles commercial real estate? Contact The Ocean Company today and let’s start building your investment portfolio!

The Impact of Industrial Real Estate Developments on San Diego's Market

Understanding the Nationwide Trends

In 2022 and 2023, developers completed over 1.5 billion square feet of U.S. industrial projects. This massive expansion, equivalent to all the existing industrial space in metropolitan Chicago, marked the largest growth in U.S. industrial supply over two years in more than half a century. Interestingly, many of these developments were completed without any tenants lined up, which significantly increased the U.S. industrial property vacancy rate from an all-time low of 3.8% in mid-2022 to 6.4%.

Recent Developments and Projections

As we move into 2024, data shows a decline in the number of projects finishing construction. Within CoStar’s National Index, 106 million square feet of industrial property developments were completed during the first quarter of 2024, a 30% drop from the previous quarter, and the lowest amount under construction in 18 months. This trend indicates a more prolonged reduction in industrial development completions is just beginning, influenced by higher interest rates and a slower leasing environment.

Key Statistics:

· Industrial projects in 2022-2023: 1.5 billion square feet

· Vacancy rate increase: 3.8% to 6.4%

· Q1 2024 completions: 106 million square feet (down 30%)

Local Impact on San Diego’s Commercial Real Estate Market

San Diego, known for its strategic location and robust economy, is no stranger to the fluctuations in the national industrial real estate market. The slowdown in new industrial development completions nationally suggests a potential stabilization or even tightening of vacancy rates locally if the demand for industrial spaces continues to improve.

Why This Matters for San Diego:

· Stabilizing Vacancy Rates: The lower number of new completions could help stabilize local vacancy rates.

· Potential for Increased Demand: With fewer new projects, existing industrial spaces might see higher demand.

· Investment Opportunities: A tighter market could present lucrative opportunities for investors.

Navigating the Market with The Ocean Company

At The Ocean Company, we specialize in tenant representation and investment sales, providing expert guidance to navigate the complexities of the commercial real estate market in San Diego. Whether you're looking to lease, buy, or invest, our team is equipped with the local knowledge and industry expertise to help you make informed decisions.

Our Services:

· Tenant Representation: Finding the perfect space to meet your business needs.

· Investment Sales: Identifying and securing profitable investment opportunities.

· Market Analysis: Providing insights into market trends and projections.

Ready to explore the opportunities in San Diego’s industrial real estate market? Contact The Ocean Company today and let us help you find the perfect solution for your business needs.

Navigating the Current Commercial Real Estate Climate: A Guide for Business Owners

In today's fluctuating commercial real estate (CRE) environment, business owners face a unique set of challenges and opportunities. Understanding the current market dynamics is crucial for making informed decisions, particularly for those planning to lease commercial space. This comprehensive guide provides insights into the latest trends and offers strategic advice to help you navigate the complexities of the CRE market.

The Current State of the Commercial Real Estate Market

The construction economy in the U.S. is experiencing a notable slowdown. The pace of growth in construction spending is expected to decelerate, influenced by underlying issues in the CRE sector. Key indicators and expert analyses point to several factors that business owners should be aware of:

1. Interest Rates and Refinancing: As commercial real estate loans come due, property owners will face the challenge of refinancing at significantly higher interest rates. This is a critical factor for businesses considering leasing or renewing their office space. Experts in the field emphasize that the market has yet to hit bottom, particularly as many office leases are set to expire in the near future. Business owners should brace for potential increases in leasing costs, specifically tenant improvements.

3. Sector-Specific Performance: Not all sectors are equally affected. While the multifamily residential sector remains a weak link, areas such as data centers, manufacturing, and logistics/distribution are poised for growth. This disparity can influence where businesses might find more favorable leasing opportunities.

4. Inflation and Material Costs: Inflation continues to be a significant concern, with materials like concrete showing unpredictable price changes. This impacts construction costs and, subsequently, lease rates for new and existing properties.

5. Labor Availability: The construction industry faces ongoing challenges with labor availability. This can lead to project delays and increased costs, affecting the timing and expense of leasing new spaces.

Strategic Recommendations for Business Owners

Given these conditions, business owners must adopt strategic approaches to secure advantageous deals in the commercial real estate market. Here are several suggestions to help you navigate this environment effectively:

1. Evaluate Lease Expirations and Renewals: With many office leases signed before 2020 still active, now is a crucial time to evaluate your lease terms. If your lease is set to expire soon, start negotiations early to lock in more favorable terms before potential rate increases.

2. Consider Alternative Locations: High vacancy rates and declining property values in certain markets present opportunities. Offices have seen a 24% decline in values since mid-2022, and national office vacancy rates are nearing 20%. Exploring markets with higher vacancy rates could yield more competitive lease terms.

3. Leverage Remote Work Trends: With 30% of paid workdays now involving remote work, consider flexible workspace solutions. Shared office spaces or hybrid work models can reduce overhead costs and provide flexibility in uncertain times.

4. Monitor Inflation and Material Costs: Stay informed about inflation trends and material costs, as these directly impact construction and leasing prices. Engaging with real estate professionals who have up-to-date market knowledge can help you anticipate and mitigate these costs.

5. Diversify Investments: For those considering real estate investments, diversify into sectors less sensitive to interest rate fluctuations. Data centers and manufacturing facilities, for instance, are currently showing robust growth prospects compared to traditional office spaces.

6. Labor Market Insights: Be mindful of labor market conditions that can affect construction timelines. Understanding these dynamics can help in planning and negotiating construction-related aspects of your lease agreements.

Looking Ahead: The CRE Market in 2024

As we look towards 2024, the CRE market presents a mixed outlook. Despite a challenging environment, there are areas of growth and opportunity:

- Economic Recovery and Interest Rates: Economic recovery is expected to continue, albeit slowly. However, interest rates are likely to remain high, maintaining pressure on financing costs. Strategic financial planning and early engagement with lenders can help mitigate some of these challenges.

- Sector Growth Variability: The outlook for multifamily properties has shifted dramatically from a projected 6.4% growth at the beginning of the year to just 0.1% now. Conversely, total non-residential building growth, although modest, remains positive at 2%. Focusing on non-residential sectors that show resilience can provide more stable leasing opportunities.

- Project Stress Conditions: Project stress conditions are now 30% above 2021 levels, driven by sustained high interest rates. Businesses should conduct thorough due diligence on potential lease deals to understand the financial health and stress levels of prospective landlords.

Conclusion: Making Informed Decisions in a Dynamic Market

In conclusion, the current commercial real estate climate requires business owners to be proactive and strategic. By understanding market trends, evaluating lease terms, exploring alternative locations, and staying informed about economic indicators, you can position your business to secure favorable deals. Engage with experienced real estate professionals who can provide valuable insights and assist in navigating this complex environment.

With careful planning and informed decision-making, you can capitalize on opportunities and mitigate risks in the commercial real estate market, ensuring your business remains resilient and poised for growth in the coming years.

Has Los Angeles Hit Bottom?

For office tenants and investors eyeing the Los Angeles market, now may be the opportune moment to capitalize on favorable market dynamics and valuations. Recent transactions hint at a newfound price stability, prompting experts to suggest that the time to act might be upon us.

Kevin Shannon from Newmark, a leading investment sales broker, notes a surge in capital seeking investment opportunities, underlining the increased competition for deals. December witnessed significant sales activity across different segments of Greater L.A.'s landscape:

- Kennedy Wilson's sale of 400 and 450 North Brand Boulevard in Glendale for $60 million.

- Carolwood's acquisition of the AON Center in Downtown L.A. at approximately $134 per square foot.

- Harbor Associates' purchase of 1640 South Sepulveda Boulevard in Westwood for $271 per square foot.

What's striking about these transactions is the substantial discount they represent compared to previous sales, ranging between 50 and 60 percent. Some industry insiders speculate that these prices might constitute the bottom, with expectations of a sustained period at this level.

Adam Rubin of Carolwood sees their acquisition of the AON Center as setting a benchmark, providing clarity amidst uncertainty. This sentiment resonates amid a challenging year that witnessed a 51 percent decrease in office investments compared to 2022.

However, fewer transactions mean fewer comparable data points, posing a challenge for prospective buyers in gauging fair market value. Despite this, the recent sales serve as early indicators of potential market stabilization, albeit varied across submarkets.

Looking ahead, Brookfield Properties' listing of 777 Tower in Downtown L.A. offers insight into future market movements. Despite being 52 percent leased, the property attracted significant interest, suggesting investor confidence despite occupancy concerns.

For both tenants and investors, maximizing leverage in this market requires strategic action. Occupancy rates significantly impact property valuation, with every percentage increase in occupancy potentially adding substantial value. Therefore, for tenants seeking space, negotiating favorable lease terms amid the current market downturn could yield significant cost savings. Similarly, investors should leverage the current pricing environment to acquire assets with strong upside potential, focusing on properties with attractive occupancy rates and long-term value prospects.

Maturing Debts May Lead To Opportunistic Aquisitions In The Office Market

The COVID-19 pandemic reshaped the way we work, triggering a surge in remote work arrangements. As a result, the office sector of the US commercial property market has been under significant pressure. Landlords are grappling with a daunting wave of debt maturities, leading to a record amount of debt being extended or modified rather than refinanced. Goldman Sachs recently cautioned that office mortgages are "living on borrowed time."

With outstanding commercial mortgages set to mature by the year-end hitting a staggering $929 billion, savvy investors are eyeing the potential opportunities arising from defaults on commercial loans. Banks hold $114 billion of this total, while non-bank entities account for the remainder. The significant increase in maturing loans has been primarily driven by lenders and borrowers opting to modify and extend loan terms rather than pursuing refinancing or foreclosure. This trend has disproportionately benefited office loans, offering a window for investors to explore distressed asset acquisitions.

Despite these efforts to delay defaults, Goldman warns that funding costs are unlikely to revert to pre-pandemic levels, potentially posing financial challenges for office properties. Data from CMBS indicate that the percentage of office loans fully paid off at maturity has fallen below 60%, contrasting with other property types where maturity payoff rates remain near decade-high levels.

As office property values plummet, the costs of refinancing existing commercial mortgage loans have soared to two-decade highs. This trend, coupled with declining property values, paints a grim picture for many office buildings, with some experiencing rock-bottom occupancy rates. For investors seeking deals, this presents an opportunity to capitalize on distressed assets and negotiate favorable terms amid market uncertainty.

Goldman analysts anticipate a continued wave of loan modifications in the near term, driven by the economic challenges facing commercial real estate borrowers. However, they caution that the risks associated with this trend are on the rise, signaling a potential shift in the market landscape.

To find opportunistic deals on office buildings where loans are in default or nearing default, investors can employ several strategies:

1. Stay informed: Keep abreast of market trends, foreclosure notices, and distressed property listings to identify potential investment opportunities.

2. Network with lenders: Establish relationships with lenders who may be looking to offload distressed assets or negotiate loan modifications.

3. Conduct thorough due diligence: Assess the financial health and occupancy rates of target properties to gauge their investment viability.

4. Seek creative financing options: Explore alternative financing sources, such as private equity firms or distressed asset funds, to fund acquisitions.

5. Be patient and persistent: Navigating the distressed property market requires patience and persistence. Stay focused on long-term investment goals and be prepared to act swiftly when opportunities arise.

6. Consult with CRE professionals with market expertise that have knowledge of commercial office buildings where landlords are struggling to make new lease transactions.

Written by Jamal Brown