THE MORE YOU KNOW

THE BETTER YOU NEGOTIATE

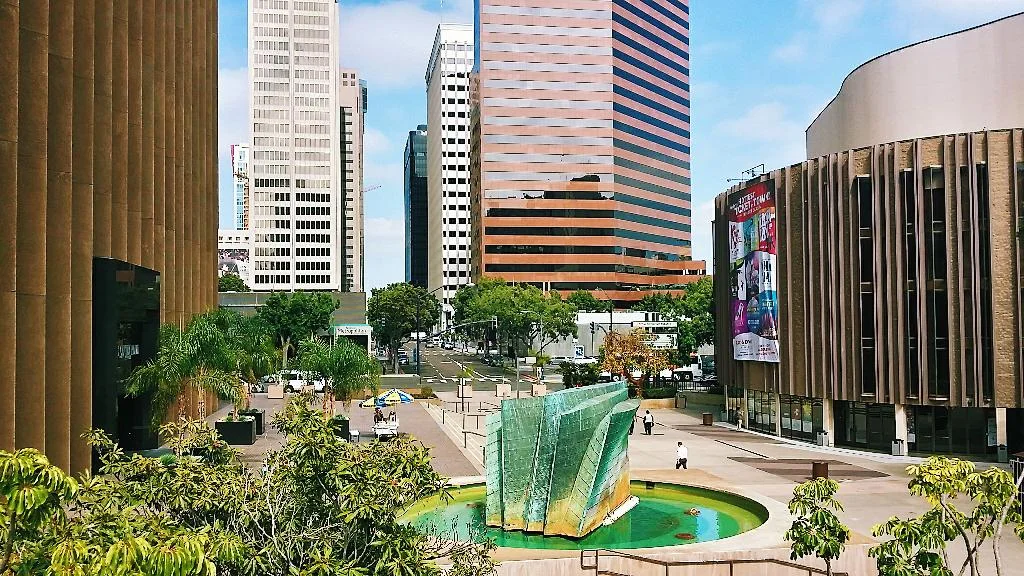

The Importance of Tenant Representation in Los Angeles

Introduction

Tenant representation is a crucial service in the commercial real estate sector, especially in a competitive market like Los Angeles. At The Ocean Company, we specialize in providing top-notch tenant representation services to help businesses find the perfect spaces for their needs.

What is Tenant Representation?

Tenant representation involves a commercial real estate broker acting on behalf of a tenant to find, negotiate, and secure rental spaces. This service is essential for businesses looking to lease commercial properties without the hassle and risk of going it alone.

Benefits of Tenant Representation

Expert Negotiation: Ensure you get the best lease terms.

Market Insight: Gain access to insider knowledge of the local market.

Time Efficiency: Save valuable time by letting experts handle the search and negotiation process.

The Los Angeles Commercial Real Estate Market

Los Angeles is a sprawling metropolis with a complex real estate market. Understanding the nuances of this market is critical for any business looking to lease commercial space.

Key Areas to Consider

Downtown LA: Known for its high-rise office buildings and bustling business environment.

Santa Monica: A hub for tech companies and creative industries.

Beverly Hills: Ideal for luxury retail and professional services.

Why Choose The Ocean Company for Tenant Representation?

At The Ocean Company, we pride ourselves on our local expertise and commitment to client satisfaction. Here’s why you should choose us:

1. Extensive Market Knowledge

Our brokers have an in-depth understanding of the Los Angeles commercial real estate market, ensuring you get the best advice and opportunities.

2. Personalized Service

We tailor our services to meet the unique needs of each client, ensuring a personalized and efficient experience.

3. Strong Negotiation Skills

Our team is skilled in negotiating favorable lease terms, saving you money and securing the best possible deal.

Steps in the Tenant Representation Process

1. Initial Consultation

We begin with a detailed consultation to understand your business needs and goals.

2. Market Research

We conduct comprehensive market research to identify suitable properties.

3. Property Tours

We arrange and accompany you on tours of selected properties, providing expert insights and advice.

4. Lease Negotiation

We handle all aspects of lease negotiation, ensuring terms that are favorable to you.

5. Finalization

We assist with the finalization of the lease agreement, ensuring all legal and logistical aspects are covered.

Conclusion

Tenant representation is a vital service for any business looking to lease commercial space in Los Angeles. At The Ocean Company, we are dedicated to providing exceptional tenant representation services that help you find the perfect space for your business.

Looking for the perfect commercial space in Los Angeles? Contact The Ocean Company today and let our experts guide you to the best lease terms and locations!

How Interest Rates and Leasing Trends Affect San Diego's Industrial Real Estate

The surge in industrial developments over the past two years has slowed considerably. Developers completed over 1.5 billion square feet of industrial projects in the U.S. during 2022 and 2023, but many of these were finished without tenants, pushing the vacancy rate from 3.8% to 6.4%. Now, early 2024 data shows a 30% drop in completed projects, signaling a significant slowdown in new developments.

Interest Rates and Their Impact

Higher interest rates have played a crucial role in curbing new industrial construction starts. By the fall of 2023, industrial construction starts had plummeted to 10-year lows, with projections indicating a continued decline through mid-2025. This decrease in new projects is a direct response to the financial environment, which affects developers' ability to finance new constructions.

Important Numbers:

Construction start decline: Down 40% in early 2023, further 60% drop in the following 12 months.

Interest rate impact: Higher costs limit new development financing.

Implications for San Diego's Market

San Diego’s industrial real estate market, while influenced by national trends, has its unique dynamics. The slowdown in new industrial projects could lead to a tighter market locally, especially if tenant demand remains steady or improves.

Local Market Insights:

Tightening Supply: Fewer new completions could reduce available industrial spaces.

Investment Potential: Limited new supply may increase the value of existing properties.

Tenant Opportunities: Businesses may need to act quickly to secure desirable spaces.

The Ocean Company: Your Partner in San Diego Real Estate

Navigating these changes requires expert knowledge and strategic planning. At The Ocean Company, we offer specialized services in tenant representation and investment sales to help you succeed in San Diego’s competitive market. Our team is dedicated to providing personalized solutions tailored to your specific needs.

What We Offer:

Customized Search: Finding industrial spaces that match your business requirements.

Strategic Investment Advice: Helping you capitalize on market opportunities.

Local Market Expertise: Providing up-to-date insights and trends.

Interested in making the most of the current market conditions? Reach out to The Ocean Company today and discover how we can assist you in achieving your real estate goals in San Diego.

Getting Above Standard Tenant Improvements

Do you want great space that helps define your business and attract new clients? Is your company culture important to hiring and retaining top talent? If any of these statements resonate with you, then you cannot afford to accept standardized tenant improvements.

Above standard tenant improvements are typically any material used to improve your space that is above the common finishes the building owner utilizes . Usually the building owner has a list or book of all standard paint carpet, lighting and other flooring finishes that they are willing to provide to improve their space with. These may not showcase your businesses image, align with your company culture, or provide current/potential clients an idea of the caliber of your services. Many architectural firms, law firms and technology companies (just to name a few) need their space to make an impression on everyone who walks through their front doors. An architect uses their lobby to speak to their design capabilities, lawyers use this & other meeting areas to set the tone for their prowess and other businesses use their interior common areas to reinforce their brand & company values.

Achieving a certain look and feel beyond what a landlord is offering typically comes at an additional cost of construction. For example: building out 5,000 sf with building standard finishes may run $60/sf ($300,000); however, your company may want to add design elements to part or all of your space that will increase that number to $85/sf ($425,000). The $125,000 delta between these two numbers can be covered in the following ways.

Tenant pays for the difference: now most tenant rep brokers hate this as it isn’t ideal for companies without a large war chest. It consumes the tenant’s capital upfront and can typically be used better by the tenant to grow their business. In the event the tenant outgrows their space ahead of the natural lease expiration, they’ve sunk capital improving a space they didn’t use for the duration of their lease.

Landlord amortization of the difference: this is the most common solution to a tenant improvement overage. The landlord factors the additional cost of the tenant improvements into the tenant’s rent over time. This keeps the tenant from paying for the improvements upfront but does raise their monthly/annual rent obligation. This can be accomplished as a $/psf rent increase or an annual percentage increase. Think of it as a loan on the difference from the landlord. Does the landlord make a return on this loan...of course. Does the tenant lose if they outgrow the space ahead of the lease expiration? Yes, but not as much as if they pay out of pocket for the improvement difference up front.

Covering the difference through a loss in concessions: this is by far the most complicated and situation specific solution. If you have a savvy tenant representative, who knows your improvement costs will overrun a standard market landlord contribution; they will negotiate a robust rent abatement package, then reduce that once the improvement costs are known so that your rent cost/sf doesn’t increase dramatically. The drawback here is that most businesses use the rent abatement period to offset moving, furniture and other soft costs associated with new space. If those costs are minimal, this may be the best option for a business needing above standard tenant improvements.

*Value Engineering: while not always strategy for covering the cost difference in negotiations, having a great project manager or construction team working with your business & tenant representative to cut construction costs after you’ve secured a certain $/sf in landlord supplied improvement funds can be to your benefit. Make sure your tenant representative negotiated a clause which allows your business to utilize any unused funds in the form of full or partial rent payments.

If you need any help finding or negotiating on space, call us. We’re here to help. #findYOURspace

5 Leasing Tips We Can Learn From Dogs

The two most persistent beings in the universe have to be dogs and children. Why are these little cutthroats so good at getting what they want? Here’s a few take aways we can we apply to the commercial leasing process which should help your company get what it needs.

Explore all your options: Dogs will stick their nose in everything just to figure out if it’s edible. At the onset of facility negotiations, you need to enroll as many desirable locations as possible. You also need to ask for everything that would make a facility contract compliment your business plan. Be strategic in the structure of the financial terms and the amount of exposure so your business can thrive.

Be Persistent: Ever had a dog beg for snacks/your dinner/belly rubs/a walk and then give up after one rebuke? Me neither. So when you don’t get a positive initial response to your requested lease terms, ask again. You may need to modify the language a little but go for what your business needs until you get it.

Play Dead: With a little training, dogs will do this for a reward. Sometimes it’s necessary in lease negotiations to take a step back, act offended, and let a landlord think their negotiation strategy killed a deal. More often than not you’ll reap the reward.

Leave Nothing Left: Whether it’s treats or steak bones, dogs rarely leave anything unfinished. Real estate costs are usually the 2nd or 3rd most costly expense your business will incur. You owe it to yourself and your employees to mitigate the fixed costs and your exposure to additional charges in negotiations. Grind multiple locations down simultaneously and don’t leave money on the table. Use each site as leverage against one another. Push hard until there’s nothing left.

Trust Your Pack: Dogs are a pretty good judge of character, and in their pack (human or canine) everyone plays their role. You need professional service providers throughout the leasing process. An experienced tenant representation broker to guide you through site selection and negotiation, a project manager to assist with construction pricing, scheduling and vendor coordination, and an attorney to negotiate and review lease language. Not only can you leverage these professionals to create the best outcome, you can spend more time focusing on your core business while they work for you. Lone wolves don’t accomplish much, you need a pack.

Jamal Brown is the CEO of The Ocean Company, an exclusive tenant representation firm with offices in San Diego, Orange County and Los Angeles focusing on the leasing and acquisition of commercial real estate.

Main: 858.356.2990 | E-mail: jbrown@theoceanco.com | social: @theoceancompany

Does a Modern Office Space Need a Kitchen/Break Room

Office space occupiers often wonder if creating a kitchen or break room within their workspace is necessary. Commercial Real Estate expert Jamal Brown breaks down the reasons why designing a kitchen or a break room as an additional meeting area within your office space may be the best solution. Finding a tenant representation broker that knows how to maximize your usable square footage and use your space to support the company culture is key. If you have any questions on our office space design recommendations, feel free to call us. The Ocean Company is a team of commercial lease and property acquisition specialists with offices in Los Angeles, Orange County and San Diego California.

Understanding 'Rentable' vs. 'Usable' Square Feet

All commercial buildings are not created equal. This is evident upon inspection of multiple factors; location, allocated parking, quality of construction, and amenities provided, just to name a few. But one of the most overlooked aspects of a building’s value to the tenant is the efficiency of that particular building when compared to another. This efficiency is in relation to the ratio of the space the tenant actually leases within their four walls (the usable square footage) and the amount of space attributed to all common areas of the building including the lobby, hallways, restrooms, common conference rooms, common kitchen areas, interior break areas, work out buildings, showers/lockers, phone and electrical rooms, and any other common use area that, when added to the usable square footage, makes up the rentable square footage. This ratio is called the building “core factor” (also referred to as “load factor”, “loss factor”, or “add-on factor”). Landlords are ensured of receiving income on this common space so it is distributed to each tenant as an “add on” to their usable square footage that then totals the tenant’s rentable square footage and this is what the rent is based on. The difference in a building’s efficiency and therefor the core factor can quickly offset a lower base rent per square foot that building may have over another. Core factors can vary by as much as 10% to 15% and many times they are “artificial” as in, implemented by the landlord with no confirmation. This becomes a marketing ploy, to offer a lower rent when, in reality, the end result is substantially more than other competing buildings with greater efficiency. We find that in many cases tenants, who have existed under leases for many years, still don’t understand this issue today.

Buildings calculate all space that is constructed as gross square footage. The standard of commercial property measurement (“BOMA”) then requires that all vertical penetrations (stairwells and elevator shafts) be deducted from the gross square footage and the remaining square footage is the rentable square footage. When a company negotiates a lease on commercial space, they are occupying the usable square footage which is the square footage within their four walls but paying for the rentable square footage, including their share of the common areas referenced above.

Understanding core factors translates directly to the bottom line. Since building costs are typically near the top of the expense list, the savings can be dramatic in comparison to other expenses. Pay attention to the core factor. The example below puts numbers to the story:

XYZ Company needs 30,000 square feet of usable space to operate their business and is evaluating two opportunities. Building A has a core factor of 19% (1.19) and Building B has a core factor of 11% (1.11). Both buildings are offering the same rental rate, say $2.00 per rentable square foot. In this scenario, XYZ Company has a choice of leasing 35,700 rentable square feet in Building A, at a monthly rent of $71,400, or leasing a more efficient 33,300 rentable square feet in Building B, at a monthly rent of $66,600 per month. Calculating the difference in XYZ Company’s rental costs, they will save $288,000 over a five year lease term if they locate in Building B for the same amount of usable square footage.

This is one of many pitfalls that can be costly if not known by companies leasing commercial space. Don’t get caught paying more than you should. Hire a broker to help you. It doesn’t cost you a dime but the savings can be extraordinary.

Finding Your First Office Space

Congratulations, business is good and you’re ready to open your first office! Now what? Startup companies that reach the point of needing an office location should examine all of their options before committing to office space. The toughest part of choosing that first office is knowing what criteria to base your decision on. Keep in mind that real estate costs are typically the second or third greatest expense on a company balance sheet, and many companies stay the red because they carry more facility related overhead than necessary.

Congratulations, business is good and you’re ready to open your first office! Now what?

Startup companies that reach the point of needing an office location should examine all of their options before committing to office space. The toughest part of choosing that first office is knowing what criteria to base your decision on. Keep in mind that real estate costs are typically the second or third largest expense on a company balance sheet, and many companies remain in the red because they carry more facility related overhead than necessary. Our suggestion for startup and small businesses looking for space is to keep three specific criteria in mind:

1. How much space do we really need for the foreseeable future?

2. Does the location or visibility of a space help our company generate more revenue?

3. How important is flexibility in the lease of any space we pursue?

Entrepreneurs who have reached this point need to be wary of how they approach leasing space. For example, many take on more space than the business requires, sign leases that have a longer term than necessary, or fail to negotiate adequate concessions, and protective clauses, during negotiations. Others sign up with executive office suite operators without realizing that the premium they are paying for space there could get them larger, or more desirable space somewhere else. Co-working spaces have a similar model to executive suite operators, but are typically more flexible when it comes to paying for space. If your business doesn’t yet require you to be in the space on a day-to-day basis, this option could be for you. Our advice to most young companies is to scout the market for space listed for sublease before engaging with the afore mentioned options. Subleased space often comes at a hefty discount from what the master tenant is paying the building owner. These spaces can come furnished, and typically have less than three years of term on them. Sometimes, a sublessor will even allow your business to sublease for a shorter term than what’s remaining on the master lease. Finally, subleases are an agreement to lease space with the master tenant, and although the landlord must approve them, can often be attained without using the business owner’s personal wealth and assets as collateral should the business become incapable of meeting its debts.

Startups and small businesses looking for space should hire an active tenant representative who understands their needs. The Ocean Company has assisted many young companies in securing their first spaces, and negotiates the best possible lease with your objectives in mind.

Urbanization's Effect on Commercial Real Estate

The great recession killed the suburbs. Since 2007, metropolitan cities across the country have experienced a migration of residents towards urban living environments. This trend could be the answer to urban decay, with many seeking more fiscally practical and cohesive living arrangements. Referred to as "re-urbanization", the trend is the opportunity San Diego needs to return neglected areas of downtown to their former prestige. Large adaptive reuse and infill projects have gained traction from Little Italy to East Village, including dynamic public spaces, but it will require buy-in from local employers before the transformation of 'America's Finest City' reaches its potential.

The great recession killed the suburbs. Since 2007, metropolitan cities across the country have experienced a migration of residents towards urban living environments. This trend could be the answer to urban decay, with many seeking more fiscally practical and cohesive living arrangements. Referred to as "re-urbanization", the trend is the opportunity San Diego needs to return neglected areas of downtown to their former prestige. Large adaptive reuse and infill projects have gained traction from Little Italy to East Village, including dynamic public spaces, but it will require buy-in from local employers before the transformation of 'America's Finest City' reaches its potential.

The new Central library, the renovation of Horton Plaza, and open space meeting areas like Quartyard, SMARTSfarm and Silo at Makers Quarter have created a buzz about downtown. The supply of living spaces downtown is increasing, and the increase in population is expected to drive an increase in demand for workspace. For office space users, this means considering locating you company near your employees or desired talent pool. If your employees demographic age is 23 – 35, odds are they reside in the area between Mission Valley, the beach communities, and Downtown. This demographic seeks employment in walk-able, livable urban areas which complement their lifestyle. Companies seeking top talent may need to consider their proximity to "live-work-play" environments in order to stay competitive. Planned developments like Makers Quarter and IDEA are courting large employers with build-to-suit options for mixed-use office/retail/residential spaces, which resemble small cities within a city. The challenge in bringing these developments to life is pre-leasing to an anchor tenant large enough to initiate construction. Recently San Diego companies The Active Network and Websense, who occupied approximately 100,000 SF each, relocated out of California, leaving a small pool of local tenants large enough these projects.

Downtown's diverse tenant mix now includes technology and professional service providers in numerous co-working spaces and incubators. The area is a logical place to create a hub for hi-tech entrepreneurs. Accelerators like Plug n Play, who expose early stage hi-tech companies to Silicon Valley capital, and Evonexus, the Qualcomm sponsored incubator located in the heart of the Civic-Core district, provide mentorship and strategic funding to start-ups making high-tech innovations. It’s likely that these businesses would stay in the area as they grow, creating a greater demand for office and living spaces. The economic benefit is measurable, according to Steven Cox, CEO of Take-Lessons "there will be 1,500 to 2,000 tech jobs created here in San Diego. The average tech job pays about $103,000. So, when you take a look at how technology and innovation fuels the economy, it’s really interesting to see how that’s growing, specifically in downtown." A study completed by The Downtown Partnership, concluded that every tech job brought downtown create(s) another 1.6 jobs meaning a welcome increase in new restaurants and retail businesses serving the area. All of this could lead to an increase the tax base in the area, resulting in more money for public works and infrastructure.

Employers do face obstacles in relocating downtown where parking spaces are scarce and costly. On-site parking downtown is generally granted at 1 parking space per one thousand feet of leased space, not attractive for high density space users with a large percentage of employees who commute from the suburbs. Parking rates in mid to high-rise office buildings range from $130 - $200/stall/month, and while surface lots in the area charge slightly less, this added expense prevents many employers from relocating to the area. The planned trolley expansion may ease these concerns, however service along the new line to UTC wouldn’t commence until 2019.

Downtown San Diego has come a long way, and is becoming more attractive to young companies, and businesses locating closer to talent or their employee base. It may take years for San Diego to have a thriving downtown sector, but with support from employers, and local government, will one day reach its potential.

What's Next for Tech?

During a recent IoT (Internet of Things, for those not familiar) Startup breakfast I realized a few things; the internet is going places most people can’t fathom, and I should have tried harder in Science class.

During a recent IoT (Internet of Things, for those not familiar) Startup breakfast I realized a few things; the internet is going places most people can’t fathom, and I should have tried harder in Science class.

While we are still a long way from flying cars and ‘Rosie’ the robot maid, scientists and entrepreneurs are creating devices which will be embedded into everything from farm equipment, to your refrigerator, to your jeans; more importantly, these devices will communicate with manufactures, service stations, medical personnel, and even each other. The processors for these embedded devices are getting smaller, cheaper, more powerful, and thanks to visionaries like SIGFOX, low power networks will exist globally to efficiently allow these devices to communicate, and retain a longer service life.

As I was dreaming of a future utopia that would make Doc Brown gasp, a presenter from Wind River (leaders in embedded software for connected systems) brought up the reality that interoperability, or the ability for devices to communicate with each other, has yet to be solved. The issue, today’s innovators are creating devices utilizing their own protocols with no standard way of translating that language. Add the implications a network security breach could have on a country full of connected, semi-automated devices or wearables, and we unveil the hurdles entrepreneurs face before I can safely own a self-driving vehicle that tells my self-maintaining refrigerator to order more beers after a long day.

How do we bridge the gap between today’s standard of living, and tomorrow’s standard of excellence? As technology entrepreneurs create applications for the future, the means by which to fund these innovations has become more robust. According to San Diego Venture Group’s David Titus "venture capital investment is up to its highest level since 2009, an estimated $30 billion in funding."

While these investment dollars are primarily chasing companies with market traction, angel investors have been seeding start-up and early stage companies that show promise in solving some of these issues.

Venture capital used to look for companies in a great market, or a product and team, now they also want companies to be killing it," says Titus.

The growth of start-up communities, hubs like CyberTech, and incubators likeEvoNexus that encourage collaboration will help bring well researched solutions to investors, and then to market.

The future is bright, and my sunglasses will know it.