THE MORE YOU KNOW

THE BETTER YOU NEGOTIATE

The Growing Demand for Medical Office Space: Key Insights for the Healthcare Industry

The healthcare real estate market is experiencing significant momentum as the delivery of healthcare continues to shift toward outpatient care. With an aging population and the rise of outpatient services, medical office spaces have become one of the most sought-after property types by both healthcare providers and investors. Let’s explore how these trends impact healthcare real estate, tips for leasing medical office space, and how occupancy costs might affect your practice.

Why Medical Office Space is in High Demand

The U.S. healthcare system is transforming, with more services moving out of hospitals and into outpatient settings. This shift is largely driven by an aging population—especially with the number of people over 80 expected to increase by 50% in the next decade—who require regular medical attention. According to the Laramar Group, this trend, along with higher insurance coverage and technological advances, continues to push demand for medical office buildings (MOBs).

In 2023, medical office construction reached new heights, with nearly 10.8 million square feet delivered nationwide, up from 10.3 million square feet in 2022. Major Midwest markets like Chicago, St. Louis, and Indianapolis are leading the charge in medical office space development and investment. As occupancy rates for medical properties remain stable—consistently above 90% since 2010—the sector has shown remarkable resilience, even as other office spaces face challenges from the remote work trend.

Tips for Leasing Medical Office Space

Leasing medical office space is a critical decision for healthcare practices. Here are some key considerations:

1. Location Matters: Proximity to patients is essential. Practices should consider locations near population centers, hospitals, and easily accessible transportation routes. Choosing the right location can help drive patient volume and ensure long-term success.

2. Space Design and Equipment Needs: Medical office spaces often require specific build-outs to accommodate exam rooms, diagnostic equipment, and patient flow. Make sure to account for these customizations when negotiating lease terms and timelines. Retrofitting standard office space into a medical office can be costly, so it’s best to work with a real estate agent experienced in healthcare properties.

3. Long-Term Lease Considerations: Unlike traditional office leases, healthcare providers tend to remain in the same location for extended periods due to the cost of moving specialized equipment and the importance of patient familiarity. A long-term lease can offer stability but should include provisions for expansions or modifications as your practice grows.

4. Understand the Market: Rental rates for medical office space continue to rise, with average net asking rents hitting a record $24.37 per square foot in 2023. In competitive markets like Chicago, where average rents are about $23 per square foot, it’s important to strike a balance between your budget and securing a prime location.

The Impact of Occupancy Costs on Healthcare Practices

Occupancy costs, including rent, utilities, and maintenance, represent a significant portion of a healthcare practice’s overhead. Rising construction costs and high demand for medical office space are putting upward pressure on rents. However, this expense can be mitigated by choosing the right lease structure and negotiating favorable terms. For example, landlords might offer rent abatement during the build-out phase or tenant improvement allowances to offset upfront costs.

Key Considerations for Managing Occupancy Costs:

• Lease Type: Gross leases, where the landlord covers all operating expenses, can provide more predictability for budgeting. On the other hand, triple-net (NNN) leases, where the tenant is responsible for taxes, insurance, and maintenance, offer more transparency on costs but could be riskier if property expenses spike.

• Space Efficiency: Ensure your medical office is the right size for your practice’s needs. Too much space can lead to unnecessary costs, while too little space may restrict growth. It’s critical to evaluate the layout and functionality of the office to avoid future disruptions.

• Energy Efficiency: Look for buildings with energy-efficient features or work with landlords to implement cost-saving upgrades like LED lighting or efficient HVAC systems. These can help reduce long-term utility expenses.

The Long-Term Outlook for Medical Office Real Estate

The outlook for medical office space remains strong, with healthcare services essential regardless of economic cycles. Healthcare expenditures as a percentage of GDP are projected to rise to 20% by 2030, and demographic trends—such as the growing number of insured individuals and the aging population—will continue to drive demand for medical services.

Despite the rising demand, new medical office construction starts dropped nearly 45% in 2023 due to rising borrowing and construction costs. This decline in new supply will likely keep vacancy rates low and maintain upward pressure on rents, creating a landlord-friendly market in many regions. For healthcare providers, this means locking in favorable lease terms sooner rather than later could be a smart move.

Conclusion: Investing in Healthcare Real Estate

Medical office buildings offer stability and growth potential for both healthcare providers and investors. Whether you are looking to lease, buy, or sell healthcare real estate, understanding market dynamics, construction trends, and occupancy costs will help position your practice or investment portfolio for long-term success. Healthcare real estate is a resilient asset class, driven by essential services and long-term demographic trends, making it a strategic choice for both providers and investors alike.

Key Takeaways:

• Medical office space is in high demand due to demographic changes and the shift toward outpatient care.

• Leasing considerations should focus on location, space design, and long-term growth potential.

• Rising occupancy costs can impact healthcare practices, so negotiating favorable lease terms and optimizing space usage is essential.

• The healthcare real estate market remains strong, offering stability in an ever-evolving economy.

As the healthcare industry continues to expand and evolve, staying informed about market trends and real estate opportunities will ensure you make sound, strategic decisions for your practice or investment.

Office Leasing in 2024: Is Now the Right Time to Secure Your Next Lease?

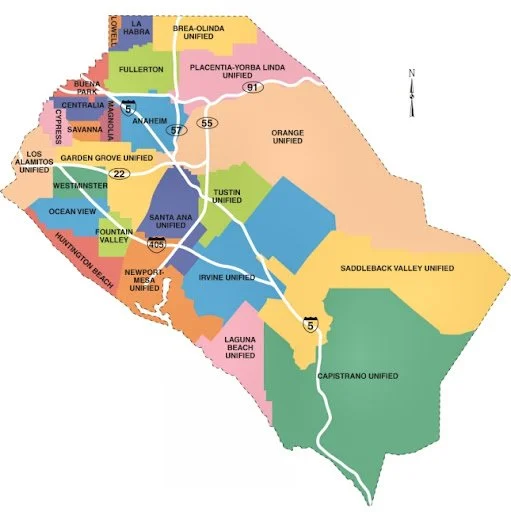

As we enter the final stretch of 2024, the office leasing market in Orange County is seeing increased activity, with 1.9 million square feet (msf) of office space leased in Q3 2024. This represents a 29.9% jump from the previous quarter, but is this spike a sign that now is the time for your business to secure its next lease?

Renewal Deals are Driving Growth

A key insight from Q3 2024 is that renewal deals are driving the leasing market. Many businesses are opting to stay in their current offices, with eight of the top 10 lease transactions coming from renewals. This trend points to a cautious market where expansion is on hold and companies are focusing on stability over growth.

Why Office Demand is Still Limited

Despite the increase in leasing activity, the demand for new office spaces remains relatively low. Many businesses are choosing to downsize their office footprints in response to the ongoing trend of remote and hybrid work. Companies are hesitant to take on new leases as they reassess their long-term space needs, leading to a “wait-and-see” approach that is keeping the market somewhat subdued.

What Tenants Need to Consider:

• Downsizing trends mean that availability for larger office spaces may increase in the future, but the current market is tight for new space.

• Leasing renewals are often negotiable, and with occupiers focused on maintaining their existing space, there’s room to secure favorable terms.

• Rental rates are creeping up slightly, but this offers an opportunity for businesses to lock in lower rates before further increases occur.

Is It the Right Time to Lease?

The key takeaway for tenants is that timing is everything. While the market is shifting and many occupiers are holding off on expansions, this could be an opportunity to secure a new lease at a competitive rate. If your business is growing or in need of a change, acting sooner rather than later might allow you to capitalize on current conditions before rental rates increase further.

The Ocean Company is Here to Help

If you’re considering a lease renewal or looking for new office space in Orange County or Los Angeles, The Ocean Company can guide you through the process. We specialize in tenant representation and can help you navigate this evolving market.

Contact us today to discuss your leasing options and find the best space for your business.

📢 Commercial Office Properties: Understanding the Loss of Value 📉

Recent transactions indicate a significant loss of value observed in commercial office properties. This trend, influenced by several factors, has sparked widespread discussion and analysis within the real estate industry. Today, we'll explore some of the key reasons behind this phenomenon.

1️⃣ Remote Work Revolution: The advent of remote work has undoubtedly played a crucial role in altering the dynamics of office spaces. The widespread acceptance and success of remote work during the pandemic have prompted many companies to adopt hybrid or fully remote work models. As a result, the demand for traditional office spaces has decreased, leading to a decline in their value.

2️⃣ Changing Workplace Preferences: The pandemic forced individuals and businesses alike to reassess their workplace preferences. Companies aiming for flexibility and cost optimization, have shifted towards smaller offices, shared workspaces, or even fully remote operations. Similarly, many employees have discovered the benefits of working from home, creating a preference for remote setups. This shift has impacted the demand and attractiveness of conventional office properties.

3️⃣ Technological Advancements: Advancements in technology and communication tools have eliminated the need for physical presence in the office. Video conferencing, collaboration software, and cloud computing have facilitated seamless remote work experiences, eroding the traditional reliance on office spaces.

4️⃣ Economic Uncertainty: The global economic downturn resulting from the pandemic has also affected the commercial real estate market. Many businesses faced financial challenges, downsizing or even closing their doors. This disruption has created a surplus of vacant office spaces, further contributing to the decline in their value.

5️⃣ Repurposing and Adaptive Reuse: In response to the changing landscape, property owners and investors have been exploring alternative uses for office buildings. Repurposing commercial office properties into residential units, hotels, or mixed-use spaces has gained traction to maximize value. While this trend promotes revitalization, it can also result in a surplus of available office properties, adding pressure to the market.

It's important to note that despite the current decline in value, the long-term future of commercial office properties remains uncertain. As businesses adapt and strategies evolve, there may be opportunities for these properties to regain their value. The ability to foster collaboration, networking, and creativity remains an essential aspect of physical workspaces.

Real estate investors and property owners are actively seeking innovative solutions to adapt to the changing needs of businesses and individuals. Whether through renovations, amenity enhancements, or redesigning existing spaces, the goal is to create appealing environments that align with the evolving demands of the workforce.

While the current loss of value in commercial office properties may present challenges, it also offers a chance for innovation and reinvention within the real estate industry. By embracing change and identifying new opportunities, stakeholders can navigate these uncertain times and shape the future of office space.

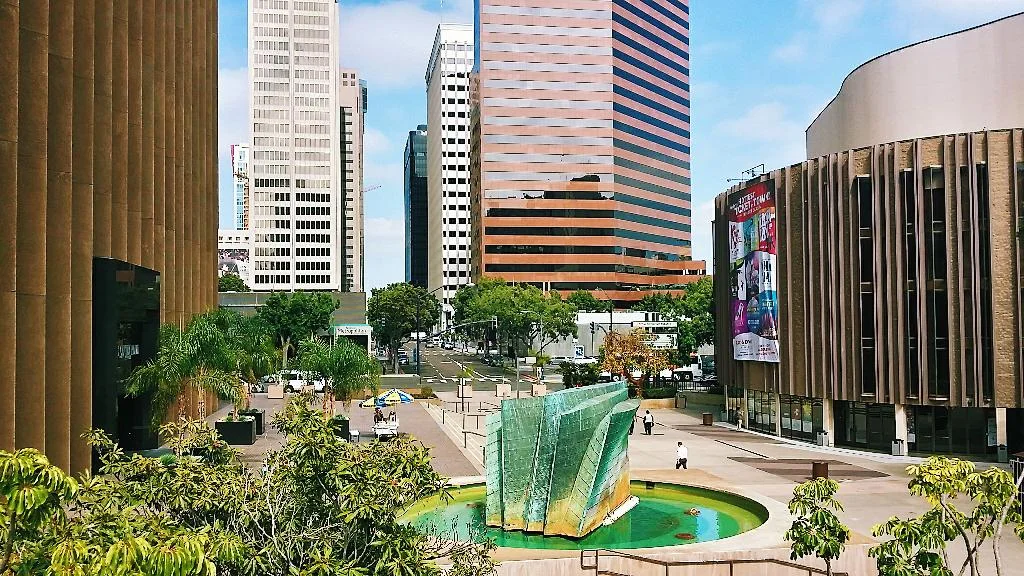

Urban Life Science Hub to Emerge in Downtown San Diego

Downtown San Diego welcomes sprawling life science campus on site of Manchester's Pacific Gate development. New commercial real estate development in marina district meant to diversify the tenant mix in the downtown submarket hopes to attract Top 50 biotech tenants.

IQHQ has closed on a majority of Manchester’s long-awaited development in San Diego’s Marina District, Pacific Gate. Once marketed as a grand mixed-use office/retail/hotel project with public space component, the project is perhaps the biggest development derailed by recessionary fears & Covid to-date. In steps Alan Gold and his new life science real estate investment group, IQHQ. Gold is no stranger to the Life Science facilities, he co-founded BioMed Realty trust, a life science facility development company he sold to Blackstone Group for a reported $8 billion in 2016. With this acquisition, IQHQ shifts the vision of the project to become San Diego’s first urban life science center. Dubbed RaDD, the San Diego Research and Development District will have unmatched views, open space, and retail amenities aimed at attracting top 50 life science companies. Manchester will retain two of the site’s eight blocks and continue developing one of the two planned hotels and 1.9-acre plaza, although the firm did not share a timeline for construction.

At the moment, construction isn’t scheduled to commence until 2021, with the district’s first phase complete in Q3 2023. Plans include a series of mid-rise structures and one 17-story tower, a museum, 3 acres of public green space and rooftop decks. The Navy’s 372,000 SF office on-site is complete and move-in ready.

The question on everyone’s lips is ‘why’.

Based on San Diego’s standing as the number 3 life science hub in the nation, with demand still driving development and an increasing number of existing pieces of industrial product being converted to satisfy their needs; new supply is needed. Existing life science hubs in Sorrento Valley, Torrey Pines and Carlsbad are achieving high rents and show no signs of stopping even through the recession and pandemic. So then, why downtown which is a minimum of 13 miles from any of these hubs? Downtown San Diego recently attracted UCSD’s expansion campus, paving the way for a more research-oriented business and resident mix. Downtown San Diego offers accessibility to a myriad of public transportation services including the new San Diego Trolley Blue Line which will connect Downtown to San Diego’s Life Science Hub in Torrey Pines near UCSD, the Green Line which connects it to SDSU, and also a half-hour train ride to the Solana Beach area. The Marina district also has a planned redevelopment of Seaport Village which would add even greater retail offerings as well as public space to the area. Add to all that the numerous multi-family developments in the area and the project suddenly makes more sense.

But isn’t downtown mainly an office hub?

Today the answer is ‘yes’. The roughly 1.5 million square feet of new office construction in the submarket may be tough to lease given the pandemic/recession In fact, multi-tenant office leasing is off over 50% year over year in the submarket, and new deliveries have yet to do any substantial pre-leasing. An urban waterfront science park could be a big draw for the Pfizer/Alexion/Roche/Merck of the world, and smaller companies would be sure to follow when large anchors are landed. Amongst the commercial real estate community there are rumors both Parallel Capital Partner’s current redevelopment of Horton Plaza is shifting to a life science use, and the recently sold Thomas Jefferson School of Law building as downtown's office market now appears over-built. All factors included, you can see why a more diverse tenant mix is needed.

Jamal Brown is the CEO of The Ocean Company, an exclusive tenant representation firm with offices in San Diego, Orange County and Los Angeles focusing on the leasing and acquisition of commercial real estate.

Main: 858.356.2990 | E-mail: jbrown@theoceanco.com | social: @theoceancompany

Getting Above Standard Tenant Improvements

Do you want great space that helps define your business and attract new clients? Is your company culture important to hiring and retaining top talent? If any of these statements resonate with you, then you cannot afford to accept standardized tenant improvements.

Above standard tenant improvements are typically any material used to improve your space that is above the common finishes the building owner utilizes . Usually the building owner has a list or book of all standard paint carpet, lighting and other flooring finishes that they are willing to provide to improve their space with. These may not showcase your businesses image, align with your company culture, or provide current/potential clients an idea of the caliber of your services. Many architectural firms, law firms and technology companies (just to name a few) need their space to make an impression on everyone who walks through their front doors. An architect uses their lobby to speak to their design capabilities, lawyers use this & other meeting areas to set the tone for their prowess and other businesses use their interior common areas to reinforce their brand & company values.

Achieving a certain look and feel beyond what a landlord is offering typically comes at an additional cost of construction. For example: building out 5,000 sf with building standard finishes may run $60/sf ($300,000); however, your company may want to add design elements to part or all of your space that will increase that number to $85/sf ($425,000). The $125,000 delta between these two numbers can be covered in the following ways.

Tenant pays for the difference: now most tenant rep brokers hate this as it isn’t ideal for companies without a large war chest. It consumes the tenant’s capital upfront and can typically be used better by the tenant to grow their business. In the event the tenant outgrows their space ahead of the natural lease expiration, they’ve sunk capital improving a space they didn’t use for the duration of their lease.

Landlord amortization of the difference: this is the most common solution to a tenant improvement overage. The landlord factors the additional cost of the tenant improvements into the tenant’s rent over time. This keeps the tenant from paying for the improvements upfront but does raise their monthly/annual rent obligation. This can be accomplished as a $/psf rent increase or an annual percentage increase. Think of it as a loan on the difference from the landlord. Does the landlord make a return on this loan...of course. Does the tenant lose if they outgrow the space ahead of the lease expiration? Yes, but not as much as if they pay out of pocket for the improvement difference up front.

Covering the difference through a loss in concessions: this is by far the most complicated and situation specific solution. If you have a savvy tenant representative, who knows your improvement costs will overrun a standard market landlord contribution; they will negotiate a robust rent abatement package, then reduce that once the improvement costs are known so that your rent cost/sf doesn’t increase dramatically. The drawback here is that most businesses use the rent abatement period to offset moving, furniture and other soft costs associated with new space. If those costs are minimal, this may be the best option for a business needing above standard tenant improvements.

*Value Engineering: while not always strategy for covering the cost difference in negotiations, having a great project manager or construction team working with your business & tenant representative to cut construction costs after you’ve secured a certain $/sf in landlord supplied improvement funds can be to your benefit. Make sure your tenant representative negotiated a clause which allows your business to utilize any unused funds in the form of full or partial rent payments.

If you need any help finding or negotiating on space, call us. We’re here to help. #findYOURspace

Not All Buildings Are Created Equal

All commercial buildings are not created equal. One of the most overlooked aspects of a building’s value to the tenant is the efficiency of that particular building when compared to another. This efficiency is in relation to the ratio of the space the tenant actually leases within their four walls (the usable square footage) and the amount of space attributed to all common areas of the building including the lobby, hallways, restrooms, common conference rooms, common kitchen areas, interior break areas, work out buildings, showers/lockers, phone and electrical rooms, and any other common use area that, when added to the usable square footage, makes up the rentable square footage. This ratio is called the building “core factor” (also referred to as “load factor”, “loss factor”, or “add-on factor”). Understanding core factors translates directly to the bottom line. Since building costs are typically near the top of the expense list, the savings can be dramatic in comparison to other expenses. Pay attention to the core factor.

Does a Modern Office Space Need a Kitchen/Break Room

Office space occupiers often wonder if creating a kitchen or break room within their workspace is necessary. Commercial Real Estate expert Jamal Brown breaks down the reasons why designing a kitchen or a break room as an additional meeting area within your office space may be the best solution. Finding a tenant representation broker that knows how to maximize your usable square footage and use your space to support the company culture is key. If you have any questions on our office space design recommendations, feel free to call us. The Ocean Company is a team of commercial lease and property acquisition specialists with offices in Los Angeles, Orange County and San Diego California.

How To Convert Warehouse Into Office Space

Many small businesses and startups are being choked by rising commercial real estate pricing. Rents are currently at or above pre-recession prices, making companies choose between their facility, or expanding their business. There are options out there for users of office space who want "cool" or creative work-spaces, and we wanted to share one with you. Converting industrial warehouse space into a usable office work-space is achievable with a few minor changes. The two items which need the most attention are climate control, and light. Adding some sort of cooling air circulation will greatly change the atmosphere of a warehouse work environment. Replacing solid doors with glass, and reducing the number of walls within the entire space will allow more ambient light to flow through the work space.

Finding Your First Office Space

Congratulations, business is good and you’re ready to open your first office! Now what? Startup companies that reach the point of needing an office location should examine all of their options before committing to office space. The toughest part of choosing that first office is knowing what criteria to base your decision on. Keep in mind that real estate costs are typically the second or third greatest expense on a company balance sheet, and many companies stay the red because they carry more facility related overhead than necessary.

Congratulations, business is good and you’re ready to open your first office! Now what?

Startup companies that reach the point of needing an office location should examine all of their options before committing to office space. The toughest part of choosing that first office is knowing what criteria to base your decision on. Keep in mind that real estate costs are typically the second or third largest expense on a company balance sheet, and many companies remain in the red because they carry more facility related overhead than necessary. Our suggestion for startup and small businesses looking for space is to keep three specific criteria in mind:

1. How much space do we really need for the foreseeable future?

2. Does the location or visibility of a space help our company generate more revenue?

3. How important is flexibility in the lease of any space we pursue?

Entrepreneurs who have reached this point need to be wary of how they approach leasing space. For example, many take on more space than the business requires, sign leases that have a longer term than necessary, or fail to negotiate adequate concessions, and protective clauses, during negotiations. Others sign up with executive office suite operators without realizing that the premium they are paying for space there could get them larger, or more desirable space somewhere else. Co-working spaces have a similar model to executive suite operators, but are typically more flexible when it comes to paying for space. If your business doesn’t yet require you to be in the space on a day-to-day basis, this option could be for you. Our advice to most young companies is to scout the market for space listed for sublease before engaging with the afore mentioned options. Subleased space often comes at a hefty discount from what the master tenant is paying the building owner. These spaces can come furnished, and typically have less than three years of term on them. Sometimes, a sublessor will even allow your business to sublease for a shorter term than what’s remaining on the master lease. Finally, subleases are an agreement to lease space with the master tenant, and although the landlord must approve them, can often be attained without using the business owner’s personal wealth and assets as collateral should the business become incapable of meeting its debts.

Startups and small businesses looking for space should hire an active tenant representative who understands their needs. The Ocean Company has assisted many young companies in securing their first spaces, and negotiates the best possible lease with your objectives in mind.