THE MORE YOU KNOW

THE BETTER YOU NEGOTIATE

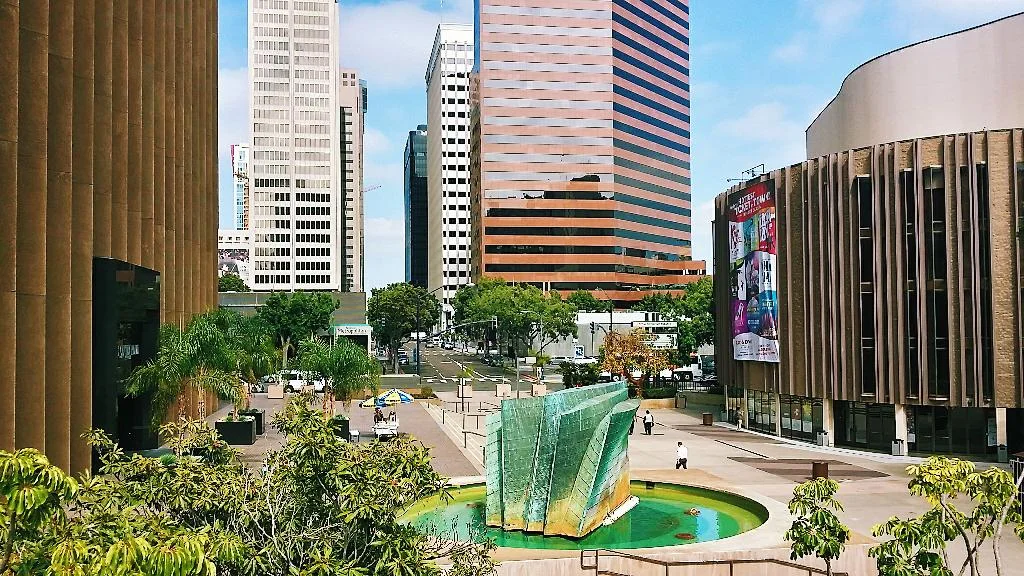

Urban Life Science Hub to Emerge in Downtown San Diego

Downtown San Diego welcomes sprawling life science campus on site of Manchester's Pacific Gate development. New commercial real estate development in marina district meant to diversify the tenant mix in the downtown submarket hopes to attract Top 50 biotech tenants.

IQHQ has closed on a majority of Manchester’s long-awaited development in San Diego’s Marina District, Pacific Gate. Once marketed as a grand mixed-use office/retail/hotel project with public space component, the project is perhaps the biggest development derailed by recessionary fears & Covid to-date. In steps Alan Gold and his new life science real estate investment group, IQHQ. Gold is no stranger to the Life Science facilities, he co-founded BioMed Realty trust, a life science facility development company he sold to Blackstone Group for a reported $8 billion in 2016. With this acquisition, IQHQ shifts the vision of the project to become San Diego’s first urban life science center. Dubbed RaDD, the San Diego Research and Development District will have unmatched views, open space, and retail amenities aimed at attracting top 50 life science companies. Manchester will retain two of the site’s eight blocks and continue developing one of the two planned hotels and 1.9-acre plaza, although the firm did not share a timeline for construction.

At the moment, construction isn’t scheduled to commence until 2021, with the district’s first phase complete in Q3 2023. Plans include a series of mid-rise structures and one 17-story tower, a museum, 3 acres of public green space and rooftop decks. The Navy’s 372,000 SF office on-site is complete and move-in ready.

The question on everyone’s lips is ‘why’.

Based on San Diego’s standing as the number 3 life science hub in the nation, with demand still driving development and an increasing number of existing pieces of industrial product being converted to satisfy their needs; new supply is needed. Existing life science hubs in Sorrento Valley, Torrey Pines and Carlsbad are achieving high rents and show no signs of stopping even through the recession and pandemic. So then, why downtown which is a minimum of 13 miles from any of these hubs? Downtown San Diego recently attracted UCSD’s expansion campus, paving the way for a more research-oriented business and resident mix. Downtown San Diego offers accessibility to a myriad of public transportation services including the new San Diego Trolley Blue Line which will connect Downtown to San Diego’s Life Science Hub in Torrey Pines near UCSD, the Green Line which connects it to SDSU, and also a half-hour train ride to the Solana Beach area. The Marina district also has a planned redevelopment of Seaport Village which would add even greater retail offerings as well as public space to the area. Add to all that the numerous multi-family developments in the area and the project suddenly makes more sense.

But isn’t downtown mainly an office hub?

Today the answer is ‘yes’. The roughly 1.5 million square feet of new office construction in the submarket may be tough to lease given the pandemic/recession In fact, multi-tenant office leasing is off over 50% year over year in the submarket, and new deliveries have yet to do any substantial pre-leasing. An urban waterfront science park could be a big draw for the Pfizer/Alexion/Roche/Merck of the world, and smaller companies would be sure to follow when large anchors are landed. Amongst the commercial real estate community there are rumors both Parallel Capital Partner’s current redevelopment of Horton Plaza is shifting to a life science use, and the recently sold Thomas Jefferson School of Law building as downtown's office market now appears over-built. All factors included, you can see why a more diverse tenant mix is needed.

Jamal Brown is the CEO of The Ocean Company, an exclusive tenant representation firm with offices in San Diego, Orange County and Los Angeles focusing on the leasing and acquisition of commercial real estate.

Main: 858.356.2990 | E-mail: jbrown@theoceanco.com | social: @theoceancompany

Urbanization's Effect on Commercial Real Estate

The great recession killed the suburbs. Since 2007, metropolitan cities across the country have experienced a migration of residents towards urban living environments. This trend could be the answer to urban decay, with many seeking more fiscally practical and cohesive living arrangements. Referred to as "re-urbanization", the trend is the opportunity San Diego needs to return neglected areas of downtown to their former prestige. Large adaptive reuse and infill projects have gained traction from Little Italy to East Village, including dynamic public spaces, but it will require buy-in from local employers before the transformation of 'America's Finest City' reaches its potential.

The great recession killed the suburbs. Since 2007, metropolitan cities across the country have experienced a migration of residents towards urban living environments. This trend could be the answer to urban decay, with many seeking more fiscally practical and cohesive living arrangements. Referred to as "re-urbanization", the trend is the opportunity San Diego needs to return neglected areas of downtown to their former prestige. Large adaptive reuse and infill projects have gained traction from Little Italy to East Village, including dynamic public spaces, but it will require buy-in from local employers before the transformation of 'America's Finest City' reaches its potential.

The new Central library, the renovation of Horton Plaza, and open space meeting areas like Quartyard, SMARTSfarm and Silo at Makers Quarter have created a buzz about downtown. The supply of living spaces downtown is increasing, and the increase in population is expected to drive an increase in demand for workspace. For office space users, this means considering locating you company near your employees or desired talent pool. If your employees demographic age is 23 – 35, odds are they reside in the area between Mission Valley, the beach communities, and Downtown. This demographic seeks employment in walk-able, livable urban areas which complement their lifestyle. Companies seeking top talent may need to consider their proximity to "live-work-play" environments in order to stay competitive. Planned developments like Makers Quarter and IDEA are courting large employers with build-to-suit options for mixed-use office/retail/residential spaces, which resemble small cities within a city. The challenge in bringing these developments to life is pre-leasing to an anchor tenant large enough to initiate construction. Recently San Diego companies The Active Network and Websense, who occupied approximately 100,000 SF each, relocated out of California, leaving a small pool of local tenants large enough these projects.

Downtown's diverse tenant mix now includes technology and professional service providers in numerous co-working spaces and incubators. The area is a logical place to create a hub for hi-tech entrepreneurs. Accelerators like Plug n Play, who expose early stage hi-tech companies to Silicon Valley capital, and Evonexus, the Qualcomm sponsored incubator located in the heart of the Civic-Core district, provide mentorship and strategic funding to start-ups making high-tech innovations. It’s likely that these businesses would stay in the area as they grow, creating a greater demand for office and living spaces. The economic benefit is measurable, according to Steven Cox, CEO of Take-Lessons "there will be 1,500 to 2,000 tech jobs created here in San Diego. The average tech job pays about $103,000. So, when you take a look at how technology and innovation fuels the economy, it’s really interesting to see how that’s growing, specifically in downtown." A study completed by The Downtown Partnership, concluded that every tech job brought downtown create(s) another 1.6 jobs meaning a welcome increase in new restaurants and retail businesses serving the area. All of this could lead to an increase the tax base in the area, resulting in more money for public works and infrastructure.

Employers do face obstacles in relocating downtown where parking spaces are scarce and costly. On-site parking downtown is generally granted at 1 parking space per one thousand feet of leased space, not attractive for high density space users with a large percentage of employees who commute from the suburbs. Parking rates in mid to high-rise office buildings range from $130 - $200/stall/month, and while surface lots in the area charge slightly less, this added expense prevents many employers from relocating to the area. The planned trolley expansion may ease these concerns, however service along the new line to UTC wouldn’t commence until 2019.

Downtown San Diego has come a long way, and is becoming more attractive to young companies, and businesses locating closer to talent or their employee base. It may take years for San Diego to have a thriving downtown sector, but with support from employers, and local government, will one day reach its potential.

What's Next for Tech?

During a recent IoT (Internet of Things, for those not familiar) Startup breakfast I realized a few things; the internet is going places most people can’t fathom, and I should have tried harder in Science class.

During a recent IoT (Internet of Things, for those not familiar) Startup breakfast I realized a few things; the internet is going places most people can’t fathom, and I should have tried harder in Science class.

While we are still a long way from flying cars and ‘Rosie’ the robot maid, scientists and entrepreneurs are creating devices which will be embedded into everything from farm equipment, to your refrigerator, to your jeans; more importantly, these devices will communicate with manufactures, service stations, medical personnel, and even each other. The processors for these embedded devices are getting smaller, cheaper, more powerful, and thanks to visionaries like SIGFOX, low power networks will exist globally to efficiently allow these devices to communicate, and retain a longer service life.

As I was dreaming of a future utopia that would make Doc Brown gasp, a presenter from Wind River (leaders in embedded software for connected systems) brought up the reality that interoperability, or the ability for devices to communicate with each other, has yet to be solved. The issue, today’s innovators are creating devices utilizing their own protocols with no standard way of translating that language. Add the implications a network security breach could have on a country full of connected, semi-automated devices or wearables, and we unveil the hurdles entrepreneurs face before I can safely own a self-driving vehicle that tells my self-maintaining refrigerator to order more beers after a long day.

How do we bridge the gap between today’s standard of living, and tomorrow’s standard of excellence? As technology entrepreneurs create applications for the future, the means by which to fund these innovations has become more robust. According to San Diego Venture Group’s David Titus "venture capital investment is up to its highest level since 2009, an estimated $30 billion in funding."

While these investment dollars are primarily chasing companies with market traction, angel investors have been seeding start-up and early stage companies that show promise in solving some of these issues.

Venture capital used to look for companies in a great market, or a product and team, now they also want companies to be killing it," says Titus.

The growth of start-up communities, hubs like CyberTech, and incubators likeEvoNexus that encourage collaboration will help bring well researched solutions to investors, and then to market.

The future is bright, and my sunglasses will know it.