THE MORE YOU KNOW

THE BETTER YOU NEGOTIATE

Avoiding Percentage Rent

If you’re an office tenant skip this one, it thankfully doesn’t apply to you - restaurant and retail space users should take notes. Your landlord is like that disgusting troll under the bridge in the story your mom used to read you. They want more than what’s fair because they think they’re in control. You’re about to pay them a monthly amount of rent, and your share of property taxes, property insurance and common area maintenance, in order to operate your business in their property. In addition, or sometimes in lieu of, they want their grubby little hands in your pocket by charging you a percentage of your (typically) gross sales...sometimes above a breakpoint but sometimes from the first dollar you earn. This is called percentage rent, and it’s absurdly legal.

As a rule of thumb your restaurant or retail store should never lease space that costs more than 6 - 10% of your projected gross sales. Seriously. Landlords who believe you have the ability to make millions of dollars in annual revenue in their space will try to parasitically attach themselves to your success using an overage percentage (DM me for details) or an absolute gross sales breakpoint on top of your rent. Whatever you sell above this breakpoint gets multiplied by your percentage and goes to the landlord. Seriously. Avoiding this is tough, but not impossible. First, know the conversation needs to be had upfront in lease negotiations and either make the percentage based on sales of something specific: i.e.: food sales, alcohol sales, super high end product you sell few of; or make your breakpoint so high you are UNLIKELY to hit it. Second, make the percentage a low number. Landlords are going to try something between 5 - 7% but it’s okay to laugh at them and offer 2 - 3%. Do not be afraid to walk away from the negotiating table in order to do this. Far too many restaurant owners fall in love with space and just agree to this nonsense. Unless you’re Tiffany’s you should stay far away from leases like these without protecting yourself, and if you need help, call us!

Jamal Brown has represented commercial tenants in lease negotiations for over 16 years.

5 Leasing Tips We Can Learn From Dogs

The two most persistent beings in the universe have to be dogs and children. Why are these little cutthroats so good at getting what they want? Here’s a few take aways we can we apply to the commercial leasing process which should help your company get what it needs.

Explore all your options: Dogs will stick their nose in everything just to figure out if it’s edible. At the onset of facility negotiations, you need to enroll as many desirable locations as possible. You also need to ask for everything that would make a facility contract compliment your business plan. Be strategic in the structure of the financial terms and the amount of exposure so your business can thrive.

Be Persistent: Ever had a dog beg for snacks/your dinner/belly rubs/a walk and then give up after one rebuke? Me neither. So when you don’t get a positive initial response to your requested lease terms, ask again. You may need to modify the language a little but go for what your business needs until you get it.

Play Dead: With a little training, dogs will do this for a reward. Sometimes it’s necessary in lease negotiations to take a step back, act offended, and let a landlord think their negotiation strategy killed a deal. More often than not you’ll reap the reward.

Leave Nothing Left: Whether it’s treats or steak bones, dogs rarely leave anything unfinished. Real estate costs are usually the 2nd or 3rd most costly expense your business will incur. You owe it to yourself and your employees to mitigate the fixed costs and your exposure to additional charges in negotiations. Grind multiple locations down simultaneously and don’t leave money on the table. Use each site as leverage against one another. Push hard until there’s nothing left.

Trust Your Pack: Dogs are a pretty good judge of character, and in their pack (human or canine) everyone plays their role. You need professional service providers throughout the leasing process. An experienced tenant representation broker to guide you through site selection and negotiation, a project manager to assist with construction pricing, scheduling and vendor coordination, and an attorney to negotiate and review lease language. Not only can you leverage these professionals to create the best outcome, you can spend more time focusing on your core business while they work for you. Lone wolves don’t accomplish much, you need a pack.

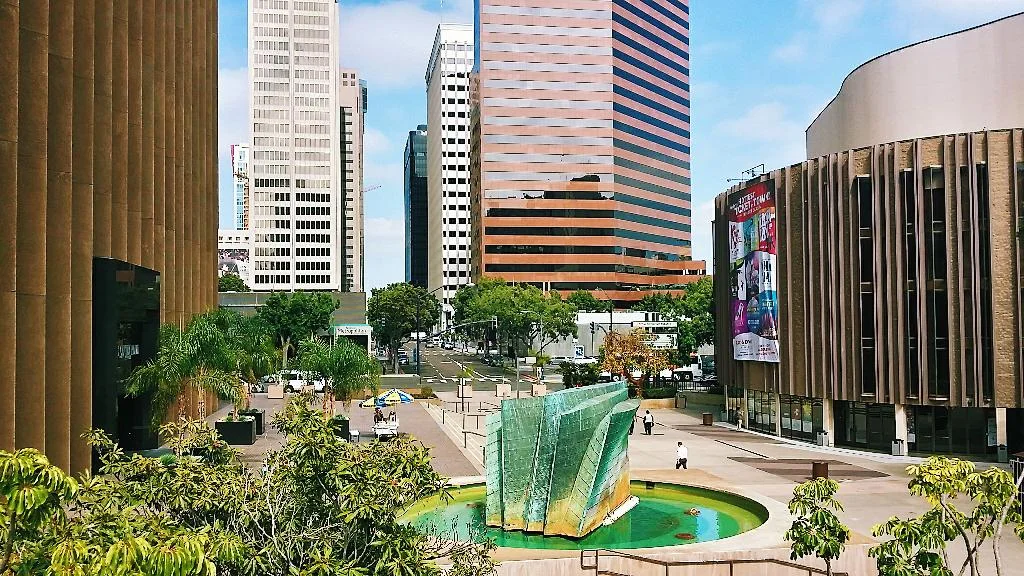

Jamal Brown is the CEO of The Ocean Company, an exclusive tenant representation firm with offices in San Diego, Orange County and Los Angeles focusing on the leasing and acquisition of commercial real estate.

Main: 858.356.2990 | E-mail: jbrown@theoceanco.com | social: @theoceancompany

5 Metrics You Need To Know

So you think you’re ready for an additional location and are prepared to spend the time, capital and effort to expand. We have all heard the ‘location, location, location’ mantra, especially when it comes to retailers and restauranteurs; but there is much more to successfully expanding your offering than this. Truly understanding the business metrics in your current location Is beneficial to finding the right location to occupy. The five business evaluations below will help you and your business determine what space is right for your next location.

When planning any expansion of your brand, knowing the true occupancy cost of your business is essential for the success.

1.Revenue generating space: Unlike the majority of office or industrial users, retail and restaurant space occupiers generate income on a much smaller percentage of their rentable area. Space usable for displaying goods, seating customers, or other “front of house” activities is typically in the 50%-60% range. The effective cost of occupying space is derived from dividing your revenue over this percentage of your square footage. In the case of restaurants, the kitchen is absolutely an important component in generating income; however, when planned correctly this space is typically less than 20% of the entire establishment footprint. When planning any expansion of your brand, knowing the true occupancy cost of your business (revenue divided by that percentage of your space that generates income) is essential for the success. The cost for a potential new location should be examined utilizing these metrics.

2. Revenue as a percentage of your Facility Cost: Your facility cost is generally the second or third line item on your balance sheet, but identifying the cost of your facility in relation to the revenue you generate from it is a key metric needed for smart expansion. Your annual revenue/annual facility cost (Base Rent + Operating Expenses + Utilities) will provide a benchmark you can apply to potential future sites.

3. Effectiveness: Business owners can evaluate your actual annual occupancy cost metric by dividing your sales by the establishment’s selling space. While this can also be done by dividing the annual top line revenue by the gross square footage it is more useful to use the revenue/selling space formula if you wish to apply this to other locations. Remember, not all spaces are equal due to inherent space shape efficiencies.

4. Demographics: We all know local population income and age numbers matter; however, you may be operating in a ‘destination’ center wherein people from surrounding areas frequent often as a result of commute or travel. It is thereby important to understand the demographics of YOUR customers. While the neighborhood, average traffic counts, and proximity to other similar retailers does have an effect on your success, knowing: who, why, when and how your revenue is generated will provide guidance should you expand.

5. Discounting: Probably the least exciting topic but one of the most important. Taking the number of sales at discount or special pricing and dividing it by the total sales (Discount Sales/Total Sales) is necessary when developing a stores profile. Restauranteurs who have to offer heavy discounts/specials to get people in the door rarely have the necessary capital or financials to expand. It’s common knowledge that food margins are slim, and if you’re discounting your per plate costs there better be an avenue to make up for it., i.e. alcohol sales. Retailers offer discounts based on seasonal changes or specific items that aren’t moving, however, the percentage of a store’s discounts should remain consistent. If this percentage increases quarter over quarter (not just seasonally) it’s indicative of a problem.

For both restauranteurs and retailers knowing these metrics can help correctly identify geographic areas, and specific sites, suitable for expansion. Performing this front-end analysis will save you time, money, and prevent you from committing to the wrong space. If you have any questions related to expanding your brand into new locations call us for a free consultation.