THE MORE YOU KNOW

THE BETTER YOU NEGOTIATE

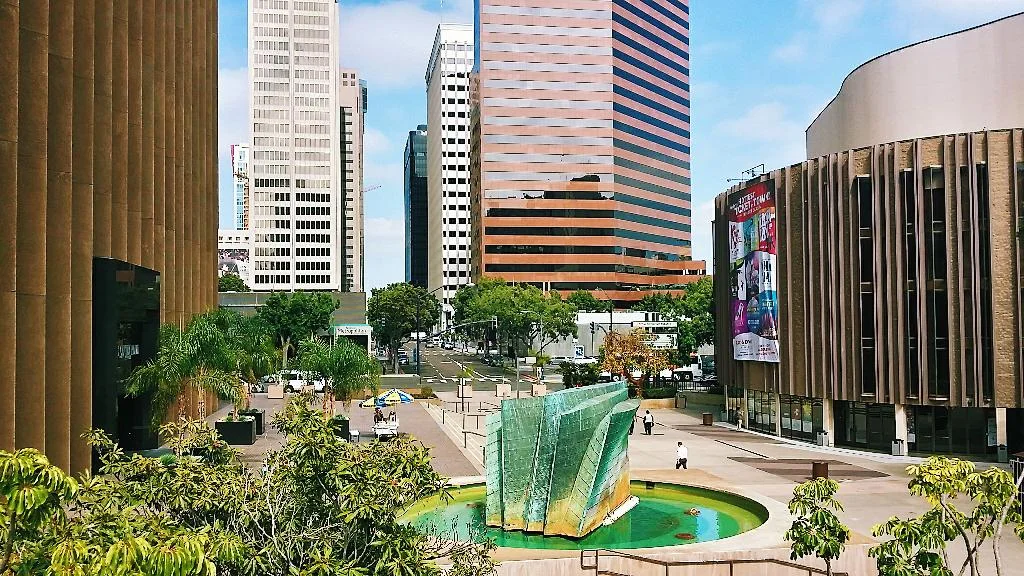

Investing in Los Angeles Commercial Real Estate: A Guide for New Investors

Los Angeles is a prime market for commercial real estate investment, offering numerous opportunities for new investors. At The Ocean Company, we specialize in helping clients navigate the complexities of commercial real estate in LA. This guide will provide you with essential tips and insights to get started.

Why Invest in Los Angeles Commercial Real Estate?

Los Angeles is one of the most dynamic and diverse real estate markets in the world. Here are some compelling reasons to invest:

Strong Economic Fundamentals

Diverse Economy: LA's economy is supported by a wide range of industries, from entertainment to technology.

Population Growth: Continuous population growth drives demand for commercial spaces.

Global City: As a global city, LA attracts businesses and investors from around the world.

High Demand for Commercial Spaces

The high demand for commercial spaces in key areas like Downtown LA and Santa Monica ensures steady rental income and potential for property appreciation.

Types of Commercial Real Estate Investments

1. Office Buildings

Office spaces in business hubs like Downtown LA are always in high demand.

2. Retail Spaces

Retail properties in areas like Beverly Hills and Santa Monica offer high visibility and foot traffic.

3. Industrial Properties

Industrial properties in locations like the South Bay are crucial for logistics and manufacturing businesses.

Key Considerations for New Investors

Investing in commercial real estate requires careful planning and due diligence. Here are some key considerations:

Location

Choose locations with high demand and potential for growth. Research local market trends and future developments.

Property Condition

Inspect the property thoroughly to identify any potential issues or required renovations.

Financing

Secure financing options that offer favorable terms. Consider working with local banks or financial institutions familiar with the LA market.

Legal Aspects

Ensure all legal aspects are covered, including zoning laws, property taxes, and lease agreements.

Working with a Commercial Real Estate Broker

A commercial real estate broker can provide invaluable assistance in navigating the investment process. Here’s how The Ocean Company can help:

Market Analysis

We provide detailed market analysis to help you make informed investment decisions.

Property Search

We assist in finding properties that meet your investment criteria and goals.

Negotiation

Our experts negotiate the best purchase terms on your behalf, ensuring a profitable investment.

Closing the Deal

We guide you through the closing process, ensuring all legal and financial aspects are handled smoothly.

Conclusion

Investing in Los Angeles commercial real estate offers tremendous opportunities for new investors. By understanding the market and working with experienced professionals like The Ocean Company, you can maximize your investment potential.

Ready to invest in Los Angeles commercial real estate? Contact The Ocean Company today and let’s start building your investment portfolio!

📢 Commercial Office Properties: Understanding the Loss of Value 📉

Recent transactions indicate a significant loss of value observed in commercial office properties. This trend, influenced by several factors, has sparked widespread discussion and analysis within the real estate industry. Today, we'll explore some of the key reasons behind this phenomenon.

1️⃣ Remote Work Revolution: The advent of remote work has undoubtedly played a crucial role in altering the dynamics of office spaces. The widespread acceptance and success of remote work during the pandemic have prompted many companies to adopt hybrid or fully remote work models. As a result, the demand for traditional office spaces has decreased, leading to a decline in their value.

2️⃣ Changing Workplace Preferences: The pandemic forced individuals and businesses alike to reassess their workplace preferences. Companies aiming for flexibility and cost optimization, have shifted towards smaller offices, shared workspaces, or even fully remote operations. Similarly, many employees have discovered the benefits of working from home, creating a preference for remote setups. This shift has impacted the demand and attractiveness of conventional office properties.

3️⃣ Technological Advancements: Advancements in technology and communication tools have eliminated the need for physical presence in the office. Video conferencing, collaboration software, and cloud computing have facilitated seamless remote work experiences, eroding the traditional reliance on office spaces.

4️⃣ Economic Uncertainty: The global economic downturn resulting from the pandemic has also affected the commercial real estate market. Many businesses faced financial challenges, downsizing or even closing their doors. This disruption has created a surplus of vacant office spaces, further contributing to the decline in their value.

5️⃣ Repurposing and Adaptive Reuse: In response to the changing landscape, property owners and investors have been exploring alternative uses for office buildings. Repurposing commercial office properties into residential units, hotels, or mixed-use spaces has gained traction to maximize value. While this trend promotes revitalization, it can also result in a surplus of available office properties, adding pressure to the market.

It's important to note that despite the current decline in value, the long-term future of commercial office properties remains uncertain. As businesses adapt and strategies evolve, there may be opportunities for these properties to regain their value. The ability to foster collaboration, networking, and creativity remains an essential aspect of physical workspaces.

Real estate investors and property owners are actively seeking innovative solutions to adapt to the changing needs of businesses and individuals. Whether through renovations, amenity enhancements, or redesigning existing spaces, the goal is to create appealing environments that align with the evolving demands of the workforce.

While the current loss of value in commercial office properties may present challenges, it also offers a chance for innovation and reinvention within the real estate industry. By embracing change and identifying new opportunities, stakeholders can navigate these uncertain times and shape the future of office space.