THE MORE YOU KNOW

THE BETTER YOU NEGOTIATE

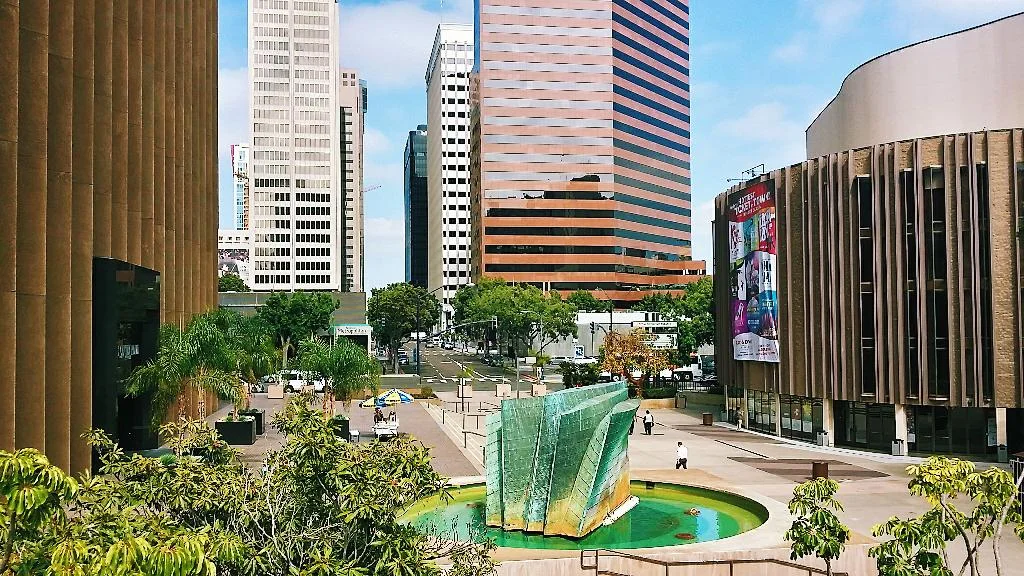

Exploring San Diego: Unveiling its Rich History, Culinary Delights, and Outdoor Adventures

San Diego, known as "America's Finest City," offers a perfect blend of history, gastronomy, and outdoor activities. Its stunning beaches, iconic landmarks, and vibrant culture make it a dream destination for travelers. Join me as we explore the enchanting tourist destinations of this southern California gem, uncovering its intriguing history, mouthwatering culinary attractions, and exhilarating outdoor adventures.

Unveiling History:

A visit to San Diego wouldn't be complete without delving into its rich historical past. Begin your journey at the historic Old Town, often referred to as the "birthplace of California." Wander through the adobe buildings, visit the preserved homes and museums, and embrace the Spanish and Mexican influences that shaped this city's heritage.

Just a short drive away, you'll find Balboa Park, a true treasure trove of history. Take a stroll through its lush gardens, admire the breathtaking architecture, and explore its impressive array of museums, including the renowned San Diego Museum of Art and the Museum of Natural History.

Culinary Scene:

San Diego's diverse cuisine scene ensures that you'll never go hungry. Indulge in the delectable flavors of Baja California at one of the city's many Mexican eateries. From authentic street tacos to mouthwatering seafood, your taste buds will be in for a treat.

Don't miss the chance to explore the historic Gaslamp Quarter, where you can find a wide variety of culinary options. Explore the vibrant streets lined with restaurants, bars, and cafes offering diverse cuisines, from contemporary American fare to international flavors.

For those seeking a unique dining experience, head to Little Italy, where the aroma of freshly-made pasta fills the air. Savor classic Italian dishes in charming trattorias or sip on a glass of wine while enjoying the famous San Diego sunset.

Outdoor Adventures:

San Diego's year-round mild climate beckons outdoor enthusiasts to embrace its natural beauty. Start by basking in the sun on the pristine beaches, such as Coronado Beach and La Jolla Cove. Take a leisurely walk along the boardwalks, try your hand at surfing, or simply relax and enjoy the breathtaking coastal views.

Nature lovers will find solace in the Torrey Pines State Natural Reserve, where picturesque hiking trails guide you through stunning sandstone cliffs and rare Torrey Pine trees. Capture panoramic vistas of the coastline from the top and relish in the tranquility of this coastal paradise.

If you're seeking more thrills, head to Mission Bay and try your hand at watersports like kayaking, jet skiing, and paddleboarding. Embrace the refreshing ocean breeze and discover the vibrant marine life that San Diego is known for.

Final Thoughts:

So why should you be here right now? San Diego offers a world of wonders for every type of traveler. From its captivating history to its diverse culinary offerings and abundance of outdoor adventures, this city will never cease to amaze you. So, pack your bags, embark on a memorable journey, and let San Diego enchant you with its unique blend of culture, flavors, and natural beauty. You heard it here first.

📢 Commercial Office Properties: Understanding the Loss of Value 📉

Recent transactions indicate a significant loss of value observed in commercial office properties. This trend, influenced by several factors, has sparked widespread discussion and analysis within the real estate industry. Today, we'll explore some of the key reasons behind this phenomenon.

1️⃣ Remote Work Revolution: The advent of remote work has undoubtedly played a crucial role in altering the dynamics of office spaces. The widespread acceptance and success of remote work during the pandemic have prompted many companies to adopt hybrid or fully remote work models. As a result, the demand for traditional office spaces has decreased, leading to a decline in their value.

2️⃣ Changing Workplace Preferences: The pandemic forced individuals and businesses alike to reassess their workplace preferences. Companies aiming for flexibility and cost optimization, have shifted towards smaller offices, shared workspaces, or even fully remote operations. Similarly, many employees have discovered the benefits of working from home, creating a preference for remote setups. This shift has impacted the demand and attractiveness of conventional office properties.

3️⃣ Technological Advancements: Advancements in technology and communication tools have eliminated the need for physical presence in the office. Video conferencing, collaboration software, and cloud computing have facilitated seamless remote work experiences, eroding the traditional reliance on office spaces.

4️⃣ Economic Uncertainty: The global economic downturn resulting from the pandemic has also affected the commercial real estate market. Many businesses faced financial challenges, downsizing or even closing their doors. This disruption has created a surplus of vacant office spaces, further contributing to the decline in their value.

5️⃣ Repurposing and Adaptive Reuse: In response to the changing landscape, property owners and investors have been exploring alternative uses for office buildings. Repurposing commercial office properties into residential units, hotels, or mixed-use spaces has gained traction to maximize value. While this trend promotes revitalization, it can also result in a surplus of available office properties, adding pressure to the market.

It's important to note that despite the current decline in value, the long-term future of commercial office properties remains uncertain. As businesses adapt and strategies evolve, there may be opportunities for these properties to regain their value. The ability to foster collaboration, networking, and creativity remains an essential aspect of physical workspaces.

Real estate investors and property owners are actively seeking innovative solutions to adapt to the changing needs of businesses and individuals. Whether through renovations, amenity enhancements, or redesigning existing spaces, the goal is to create appealing environments that align with the evolving demands of the workforce.

While the current loss of value in commercial office properties may present challenges, it also offers a chance for innovation and reinvention within the real estate industry. By embracing change and identifying new opportunities, stakeholders can navigate these uncertain times and shape the future of office space.

Will Life Science Revive Downtown San Diego?

With new Life Science developments approaching completion, will Downtown San Diego experience a renewed interest among businesses and young professionals?

Downtown San Diego's office market is set to receive the biggest wave of new inventory in over 20 years.

About 2.8 million square feet of newly-developed space scheduled to be delivered by 2024, increasing the total inventory by 19.3%.

These statistics don’t bode well for traditional office landlords, however they do look favorable for tenants looking to secure above market concessions in lease negotiations.

Historically, Downtown San Diego has been home to law firms, and personal service businesses but there is a new player in the mix. San Diego has cemented its position as the number three biotech hub in the country. Along with the new deliveries are: Campus at Horton, a 750,000-square-foot office and life science project — which includes an additional 300,000 square feet of retail and experiential space to deliver by the end of the year, the RaDD ("Research and Development District”) project, a 1.7 million-square-foot project boasting a mix of office, life science and retail space in the Marina district at San Diego's waterfront, and Genesis, a 203,000-square-foot building at Island Ave which leased a full floor (27,000 SF) to Endeavor BioMedicines. Downtown San Diego is positioning itself to become an important hub within a hub for life science tenants.

Additionally, the area also has a well-educated resident base filled with young professionals who are attracted to the cultural amenities, nightlife and walkability. According to an analysis completed by the Downtown San Diego Partnership and released in a report, “More than 41 percent of downtown’s 24,000 working residents are employed in occupations within management, business, science or the arts, which is around five percentage points greater than the rest of San Diego County.” And the “fastest growing occupation for downtown working residents within [those sectors] are life scientists.”

While traditional office leasing activity remains sluggish with the effects of the pandemic largely at the forefront, Life Science leasing may be the key to reviving spending and interest in the downtown neighborhoods. Downtown also has roughly 6.5 million square feet of space available for lease, or more than 38% of total inventory. That has led to the region’s highest vacancy rate of almost 25%. Available sublet space has also added pressure here, with more than 350,000 square feet available for sublease, more than double the average from 2016 through 2019. It should also be noted that downtown faces long-term challenges that few other areas of San Diego are forced deal with. It is beset by a growing population of homelessness that has led the city council and the mayor to discuss enforcing encroachment laws.

The lack of and high cost of parking also lead many firms to choose other locations.

San Diego Office Outlook - Lessons learned from Q1 2022

Accelerated demand for San Diego’s class A and B office inventory has had an effect on on vacancy rates coming into 2022. Expansion from local biotech firms absorbing vacant space with larger transactions requiring new construction are driving demand throughout Torrey Pines, Carmel Valley and Del Mar Heights.

Breakthrough Properties and Gemdale are building large lab campuses along the State Route 56 corridor that received pre-lease commitments totaling 850,000 square feet since the end of last year. BD Biosciences signed for 220,000 square feet at Torrey View and Neurocrine Biosciences leased roughly 630,000 square feet at Aperture Del Mar.

Alexandria Real Estate Equities pre-leased 430,000 square feet to Brisol Myers Squibb at the interchange of I-5 and I-805 at its Campus Point 4 building in Alexandria Point, where Amazon occupies more than 130,000 square feet.

Those large deals at upscale office properties have driven leasing during the first quarter in San Diego market to the highest quarterly total in more than 15 years, with over 2.5 million square feet of new leasing activity.

In turn, there has been a noticeable shift in where that activity is falling.

Historically, leasing in urban locations in San Diego have led volume. However, since 2019, demand has shifted to suburban areas of San Diego, where many firms are choosing to locate near where their workers live. The pandemic work-from-home and subsequent ‘hub and spoke’ model adopted by larger businesses to accommodate suburban employee bases continues to keep vacancy low in suburban submarkets north of Hwy-52.

Companies forecasting their office space needs for the next 12 - 24 months should expect rates to increase in suburban markets, and inventory to remain low. However, there are hidden opportunities to reduce occupancy cost in the urban markets, specifically downtown San Diego, where the sublease inventory is still high and large blocks of space sit vacant for longer.

Hotel Rooms and Offices Get New Life as Apartments

Two out of the three suffering commercial product types (office, retail, and hospitality) can be converted to a use with high demand, living spaces.

Let's discuss an interesting pivot I've been seeing.

Two out of the three suffering commercial product types (office, retail, and hospitality) can be converted to a use with high demand, living spaces.

Even in tourist havens like San Diego, hotels have been hit particularly hard. While most hotel rooms can only be converted into studios, Extended Stay operations usually have all the components of an apartment. With occupancy at historic lows, these properties may trade cheaply and implementing an affordable housing play makes sense.

Office buildings do not yet show the type of vacancy where their value decreases, however, the occupancy rates for the last 10 months have been hovering around 20% in metro areas. Whether tenants will return to the office in mass is yet to be seen, if they don't, expect to see office-to-multifamily conversions for older product.

Of course zoning restrictions may apply & cities may be reluctant to lose transit occupancy tax from hotel uses, but these conversions would most definitely benefit struggling retailers and restaurants in the neighborhood who desperately need the patronage.

That's my take, would love to hear what you think.

Why We Listen Before We Speak

Our clients and prospective clients have our undivided attention. After all, how can we truly serve them if we don’t know their “why”?

You can’t learn anything if you’re always talking.

Every business has a specific space need, learning about how they utilize space, and what role real estate plays in its business plan is crucial to being able to assist them.

Every investor has a portfolio strategy that requires expert analysis and execution.

You can’t service either type of client if you’re always talking about yourself.

Listening and asking questions to understand is the key to our business. Knowing a client’s “why” is more important than talking about your “how”.

It’s time we became problem solvers more than just deal makers.

Now, tell me what you’re looking for...

California stay-at-home order hurts Restaurant industry

To our hospitality friends:

WE ARE WITH YOU

Urging everyone in California to support all your local restaurants as they struggle through California’s new stay-at-home orders.

THINGS YOU CAN DO

1. Support your favorite restaurants that continue to operate outdoor service according to safe, CDC guidelines.

2. Buy GIFT CARDS from locally owned restaurants and give them out as holiday gifts.

3. When you order delivery, try and place your orders directly with the restaurant. Third-party apps take up to 30% of the value of the order. Let’s do what we can to give 100% of our support to the people creating our meals.

4. Share these tips with your friends and support the locally owned restaurants in your area.

This holiday season, let’s truly practice the act of giving.

#wereinthistogether #saverestaurants #ilovemycity

If you have any commercial leasing or purchasing questions call us ☎️ 858.356.2990 and Jamal will assist you.

The Future of Customer Loyalty

Customer Loyalty. Its a term that gets thrown around often, but this year with online shopping and take-out orders dominating the landscape, repeat customers are essential to survival. Assuming you have a CRM (and you should) here's what should you do to stand out:

1. Personalized Touches:

-Adding hand written cards (like the one I recently received from my online order with Boochcraft) that thank your customer for their purchase

-Suggesting specifically curated additional items for your customer based on their buying history (you should have this data for returning customers)

-Asking how they enjoyed their last purchase of (insert item) from you

2. Convenient user interface: how quickly and comfortably your customer completes orders from you makes a difference. Make sure to thank them in a meaningful way

3. Flexibility:

-In store pick-up greetings feel like the traditional shopping experience

-Make curbside pick-up quick, easy and on-time (especially restaurants)

-Native delivery service (rather than 3rd party) rewards points

San Diego Retail: Minor Pain or Disability

Costar is dancing around the issue in this article. The pandemic is accelerating a trend that existed back when Corona was just a beer.

Yes the SD inventory is temporarily down due to the Parallel Capital's acquisition and repurposing of Horton Plaza, but that entire mall was long dead and 1/2 vacant pre-pandemic due to the loss of Nordstroms. As of now Parallel still plans on building/leasing 300k sf of retail on that site, whether they should is another question. So the current vacancy rates aren't really telling the story at all. Longstanding anchors have been upended due to a little thing called the internet, and people's preference to avoid salespeople while having their goods delivered. The subplot is...there's no one to meaningfully backfill them. Before you angrily spout stats about discount stores or Amazon distribution centers think this through; the discount crowd isn’t shopping at the remaining inline stores, and no one is coming to a center for an Amazon distribution center.

Locally, the recent loss of large occupiers (RIP Souplantation & Pier 1) from centers doesn't bode well for the smaller stores that depended on the foot traffic, but this was foreshadowed by the closure of well known national big box retailers over the last few years.

Look I want everyone to win, but they have to adapt to survive. Hopefully small/regional operators focus on their online presence and develop a community to generate sales; however the long term result of this points to smaller footprints/less inventory on-hand in stores across the board in my opinion. And that's just the burbs, CBD retailers are facing a potential population shift (on top of everything else) that may hurt sales for the foreseeable future. When do they start asking “why am I paying $84/sf to be surrounded by boarded up shops”?

However you cut it, our addiction to online shopping is the root of retail leasing woes, Covid-19 is just an accelerant.

Jamal Brown is the CEO of The Ocean Company, an exclusive tenant representation firm with offices in San Diego, Orange County and Los Angeles focusing on the leasing and acquisition of commercial real estate.

Main: 858.356.2990 | E-mail: jbrown@theoceanco.com | social: @theoceancompany

How to Maximize Rent Abatement

How to negotiate free rent on your commercial lease in a tenant’s market that exceeds the typical market deal.

RENT ABATEMENT: The period of months where you the tenant do not pay base rent (expenses are still accrued) as a concession to signing a multi-year lease. This usually gets capped out at a maximum of one month of abatement per year of term.

But what if you could convince a landlord to give you additional rent abatement in the form of a rent credit?

If you negotiate a robust Tenant Improvement allowance that covers your construction bids, but then value engineer the cost of that construction to be less than the estimate you based your TI allowance off of; shouldn’t you get to use the money saved? The answer is YES but you have to negotiate that language into your lease. This helps offset your initial rent obligation, or can even be applied to buying new furniture or fixturized equipment. You just have to know what to ask for.

If you’ve got questions about leasing or purchasing commercial real estate, we’ve got answers.

Jamal Brown is the CEO of The Ocean Company, an exclusive tenant representation firm with offices in San Diego, Orange County and Los Angeles focusing on the leasing and acquisition of commercial real estate.

Main: 858.356.2990 | E-mail: jbrown@theoceanco.com | social: @theoceancompany

Urban Life Science Hub to Emerge in Downtown San Diego

Downtown San Diego welcomes sprawling life science campus on site of Manchester's Pacific Gate development. New commercial real estate development in marina district meant to diversify the tenant mix in the downtown submarket hopes to attract Top 50 biotech tenants.

IQHQ has closed on a majority of Manchester’s long-awaited development in San Diego’s Marina District, Pacific Gate. Once marketed as a grand mixed-use office/retail/hotel project with public space component, the project is perhaps the biggest development derailed by recessionary fears & Covid to-date. In steps Alan Gold and his new life science real estate investment group, IQHQ. Gold is no stranger to the Life Science facilities, he co-founded BioMed Realty trust, a life science facility development company he sold to Blackstone Group for a reported $8 billion in 2016. With this acquisition, IQHQ shifts the vision of the project to become San Diego’s first urban life science center. Dubbed RaDD, the San Diego Research and Development District will have unmatched views, open space, and retail amenities aimed at attracting top 50 life science companies. Manchester will retain two of the site’s eight blocks and continue developing one of the two planned hotels and 1.9-acre plaza, although the firm did not share a timeline for construction.

At the moment, construction isn’t scheduled to commence until 2021, with the district’s first phase complete in Q3 2023. Plans include a series of mid-rise structures and one 17-story tower, a museum, 3 acres of public green space and rooftop decks. The Navy’s 372,000 SF office on-site is complete and move-in ready.

The question on everyone’s lips is ‘why’.

Based on San Diego’s standing as the number 3 life science hub in the nation, with demand still driving development and an increasing number of existing pieces of industrial product being converted to satisfy their needs; new supply is needed. Existing life science hubs in Sorrento Valley, Torrey Pines and Carlsbad are achieving high rents and show no signs of stopping even through the recession and pandemic. So then, why downtown which is a minimum of 13 miles from any of these hubs? Downtown San Diego recently attracted UCSD’s expansion campus, paving the way for a more research-oriented business and resident mix. Downtown San Diego offers accessibility to a myriad of public transportation services including the new San Diego Trolley Blue Line which will connect Downtown to San Diego’s Life Science Hub in Torrey Pines near UCSD, the Green Line which connects it to SDSU, and also a half-hour train ride to the Solana Beach area. The Marina district also has a planned redevelopment of Seaport Village which would add even greater retail offerings as well as public space to the area. Add to all that the numerous multi-family developments in the area and the project suddenly makes more sense.

But isn’t downtown mainly an office hub?

Today the answer is ‘yes’. The roughly 1.5 million square feet of new office construction in the submarket may be tough to lease given the pandemic/recession In fact, multi-tenant office leasing is off over 50% year over year in the submarket, and new deliveries have yet to do any substantial pre-leasing. An urban waterfront science park could be a big draw for the Pfizer/Alexion/Roche/Merck of the world, and smaller companies would be sure to follow when large anchors are landed. Amongst the commercial real estate community there are rumors both Parallel Capital Partner’s current redevelopment of Horton Plaza is shifting to a life science use, and the recently sold Thomas Jefferson School of Law building as downtown's office market now appears over-built. All factors included, you can see why a more diverse tenant mix is needed.

Jamal Brown is the CEO of The Ocean Company, an exclusive tenant representation firm with offices in San Diego, Orange County and Los Angeles focusing on the leasing and acquisition of commercial real estate.

Main: 858.356.2990 | E-mail: jbrown@theoceanco.com | social: @theoceancompany

Office Occupiers Eye a Return To The Workplace

Recent interview w/the CEO of an international commercial real estate firm provides some insight while raising some interesting questions.

1. If the return to the office is a collaboration/new hire on-boarding/company culture play; how do we consistently promote company values/build team dynamics when the space is utilized fractionally?

2. It appears we will be moving towards greater square footage per employee, thereby increasing the overall office footprint. Does this mean we should expect to see a flight from quality due to rents? Larger footprints = increased overhead = reduced profit margins. What does this do to the class A office market?

3. Current uncertainty & its effect on leasing decisions should prompt landlords to offer robust concessions packages to tenants that will make long term commitments, however, we aren’t seeing that yet. When do landlords accept that we’re in a Tenant’s market?

Unfortunately, no one has all the answers. I am interested to hear your thoughts.

Jamal has negotiated thousands of leases on behalf of tenants since 2003 and continues to advise companies on their on-going real estate strategies.

How Parking Effects Your Business

Lets talk about: PARKING

We all hate parking far from the entrance to the restaurant, store, gym or workplace. Sometimes lack of parking stops us from even visiting these establishments...ok not work but you know it’s still annoying. Here is a breakdown by sector on how parking effects your patronage.

Retail: While this might be intuitive for suburban retailers who often enjoy 5.0/1,000 sf leased parking ratios, there are certain operators, like gyms, who need customers to be able to park and be a 30 second walk to the front door. In my experience w/@lafitness the time it takes to get from car to club is a huge factor in whether or not people visit your location. Urban retailers don’t always have the luxury of on-site parking and should locate in either a “destination” zone (most frequently traveled blocks) or nearest to public parking as possible.

Hospitality: similar in discussion to retailers, however, suburban sites should have “express” or “to-go” stalls adjacent the ADA stalls at the facility. Covid makes taking over your parking lot a necessity right now, but your to-go delivery speed is a still a factor...besides, who wants to pay Grub Hub, Uber Eats or Postmates 30% of your sale?! Urban food & beverage operators primarily want to locate where the people are and where their concept isn’t over saturated. Let’s face it, city living forces you to walk and we will gladly do so to get to our favorite places.

Office: for office tenants, parking can be a financial component that effects their bottom line. Most suburban office parking comes free of charge, except for you Santa Monica. Urban office parking can run $100-$300/stall/month and subsidizing your employee parking charges will substantially increase your monthly overhead.

Whatever sector you fit into, parking is an aspect of the real estate selection you need to pay attention to in order to ensure overall success.

Experiential Retail and Mixed Use Communities Shape San Diego

From an employers standpoint Mission Valley was viewed as an accessible, yet unattractive submarket between downtown and UTC. These new developments will strengthen the area opportunity for a greater live/work atmosphere, as well as a recruiting hub.

If you haven't been paying attention to what is going on in Mission Valley let me help you.

SDSU was awarded the redevelopment of Qualcomm stadium (RIP Chargers) and will be expanding their campus presence, creating a new stadium, hotel, student housing, and 95k SF of retail as well as creating a public open space park.

Civita, the sustainable "city within a city" has completed phase one including housing, experiential retail and restaurants, and a 14.3 acre park. The development is pushing forward with phase 2 of its retail development.

Finally, Hines is redeveloping the Riverwalk golf course as a forward thinking, mixed-use community with over 90k square feet of retail, a 50 acre river park and 4000+ homes.

The fact that all of these developments are directly accessible from the trolley line, which itself is expanding into UTC, will truly connect San Diego neighborhoods in a way employers find beneficial. From an employers standpoint Mission Valley was viewed as an accessible, yet unattractive submarket between downtown and UTC. These new developments will strengthen the area opportunity for a greater live/work atmosphere, as well as a recruiting hub.

Signs we've entered a tenant's market

Significant write down and sale of the U.S. Bank Tower, an iconic DTLA office property leads me to believe a few things.

🏢 Sluggish leasing activity as a result of the recession and the pandemic is cause for concern to landlords whose rent rolls aren’t showing long term stability.

❓Shadow vacancy, again as a result of the pandemic and recession, could result in a tsunami of new-to-market subleases further hampering velocity in leasing activity.

💰 Overwhelming signs that we’re at the end of the “landlord’s market” cycle mean future lease economics will be more tenant friendly including robust concessions packages.

Although we aren’t currently seeing a direct effect of economic stagnation reflected in leasing rates throughout Southern CA, I am sure 2021 will mark the beginning of a fresh cycle in the office market.

Work-From-Home: Silver Lining or Death Knell for Commercial Real Estate?

Work From Home may save the Retail and Multi-Family sectors of commercial real estate.

Google extended 'WFH' through Q3 2021 & while the effect could be negative across the office/retail/multi-family sector if additional employers react similarly; there could be a silver lining.

Now this is an unpopular opinion but stay with me. Working from home isn't the panacea for combatting C-19 in work environments it was made out to be. Lack of human (read: adult) interaction is hard on teams meant to collaborate, cultivating relationships with potential customers is difficult, and families are facing the fact that the kids probably aren't going back to school in a few weeks. However, this could halt the losses in the retail sector as employees venture out of the house to work and spend dollars usually reserved for commuting. Instead of fleeing cities the multi-family sector could see a flight to quality from households, and the office sector may see companies adopt larger footprints to accommodate social distancing norms.

All of these things could happen averting the disastrous outlook forecasted for the commercial real estate and small business in general. Alternatively, none of these things could happen and we're in for a rough 2 years. Thoughts?

Getting Above Standard Tenant Improvements

Do you want great space that helps define your business and attract new clients? Is your company culture important to hiring and retaining top talent? If any of these statements resonate with you, then you cannot afford to accept standardized tenant improvements.

Above standard tenant improvements are typically any material used to improve your space that is above the common finishes the building owner utilizes . Usually the building owner has a list or book of all standard paint carpet, lighting and other flooring finishes that they are willing to provide to improve their space with. These may not showcase your businesses image, align with your company culture, or provide current/potential clients an idea of the caliber of your services. Many architectural firms, law firms and technology companies (just to name a few) need their space to make an impression on everyone who walks through their front doors. An architect uses their lobby to speak to their design capabilities, lawyers use this & other meeting areas to set the tone for their prowess and other businesses use their interior common areas to reinforce their brand & company values.

Achieving a certain look and feel beyond what a landlord is offering typically comes at an additional cost of construction. For example: building out 5,000 sf with building standard finishes may run $60/sf ($300,000); however, your company may want to add design elements to part or all of your space that will increase that number to $85/sf ($425,000). The $125,000 delta between these two numbers can be covered in the following ways.

Tenant pays for the difference: now most tenant rep brokers hate this as it isn’t ideal for companies without a large war chest. It consumes the tenant’s capital upfront and can typically be used better by the tenant to grow their business. In the event the tenant outgrows their space ahead of the natural lease expiration, they’ve sunk capital improving a space they didn’t use for the duration of their lease.

Landlord amortization of the difference: this is the most common solution to a tenant improvement overage. The landlord factors the additional cost of the tenant improvements into the tenant’s rent over time. This keeps the tenant from paying for the improvements upfront but does raise their monthly/annual rent obligation. This can be accomplished as a $/psf rent increase or an annual percentage increase. Think of it as a loan on the difference from the landlord. Does the landlord make a return on this loan...of course. Does the tenant lose if they outgrow the space ahead of the lease expiration? Yes, but not as much as if they pay out of pocket for the improvement difference up front.

Covering the difference through a loss in concessions: this is by far the most complicated and situation specific solution. If you have a savvy tenant representative, who knows your improvement costs will overrun a standard market landlord contribution; they will negotiate a robust rent abatement package, then reduce that once the improvement costs are known so that your rent cost/sf doesn’t increase dramatically. The drawback here is that most businesses use the rent abatement period to offset moving, furniture and other soft costs associated with new space. If those costs are minimal, this may be the best option for a business needing above standard tenant improvements.

*Value Engineering: while not always strategy for covering the cost difference in negotiations, having a great project manager or construction team working with your business & tenant representative to cut construction costs after you’ve secured a certain $/sf in landlord supplied improvement funds can be to your benefit. Make sure your tenant representative negotiated a clause which allows your business to utilize any unused funds in the form of full or partial rent payments.

If you need any help finding or negotiating on space, call us. We’re here to help. #findYOURspace

Avoiding Percentage Rent

If you’re an office tenant skip this one, it thankfully doesn’t apply to you - restaurant and retail space users should take notes. Your landlord is like that disgusting troll under the bridge in the story your mom used to read you. They want more than what’s fair because they think they’re in control. You’re about to pay them a monthly amount of rent, and your share of property taxes, property insurance and common area maintenance, in order to operate your business in their property. In addition, or sometimes in lieu of, they want their grubby little hands in your pocket by charging you a percentage of your (typically) gross sales...sometimes above a breakpoint but sometimes from the first dollar you earn. This is called percentage rent, and it’s absurdly legal.

As a rule of thumb your restaurant or retail store should never lease space that costs more than 6 - 10% of your projected gross sales. Seriously. Landlords who believe you have the ability to make millions of dollars in annual revenue in their space will try to parasitically attach themselves to your success using an overage percentage (DM me for details) or an absolute gross sales breakpoint on top of your rent. Whatever you sell above this breakpoint gets multiplied by your percentage and goes to the landlord. Seriously. Avoiding this is tough, but not impossible. First, know the conversation needs to be had upfront in lease negotiations and either make the percentage based on sales of something specific: i.e.: food sales, alcohol sales, super high end product you sell few of; or make your breakpoint so high you are UNLIKELY to hit it. Second, make the percentage a low number. Landlords are going to try something between 5 - 7% but it’s okay to laugh at them and offer 2 - 3%. Do not be afraid to walk away from the negotiating table in order to do this. Far too many restaurant owners fall in love with space and just agree to this nonsense. Unless you’re Tiffany’s you should stay far away from leases like these without protecting yourself, and if you need help, call us!

Jamal Brown has represented commercial tenants in lease negotiations for over 16 years.

5 Leasing Tips We Can Learn From Dogs

The two most persistent beings in the universe have to be dogs and children. Why are these little cutthroats so good at getting what they want? Here’s a few take aways we can we apply to the commercial leasing process which should help your company get what it needs.

Explore all your options: Dogs will stick their nose in everything just to figure out if it’s edible. At the onset of facility negotiations, you need to enroll as many desirable locations as possible. You also need to ask for everything that would make a facility contract compliment your business plan. Be strategic in the structure of the financial terms and the amount of exposure so your business can thrive.

Be Persistent: Ever had a dog beg for snacks/your dinner/belly rubs/a walk and then give up after one rebuke? Me neither. So when you don’t get a positive initial response to your requested lease terms, ask again. You may need to modify the language a little but go for what your business needs until you get it.

Play Dead: With a little training, dogs will do this for a reward. Sometimes it’s necessary in lease negotiations to take a step back, act offended, and let a landlord think their negotiation strategy killed a deal. More often than not you’ll reap the reward.

Leave Nothing Left: Whether it’s treats or steak bones, dogs rarely leave anything unfinished. Real estate costs are usually the 2nd or 3rd most costly expense your business will incur. You owe it to yourself and your employees to mitigate the fixed costs and your exposure to additional charges in negotiations. Grind multiple locations down simultaneously and don’t leave money on the table. Use each site as leverage against one another. Push hard until there’s nothing left.

Trust Your Pack: Dogs are a pretty good judge of character, and in their pack (human or canine) everyone plays their role. You need professional service providers throughout the leasing process. An experienced tenant representation broker to guide you through site selection and negotiation, a project manager to assist with construction pricing, scheduling and vendor coordination, and an attorney to negotiate and review lease language. Not only can you leverage these professionals to create the best outcome, you can spend more time focusing on your core business while they work for you. Lone wolves don’t accomplish much, you need a pack.

Jamal Brown is the CEO of The Ocean Company, an exclusive tenant representation firm with offices in San Diego, Orange County and Los Angeles focusing on the leasing and acquisition of commercial real estate.

Main: 858.356.2990 | E-mail: jbrown@theoceanco.com | social: @theoceancompany

Not All Buildings Are Created Equal

All commercial buildings are not created equal. One of the most overlooked aspects of a building’s value to the tenant is the efficiency of that particular building when compared to another. This efficiency is in relation to the ratio of the space the tenant actually leases within their four walls (the usable square footage) and the amount of space attributed to all common areas of the building including the lobby, hallways, restrooms, common conference rooms, common kitchen areas, interior break areas, work out buildings, showers/lockers, phone and electrical rooms, and any other common use area that, when added to the usable square footage, makes up the rentable square footage. This ratio is called the building “core factor” (also referred to as “load factor”, “loss factor”, or “add-on factor”). Understanding core factors translates directly to the bottom line. Since building costs are typically near the top of the expense list, the savings can be dramatic in comparison to other expenses. Pay attention to the core factor.